[CBSE] Q 6 Depreciation Solutions TS Grewal Class 11 (2022-23)

Are you looking for a solution of Question number 6 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2022-23 Session.

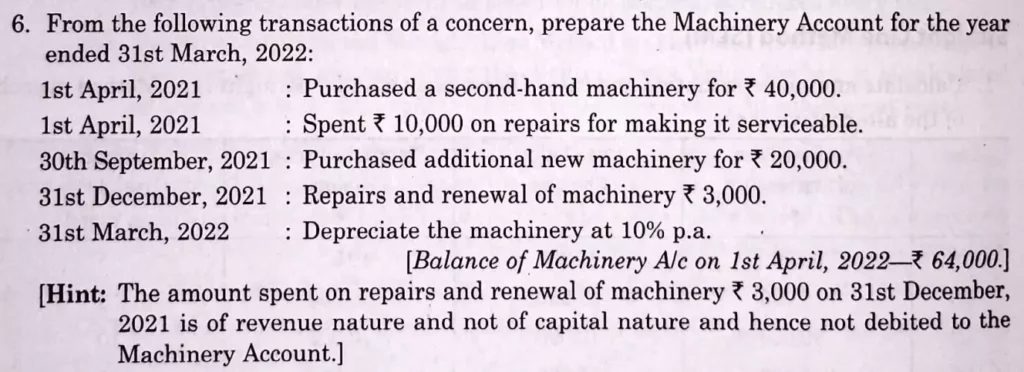

From the following transactions of a concern, prepare the Machinery Account for the year ended 31st March, 2022:

| 1st April, 2021 | Purchased a second-hand machinery for ₹ 40,000. |

| 1st April, 2021 | Spent ₹ 10,000 on repairs for making it serviceabale. |

| 30th September, 2021 | Purchased additional new machinery for ₹ 20,000. |

| 31st Decemeber, 2021 | Repairs and renewal of machinery ₹ 3,000. |

| 31st March, 2022 | Depreciate the machinery at 10% p.a. |

[Balance of Machinery A/c on 1st April, 2022 – ₹ 64,000.]

[Hint: The amount spent on repairs and renewal of machinery ₹ 3,000 on 31st December, 2021 is of revenue nature and not of capital nature and hence not debited to the Machinery Account.]

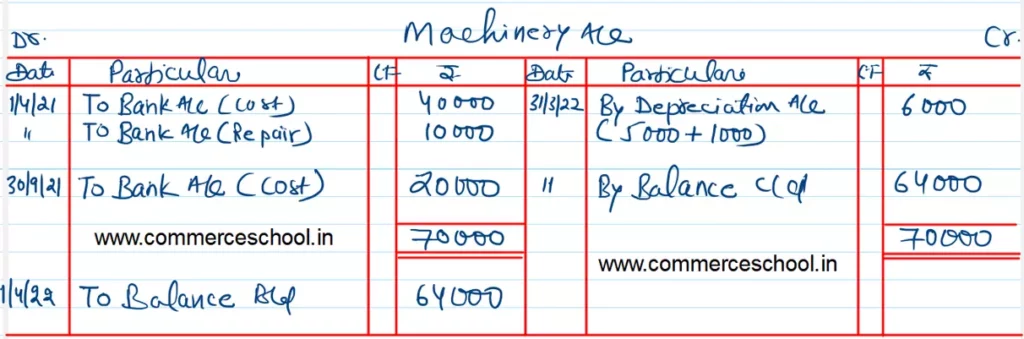

Solution:-

Following is the list of all solutions of depreciation chapter of ts Grewal CBSE for the 2022-23 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |