Source/Case Based MCQs of Accounting for Partnership Firm Fundamentals with answers Class 12

Free PDF Download of CBSE Accountancy source/case based Multiple Choice Questions for Class 12 with Answers Chapter 1 Accounting for Partnership Firms — Fundamentals. Accountancy MCQs for Class 12 Chapter Wise with Answers PDF Download was Prepared Based on Latest Exam Pattern. Students can solve NCERT Class 12 Accountancy Accounting for Partnership Firms — Fundamentals MCQs Pdf with Answers to know their preparation level.

On 1st January 2024, Ravi, Mohan and Shreya entered into partnership with fixed capitals of ₹ 3,00,000, ₹ 2,00,000 and ₹ 1,00,000 respectively.

Their partnership deed provided for the following:

(a) Salary to Ravi @ ₹ 20,000 per month.

(b) Rento Mohan for the use of his property for business purpose @ ₹ 5,000 per month.

(c) Manager is to be allowed a commission of 10% of the profit of the firm.

Profit for the year ended 31st March, 2024 before providing for the above adjustments amounted to ₹ 3,45,000.

Q. 1 Remuneration to a Manager will be:

(a) ₹ 30,000

(b) ₹ 33,000

(c) ₹ 34,500

(d) ₹ 27,000

Ans:- b)

Interest on Capital allowed to partners will be:

(a) @ 12% p.a.

(b) @ 6% p.a.

(c) @ 10% p.a.

(d) No Interest will be allowed

Ans:- d)

Shreya’s share of profit will be:

(a) ₹ 79,000

(b) ₹ 80,000

(c) ₹ 39,500

(d) ₹ 40,000

Ans:- a)

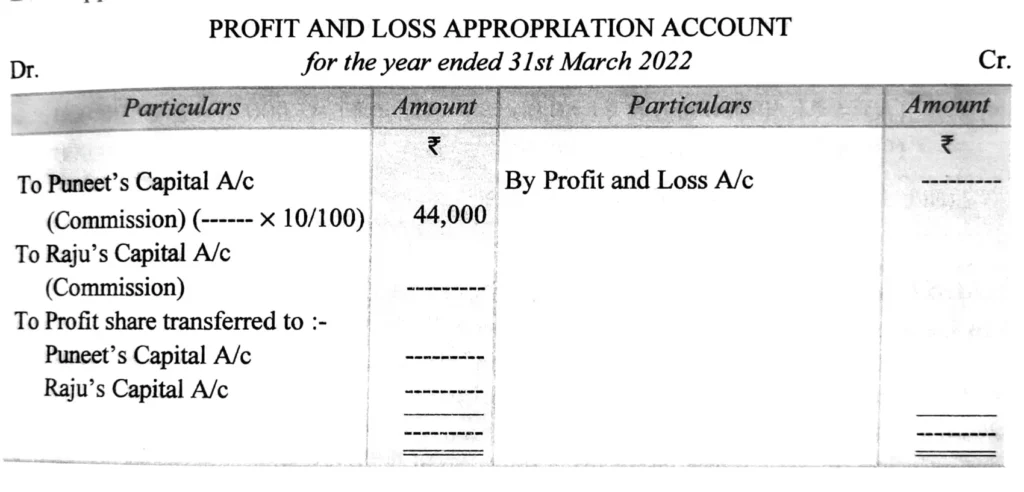

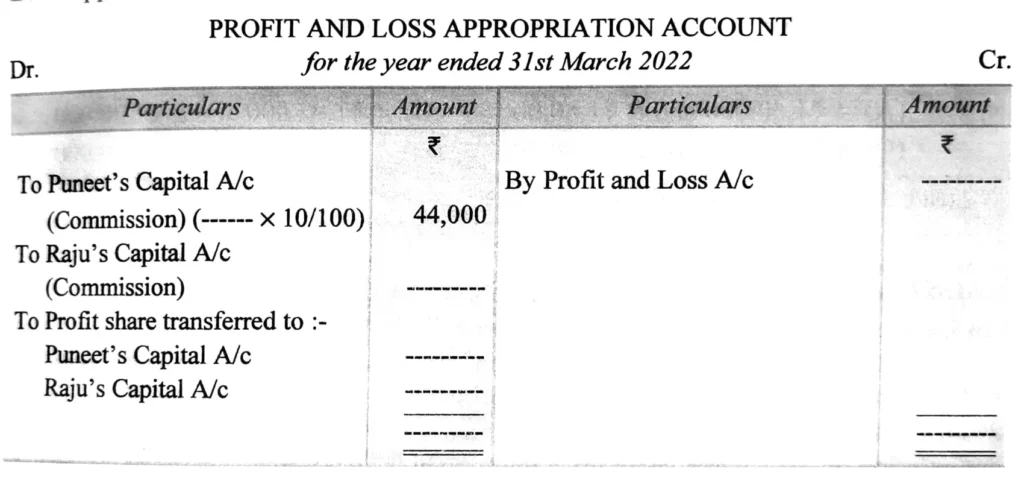

Puneet and Raju are partners in a clay toys making firm. Their capitals were ₹ 5,00,000 and ₹ 10,00,000 respectively. The firm allowed Puneet to get a commission of 10% on the net profit before charging any commission and Raju to get a commission of 10% on the net profit after charging all commissions. Following is the profit and Loss Appropriation Account for the year ended 31st March 2022.

Q. 1 Raju’s commission will be :

(a) ₹ 40,000

(b) ₹ 44,000

(c) ₹ 36,000

(d) ₹ 36,440

Ans:- c)

Q. 2 Puneet’s share of profit will be:

(a) ₹ 1,80,000

(b) ₹ 1,44,000

(c) ₹ 2,16,000

(d) ₹ 1,60,000

Ans:- a)

A and B are partners with Capitals of ₹ 10,00,000 and ₹ 6,00,000 respectively. Interest on Capital is agreed @ 5% p.a. B is to be allowed a salary of ₹ 10,000 per month. During the year 2023-24, the profits prior to the calculation of interest on capital but after charging B’s salary amounted to ₹ 3,00,000. Manager is to be allowed a commission of 5% of the profit after charging such commission.

Based on the above information you are required to answer the following questions:

Q. 1. Manager’s Commission will be recorded:

(a) In Profit & Loss Account

(b) In Profit & Loss Appropriation Account

(c) In Revaluation Account

(d) In Realisation Account

Ans:- a)

Q. 2 In case of fluctuating Capitals, Interest on Capital will be recorded:

(a) On the Credit Side of Current Accounts

(b) On the Debit Side of Current Accounts

(c) On the Credit Side of Capital Accunts

(d) On the Debit Side of Profit & Loss Account

Ans:- c)

Q. 3. Manager’s Commission will amount to:

(a) ₹ 21,000

(b) ₹ 20,000

(c) ₹ 8,571

(d) ₹ 16,190

Ans:- b)

Q. 4 Share of Profit will be:

(a) A ₹ 1,60,000 and B ₹ 1,60,000

(b) A ₹ 1,92,000 and B ₹ 1,28,000

(c) A ₹ 1,20,000 and B ₹ 80,000

(d) A ₹ 1,00,000 and B ₹ 1,00,000

Ans:- d)

Sachi and Gauri are partners with fixed capitals of ₹ 6,00,000 and ₹ 3,00,000 respectively. The profit for the year ended 31st March 2024 was ₹ 2,49,600 before allowing interest on partner’s loan. Following is to be taken into consideration as per partnership deed:

(i) Interest on Loan by Sachi of ₹ 2,00,000 to the firm provided on 1st November, 2023.

(ii) Interest on drawings @ 12% p.a. Drawings were Sachi ₹ 50,000 and Gauri ₹ 40,000.

(iii) Gauri is to be allowed a Commission of 2.5% on sales. Sales for the year were ₹ 40,00,000.

(iv) 10% of the divisible profits is to be kept in a Reserve Account.

Based on the above information you are required to answer the following questions:

Q. 1. Interest on Loan by Sachi will be:

(a) Credited to Sachi’s Capital A/c

(b) Credited to Sachi’s Current A/c

(c) Debited to Profit & Loss A/c

(d) Debited to Profit & Loss Appropriation A/c

Ans:- c)

Q. 2 Interest on Drawings will be recorded:

(a) On the Debit of Profit & Loss Appropriation Account

(b) On the Credit of Partner’s Current Accounts

(c) On the Debit of Partner’s Capital Accounts

(d) On the debit of Partner’s Current Accounts.

Ans:- d)

Q. 3. Commission to Gauri will be recorded:

(a) On the Debit side of Profit & Loss Account

(b) On the Credit side of Gauri’s Capital Account

(c) On the Credit side of Gauri’s Current Account

(d) On the Debit side of Gauri’s Current Account

Ans:- c)

Q. 4 Share of Profit will be:

(a) Sachi ₹ 69,930 and Gauri ₹ 69,930

(b) Sachi ₹ 67,500 and Gauri ₹ 67,500

(c) Sachi ₹ 62,520 and Gauri ₹ 62,520

(d) Sachi ₹ 62,770 and Gauri ₹ 62,770

Ans:- b)

P and Q are partners with profit sharing ratio of 2 : 3 with fixed capitals of ₹ 5,00,000 and ₹ 8,00,000 respectively. On 1st June 2023, P and Q granted loans of ₹ 2,00,000 and ₹ 1,00,000 respectively to the firm. Books of the firm are closed on 31st March 2024. You are required to answer the following questions:

Q. 1. If the profit before interest on loan for the year amounted to ₹ 6,000, the interest allowed on loan by P will be:

(a) ₹ 10,000

(b) ₹ 9,000

(c) ₹ 6,000

(d) ₹ 12,000

Ans:- a)

Q. 2. If the loss before interest on loan for the year amounted to ₹ 10,000, the interest allowed on loan by P will be:

(a) Nil

(b) ₹ 6,000

(c) ₹ 10,000

(d) ₹ 12,000

Ans:- c)

Q. 3 Interest on Loan by P will be:

(a) Credited to P’s Capital Account

(b) Credited to P’s Current Account

(c) Credited to P’s Loan Account

(d) Debited to P’s Loan Account

Ans:- c)

Interest on Loan by Partner P

(a) Is an appropriation of Profit

(b) Is a charge against Profit

(c) Will be Debited to Profit & Loss Account

(d) Will be Debited to Profit & Loss Appropriation Account

Ans:- b) and c)

Read the following text and answer the given questions:

Chandrika and Tara are in partnership with Capitals of ₹ 30,00,000 and ₹ 20,00,000 respectively. Business is being carried from the property owned by Tara on a monthly rent of ₹ 10,000. Chandrika is entitled to a salary of ₹ 15,000 per quarter and Tara a salary of ₹ 5,000 per month.

Manager is entitled to a commission of 10% of profit before charging such commission. Net profit for the year ended 31st March 2024 before any of the above adjustments was ₹ 10,00,000.

Q. 1 Rent payable to Tara is

(a) Appropriation of Profit

(b) Charge against Profit

(c) Debited to Profit & Loss Account

(d) Debited to Profit & Loss Appropriation Account

Ans:- b) and c)

Q. 2 Salary payable to partners is

(a) Appropriation of Profit

(b) Charge against Profit

(c) Debited to Profit & Loss Account

(d) Debited to Profit & Loss Appropriation Account

Ans:- a) and d)

Q. 3. Net Profit for the year will be:

(a) ₹ 10,00,000

(b) ₹ 8,80,000

(c) ₹ 7,92,000

(d) ₹ 8,00,000

Ans:- c)

Share of Profit will be :

(a) Chandrika ₹ 3,40,000 and Tara ₹ 3,40,000

(b) Chandrika ₹ 3,36,000 and Tara ₹ 3,36,000

(c) Chandrika ₹ 4,03,200 and Tara ₹ 2,68,800

(d) Chandrika ₹ 4,08,000 and Tara ₹ 2,72,000

Ans:- b)

Charu and Dushyant are partners with Capitals of ₹ 14,00,000 and ₹ 6,00,000 respectively. During the year ended 31st March 2024, they earned a profit of ₹ 5,00,000 before any of the following adjustments:

(i) Interest on Capital is to be allowed @ 7% p.a.

(ii) Charu granted a loan of ₹ 1,00,000 to the firm on 1st April, 2023. Out of this amount, ₹ 25,000 were returned to her on 31st July 2023.

(iii) Dushyant is to get a quarterly rent of ₹ 45,000 for the use of his property by the firm.

(iv) Interest on Drawings is to be charged at 8% p.a. Drawings of the partners were: Charu ₹ 1,00,000 and Dushyant ₹ 25,000.

Based on the above information you are required to answer the following questions:

Q. 1. Interest on Charu’s Loan is

a) Debited to Profit and Loss Appropriation Account

b) Debited to Profit and Loss Account

c) Appropriation of Profit

d) Charge against Profit

Ans:- b) and d)

Q. 2. Interest on Drawings will be

a) Credited to Partner’s Current Accounts

b) Credited to Partner’s Capital Accounts

c) Debited to Partner’s Current Accounts

d) Debited to Partner’s Capital Accounts

Ans:- d)

Q. 3. Net Profit for the year will amount to:

a) ₹ 3,20,000

b) ₹ 5,00,000

c) ₹ 3,15,000

d) ₹ 1,80,000

Ans:- c)

Q. 4. Share of Profit will be:

a) Charu’s ₹ 92,500 and Dushyant ₹ 92,500.

b) Charu’s ₹ 90,000 and Dushyant ₹ 90,000

c) Charu ₹ 1,26,000 and Dushyant ₹ 54,000

d) Charu ₹ 1,29,500 and Dushyant ₹ 55,500

Ans:- b)

Ananya and Mukti are partners in a firm. On 1st April, 2023 their fixed capitals were ₹ 6,00,000 and ₹ 4,00,000 respectively. On 1st January, 2024, Ananya granted a loan of ₹ 2,00,000 to the firm. Mukti had allowed the firm to use her property for business for monthly rent of ₹ 15,000. The partnership deed provides that interest on capital will be allowed @ 8% p.a. and Mukti is to be allowed a salary of ₹ 10,000 per month.

The firm earned a profit of ₹ 63,000 for the year ended 31st March 2024 before any of the above adjustment is made.

Based on the above information you are required to answer the following questions:

Q. 1 Interest on Ananya’s Loan will be recorded in

a) Ananya’s Current Account

b) Ananya’s Capital Account

c) Ananya’s Loan Account

d) Profit & Loss Appropriation Account

Ans:- c)

Q. 2 Which of the following is charge against profit?

a) Rent Payable to Mukti

b) Interest on Ananya’s Loan

c) Salary Payable to Mukti

d) Interest on Capital

Ans:- a) and b)

Q. 3. Interest allowed on Capital will be:

a) Ananya ₹ 48,000 and Mukti ₹ 32,000

b) Ananya ₹ 37,800 and Mukti ₹ 25,000

c) Ananya ₹ 36,000 and Mukti ₹ 24,000

d) No Interest will be allowed

Ans:- d)

Q. 4. Mukti’s share of net loss will be:

a) ₹ 24,000

b) ₹ 64,000

c) ₹ 1,60,000

d) ₹ 60,000

Ans:- d)

Jai and Partap are partners sharing profits in the ratio of 3 : 2. Their capitals are ₹ 4,00,000 and ₹ 2,00,000 respectively. Firm earned a profit of ₹ 97,000 for the year ended 31st March, 2024 before providing for any of the following adjustments:

(i) Interest on Capital is to be allowed @ 8% p.a.

(ii) Interest is to be provided on Loan of ₹ 1,00,000 taken from Partap on 1st June 2023 and again ₹ 50,000 taken on 1st August, 2023.

(iii) Jai is entitled to a rent of ₹ 5,000 per month for using his property for business purposes. Rent is still payable at the end of the year.

Based on the above information you are required to answer the following questions:

Q.1 Rent payable to Jai will be

(a) Debited to Profit & Loss Account

b) Debited to Profit & Loss Appropriation Account

c) Credited to Jai’s Capital Account

d) Credited to Rent Payable Account

Ans:- a) and d)

Q. 2. Interest on Partap’s Loan will be

a) Debited to Profit & Loss Account

b) Debited to Profit & Loss Appropriation Account

c) Credited to Partap’s Loan Account

d) Credited to Partap’s Capital Account.

Ans:- a) and c)

Net Profit for the year will amount to:

a) ₹ 37,000

b) ₹ 30,000

c) ₹ 97,000

d) ₹ 90,000

Ans:- b)

Q. 4. Interest on Capital will be:

a) Jai ₹ 32,000 and Partap ₹ 16,000.

b) Jai ₹ 18,000 and Partap ₹ 12,000

c) Jai ₹ 20,000 and Partap ₹ 10,000

d) No Interest will be allowed

Ans:- c)

Read the following text and answer the given questions:

A and B are partners having fixed capital os ₹ 3,00,000 and ₹ 2,00,000 on 1st April 2023. They are allowed interest on Capitals @ 8% p.a. and are charged interest on drawings @ 10% p.a.

During the year, A withdrew ₹ 5,000 per month in the beginning of every month, whereas B withdrew ₹ 15,000 per quarter at the end of every quarter.

The profits for the year ended 31st March, 2024, before that above mentioned adjustments were ₹ 1,34,500.

Q. 1. Interest on Capital will be recorded

a) On the Credit side of Capital Accounts

b) On the Credit side of Profit & Loss Appropriation Account

c) On the Credit side of Current Accounts

d) On the Debit side of Current Accounts

Ans:- c)

Q. 2. Interest on Drawings will amount to:

a) A ₹ 3,250 and B ₹ 2,750

B) A ₹ 3,750 and B 2,250

c) A ₹ 3,250 and B ₹ 3,750

d) A ₹ 3,250 and B ₹ 2,250

Ans:- d)

Q. 3. Share of Profit will be:

a) A ₹ 60,000 and B ₹ 40,000

b) A ₹ 50,000 and B ₹ 50,000

c) A ₹ 50,250 and B ₹ 50,250

d) A ₹ 60,300 and B ₹ 40,200

Ans:- b)

Q. 4. Balance of Current Accounts will be:

a) A ₹ 20,750 (cr.) and B ₹ 6,250 (Dr.)

b) A ₹ 20,750 (Dr.) and B ₹ 6,250 (Cr.)

c) A ₹ 10,750 (Cr.) and B ₹ 3,750 (Cr.)

d) A ₹ 10,750 (Dr.) and B ₹ 3,750 (Dr.)

Ans:- c)

On 1st April, 2020, Pixie, Nixie and Gypsy entered into a partnership with fixed capitals of ₹ 60,000, ₹ 50,000 and ₹ 30,000 respectively.

On 1st October, 2020, Pixie gave a loan of ₹ 12,000 to the firm.

The partnership deed contained the following clauses:

(a) Interest on drawings to be charged @ 4% per annum.

(b) Pixie to be entitled to a rent of ₹ 2,000 per annum for allowing the firm to carry on the business in his premises.

Nixie withdrew ₹ 1,000 at the end of the month for the first six months.

Net Profit of the firm for the year ending 31st March, 2021 (before any interest but after rent on Pixie’s premises) was ₹ 1,21,000.

Q. 1. The net profit of the firm will be:

a) ₹ 1,21,000

b) ₹ 1,20,640

c) ₹ 1,18,640

d) ₹ 96,640

Ans:- b)

Interest on Drawings charged from Nixie will be:

a) ₹ 340

b) ₹ 220

c) ₹ 170

d) ₹ 18.33

Ans – c)

Ans:- c)

Indu and Surekha are partners sharing profits and losses in the ratio of 2 : 1 with Capitals of ₹ 3,00,000 and ₹ 2,00,000.

You are required to answer the following questions in each of the following alternatives cases:

Q. 1. If the partnership deed provides for interest on Capital @ 9% p.a and the profits for the year are ₹ 36,000, then Indu’s share of interest on Capital will be:

a) ₹ 24,000

b) ₹ 27,000

c) ₹ 21,600

d) ₹ 14,400

Ans – c)

Ans:- c)

Q. 2. If the partnership deed provides for interest on Capital @ 9% p.a. and the loss for the year is ₹ 15,000, then Indu’s share of interest on Capital will be:

a) ₹ 27,000

b) ₹ 9,000

c) ₹ 10,000

d) Nil

Ans:- d)

Q. 3. If the partnership deed is silent as to interest on Capital and the profits for the year are ₹ 60,000,, then Surekha’s share of interest on Capital will be:

a) ₹ 18,000

b) ₹ Nil

c) ₹ 27,000

d) ₹ 12,000

Ans:- b)

Q. 4. If the partnership deed provides for interest on Capital @ 9% p.a. even if it involves the firm in loss and the profits for the year are 30,000, then Indu’s share of interest on Capital will be:

a) ₹ 18,000

b) ₹ 20,000

c) ₹ 27,000

d) ₹ 12,000

Ans:- c)

Pushpa and Rashmi are partners in a firm. Their capitals were ₹ 3,00,000 and ₹ 2,00,000 respectively. Pushpa was to get a commission of 10% on the net profits before charging any commission. However, Rashmi was to get a commission of 10% on the net profits after charging all commissions. Following Profit and Loss Appropriation Account for the year ended 31st March 2021 is given to you:

Rashmi’s Commission will be:

(a) ₹ 40,000

(b) ₹ 1,44,000

(c) ₹ 36,000

(d) ₹ 36,364

Ans:- c)

Rashmi’s share of profit will be:

(a) ₹ 1,80,000

(b) ₹ 1,44,000

(c) ₹ 2,16,000

(d) ₹ 1,60,000

Ans:- a)

In case there is no partnership agreement, which of the following is incorrect:

(a) Interest on partner’s loan will be allowed at 6% p.a.

(b) No interest is to be charged on drawings made by the partners.

(c) Interest on Partner’s Loan to the firm will not be allowed in case of loss in the firm.

(d) Even if the capitals of partners are unequal, profits and losses are to be shared equally.

Ans:- c)

Tripti and Khushi are partners sharing profits in the ratio of 3 : 2. Ruchi was manager who received quarterly salary of ₹ 20,000 in addition to commission of 10% on net profits after charging such commission. Total remuneration to Ruchi amounted to ₹ 1,30,000. What was the profit for the year before charging salary and commission?

(a) ₹ 5,50,000

(b) ₹ 4,70,000

(c) ₹ 6,30,000

(d) ₹ 5,00,000

Ans:- c)

Sweta and Tripti are partners sharing profits and losses in the ratio of 2 : 1 with Capitals of ₹ 3,00,000 and ₹ 2,00,000.

You are required to answer the following questions in each of the following alternative cases:

If the partnership deed provides for interest on Capital @ 9% p.a. and the profits for the year are ₹ 36,000, then Sweta’s share of interest on Capital will be:

a) ₹ 24,000

b) ₹ 27,000

c) ₹ 21,600

d) ₹ 14,400

Ans:- c)

If the partnership deed provides for interest on capital @ 9% p.a. and the loss for the year is ₹ 15,000, then Sweta’s share of interest on Capital will be:

a) ₹ 27,000

b) ₹ 9,000

c) ₹ 10,000

d) Nil

Ans:- d)

If the partnership deed is silent as to interest on Capital and the profits for the year are ₹ 60,000, then Tripti’s share of interest on Capital will be:

a) ₹ 18,000

b) Nil

c) ₹ 27,000

d) ₹ 12,000

Ans:- b)

A, B and C are in partnership. On 1st April, 2023 their capitals were : A ₹ 10,00,000 (Credit), B ₹ 6,00,000 (Credit) and C ₹ 1,00,000 (Debit). As per Partnership deed interest on capital is to be allowed @ 8% p.a. and interest on drawings is to be charged @ 10% p.a. You find that:

(i) On 1st January, 2024, A withdrew ₹ 1,50,000 against Capital;

(ii) B withdrew ₹ 10,000 p.m. during the year.

(iii) C withdrew ₹ 1,20,000 during the year.

The profit for the year ended 31st March, 2024 amounted to ₹ 5,63,000.

You are required to answer the following questions:

Interest on A’s drawings will amount to:

a) ₹ 15,000

b) ₹ 3,750

c) nil

d) ₹ 3,000

Ans – c)

Interest on A’s Capital will amount to:

a) ₹ 80,000

b) ₹ 77,000

c) ₹ 68,000

d) ₹ 74,000

Ans:- b)

Each partner’s share of profit will be:

a) ₹ 1,50,000

b) ₹ 1,51,250

c) ₹ 1,49,000

d) ₹ 1,54,000

Ans:- a)

Ravi and Kishan are partners sharing profits in the ratio of 3 : 2. Their fixed capitals on 1st April 2023 were ₹ 2,00,000 and ₹ 1,00,000 respectively. The partnership deed provides that:

(i) Interest on Capital is to be allowed at 6% p.a. and charged on drawings @ 10% p.a.

(ii) Ravi was to be paid a salary of ₹ 5,000 p.m. whereas Kishan was to get a commission of 4% on sales.

It is ascertained that Ravi withdrew ₹ 4,000 at the end of every month and Kishan withdrew ₹ 12,000 at the end of every quarter. Sales for the year ended 31st March 2024 amounted to ₹ 3,00,000. The net profit fo the firm before making the above adjustments was ₹ 56,000.

Based on the above information you are required to answer the following questions:

Interest on Drawings will amount to:

a) Ravi ₹ 2,600 and Kishan ₹ 1,800

b) Ravi ₹ 2,600 and Kishan ₹ 3,000

c) Ravi ₹ 2,200 and Kishan ₹ 1,800

d) Ravi ₹ 2,200 and Kishan ₹ 3,000

Ans:- c)

Share of Profit will be:

a) Ravi ₹ 44,800 and Kishan ₹ 11,200

b) Ravi ₹ 48,000 and Kishan ₹ 12,000

c) Ravi ₹ 36,000 and Kishan ₹ 24,000

d) Ravi ₹ 72,000 and Kishan ₹ 18,000

Ans:- b)

Ravi’s Current Account Balance will be:

a) Dr. ₹ 2,200

b) Cr. ₹ 2,200

c) Dr. ₹ 14,200

d) Dr. ₹ 5,400

Ans:- a)