What are the Types of Debentures class 12

Looking, what are the Types of Debentures as per the syllabus of Accountancy class 12 CBSE, ISC, and other State Boards.

See, there are various types of debentures that a company can issue.

In this article, I would discuss some of the important major types of debentures that a public limited company can issue to the public to raise the funds.

If you understand what are debentures, it would be easy for you to understand its types too.

I have explained this topic in detail.

You can watch below video lectures. Otherwise can read below articles.

What are the different types of debentures class 12

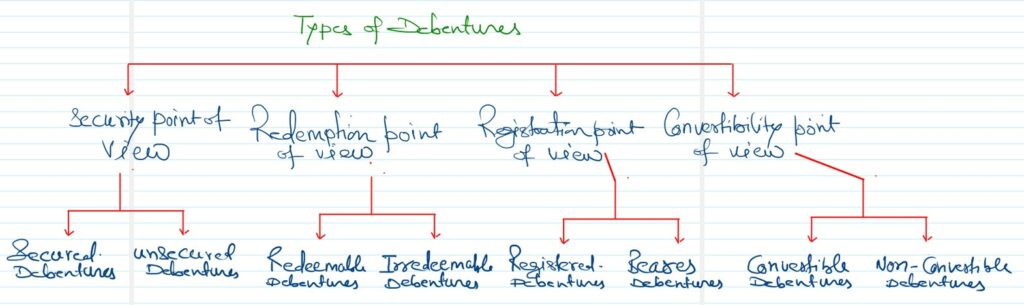

Majorly, Debentures can be classified on the basis of 4 characteristics

- Security

- Redemption

- Registration

- Convertibility

Types of Debentures from Security point of view

There are two types of debentures from the security point of view

i) Secured or Mortgage Debentures:-

Such debentures are those which are secured either on particular assets of the company called a fixed charge or on all assets of the company in general, called a floating charge.

Under the fixed charge, the company can not use the assets mortgage against debentures.

But Under the floating charge, the company is allowed to use the assets mortgage as security against debentures issued.

In the case of a company is unable to repay the amount of debentures on maturity, the debenture holders can realise their money from the assets mortgaged with them.

There are further types of Secured Debentures.

First Secured (Mortgage) Debentures:-

First mortgage debentures are those that have a first claim on the assets charged against debentures issued.

Second Secured (Mortgage) Debentures:-

The second mortgage debentures are those having a second claim on the assets charged.

Note:- In India, Debentures issued must be of secured Debentures type

Unsecured or Naked Debentures:-

These are a kind of debentures that are not secured by a charge on the assets of the company.

The holders of such debentures are treated as the unsecured creditors of the company at the time of liquidation.

Such debentures are not very common these days, unless otherwise stated, all debentures are considered secured.

Types of Debentures from Redemption Point of view

There are two types of debentures from the Redemption point of view.

Redeemable Debentures:-

Such debentures are those debentures that are repaid either in a lump sum or in installment after the end of the specified period of time.

Note:- Most of the debentures nowadays are redeemable debentures

Irredeemable or Perpetual Debentures:-

The irredeemable debentures are those debentures that are not repaid by the company during its lifetime.

These debentures are repayable only at the time of liquidation of the company

Types of Debentures on Registration Point of view

there are two types of debentures on registration point of view

Registered Debentures:-

The Registered Debentures are those debentures where the name and address of the debenture holders are recorded in the register of the company called ‘Register of Debentureholders’.

The principal and the interest are paid to the registered debenture holders.

Such debentures are not freely transferable. The transfer of such debentures requires the proper execution of the transfer deed.

Bearer Debentures:-

The bearer Debentures are those debentures where the name and address of the debenture holder are not recorded in the company.

Such debentures are transferable just by delivery.

A coupon is attached to such debentures.

The principal and interest are paid to the bearer of such debentures who produce the coupons in the specified bank.

Types of Debentures on Convertibility point of view

There are two types of debentures from a convertibility point of view.

Convertible Debentures:-

The convertible debentures are those debentures that can be converted into shares.

such debentures are further classified in two forms

Partly Convertible Debentures

If a part of the debenture amount is convertible into Equity Shares, they are known as Partly Convertible Debentures.

Fully Convertible Debentures

If the full amount of debentures is convertible into Equity Shares, they are known as Fully Convertible Debentures.

Note:- SEBI Guidelines require that where the conversion is to be made at or after 18 months from the date of allotment but before 36 months, any conversion in part or whole shall be optional on the part of the debenture holders

Non-Convertible Debentures:-

Non-Convertible Debentures are the debentures that are not convertible into shares.

Further Reading:-

What are Debentures, meaning definition, and examples