[CBSE] Q. 75 solution of Fundamentals of Partnership Firms TS Grewal Book (2022-23)

Solution of Question number 75 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2022-23 Edition?

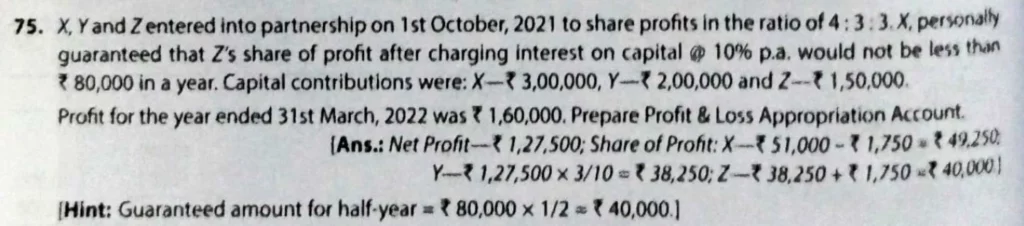

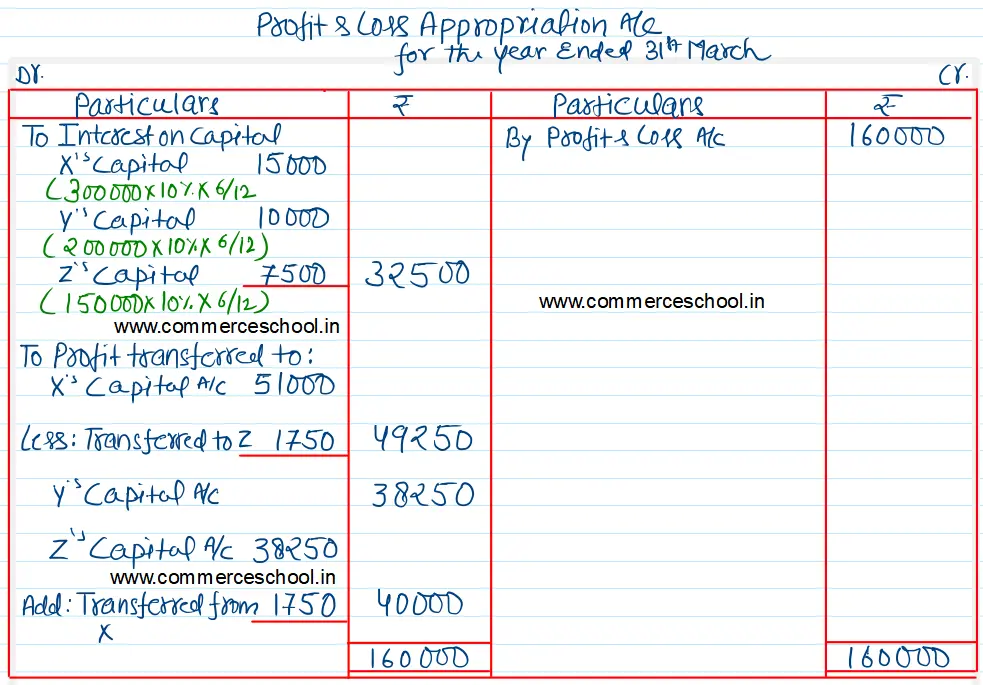

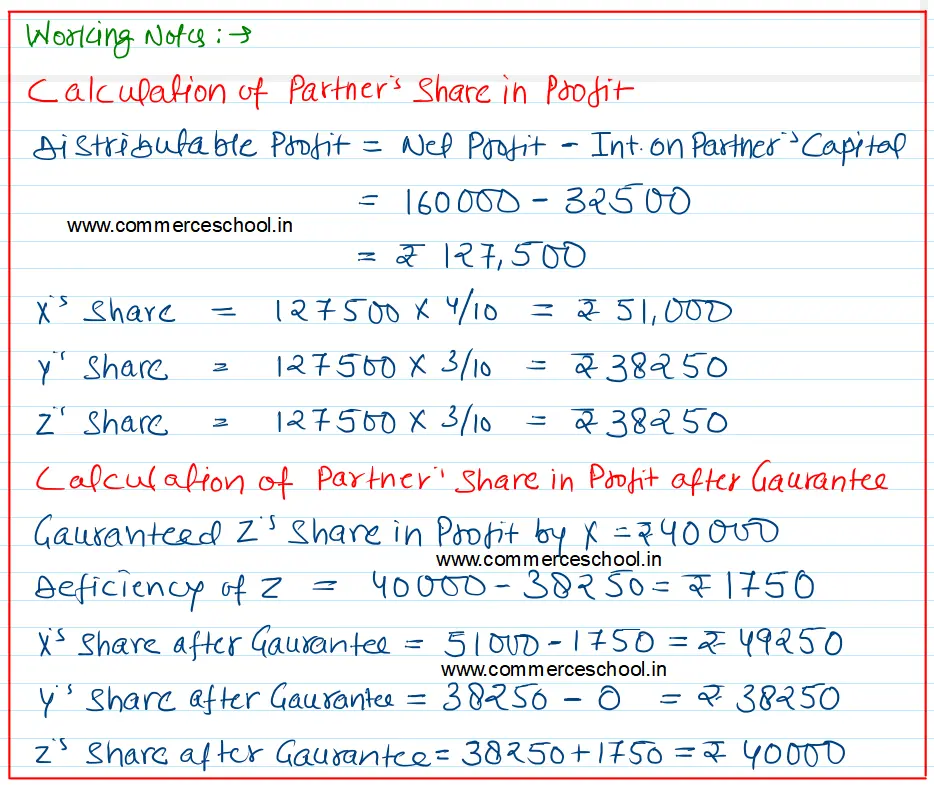

X, Y, and Z entered into a partnership on 1st October 2021 to share profits in the ratio of 4:3:3. X, personally guaranteed that Z’s share of profit after allowing interest on capital @ 10% p.a. would not be less than ₹ 8,000 in a year. Capital contributions were: X – ₹ 3,00,000, Y – ₹ 2,00,000, and Z – ₹ 1,50,000.

Profit for the year ended 31st March 2022 was ₹ 1,60,000. Prepare Profit and Loss Appropriation Account.

Solution:-

Note:- As partners started business on 1st October, thus interest on capital and guarantee to partners are provided only for six months from 1st October to 31st March.

Here is the list of all Solutions.

| S.N | Questions |

| 1. | Question – 1 |

| 2. | Question – 2 |

| 3. | Question – 3 |

| 4. | Question – 4 |

| 5. | Question – 5 |

| 6. | Question – 6 |

| 7. | Question – 7 |

| 8. | Question – 8 |

| 9. | Question – 9 |

| 10. | Question – 10 |

| S.N | Questions |

| 11. | Question – 11 |

| 12. | Question – 12 |

| 13. | Question – 13 |

| 14. | Question – 14 |

| 15. | Question – 15 |

| 16. | Question – 16 |

| 17. | Question – 17 |

| 18. | Question – 18 |

| 19. | Question – 19 |

| 20. | Question – 20 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 31. | Question – 31 |

| 32. | Question – 32 |

| 33. | Question – 33 |

| 34. | Question – 34 |

| 35. | Question – 35 |

| 36. | Question – 36 |

| 37. | Question – 37 |

| 38. | Question – 38 |

| 39. | Question – 39 |

| 40. | Question – 40 |

| S.N | Questions |

| 41. | Question – 41 |

| 42. | Question – 42 |

| 43. | Question – 43 |

| 44. | Question – 44 |

| 45. | Question – 45 |

| 46. | Question – 46 |

| 47. | Question – 47 |

| 48. | Question – 48 |

| 49. | Question – 49 |

| 50. | Question – 50 |

| S.N | Questions |

| 51. | Question – 51 |

| 52. | Question – 52 |

| 53. | Question – 53 |

| 54. | Question – 54 |

| 55. | Question – 55 |

| 56. | Question – 56 |

| 57. | Question – 57 |

| 58. | Question – 58 |

| 59. | Question – 59 |

| 60. | Question – 60 |

| S.N | Questions |

| 61. | Question – 61 |

| 62. | Question – 62 |

| 63. | Question – 63 |

| 64. | Question – 64 |

| 65. | Question – 65 |

| 66. | Question – 66 |

| 67. | Question – 67 |

| 68. | Question – 68 |

| 69. | Question – 69 |

| 70. | Question – 70 |

| S.N | Questions |

| 71. | Question – 71 |

| 72. | Question – 72 |

| 73. | Question – 73 |

| 74. | Question – 74 |

| 75. | Question – 75 |

| 76. | Question – 76 |

| 77. | Question – 77 |

| 78. | Question – 78 |

| 79. | Question – 79 |

| 80. | Question – 80 |

| S.N | Questions |

| 81. | Question – 81 |

| 82. | Question – 82 |

| 83. | Question – 83 |

| 84. | Question – 84 |

| 85. | Question – 85 |

| 86. | Question – 86 |

| 87. | Question – 87 |

| 88. | Question – 88 |