[CBSE] Q 13 Depreciation Solutions TS Grewal Class 11 (2022-23)

Are you looking for a solution of Question number 13 of the Depreciation chapter TS Grewal Class 11 CBSE Board for the 2022-23 Session?

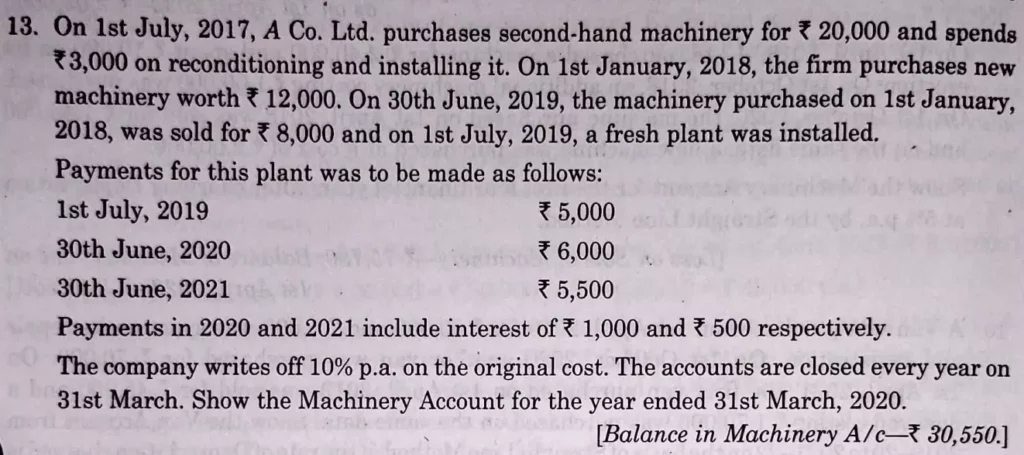

On 1st July, 2017, A Co. Ltd purchases second-hand machinery for ₹ 20,000 and spends ₹ 3,000 on reconditioning and installing it. On 1st January, 2018, the firm purchases new machinery worth ₹ 12,000. On 30th June, 2019, the machinery purchased on 1st January, 2018, was sold for ₹ 8,000 and on 1st July, 2019, a fresh plant was installed.

Payments for this plant was to be made as follows:

| 1st July, 2019 | ₹ 5,000 |

| 30th June, 2020 | ₹ 6,000 |

| 30th June, 2021 | ₹ 5,500 |

Payments in 2020 and 2021 include interest of ₹ 1,000 and ₹ 500 respectively.

The company writes off 10% p.a. on the original cost. The accounts are closed every year on 31st March. Show the Machinery Account for the year ended 31st March, 2020.

[Balance in Machinery A/c – ₹ 30,550.]

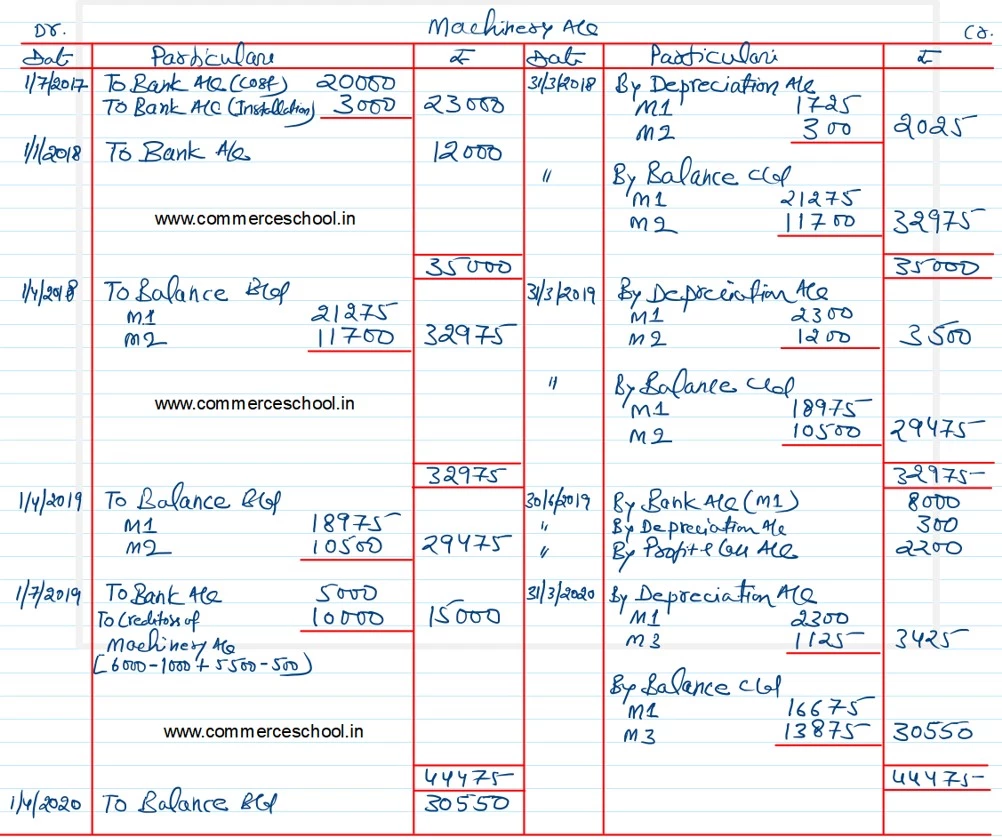

Solution:-

Following is the list of all solutions of depreciation chapter of ts Grewal CBSE for the 2022-23 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |