[CBSE] Q 11 Depreciation Solutions TS Grewal Class 11 (2022-23)

Are you looking for a solution of Question number 11 of the Depreciation chapter TS Grewal Class 11 CBSE Board for the 2022-23 Session?

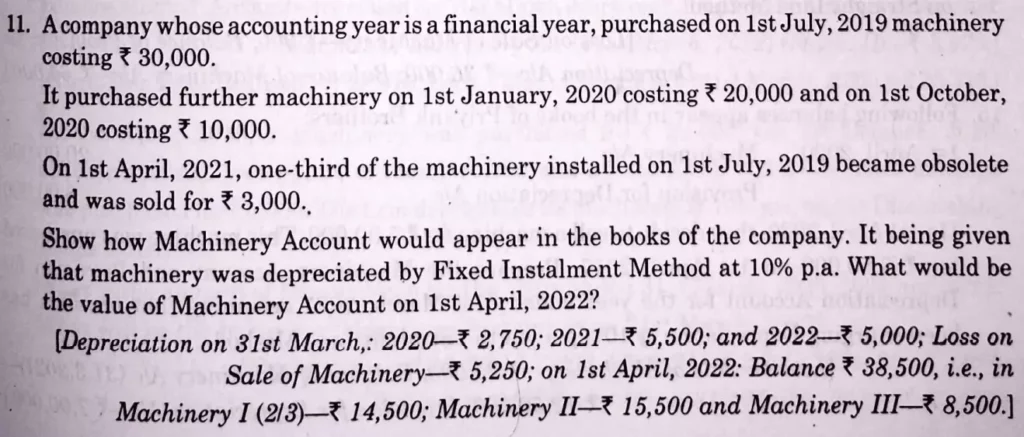

A company whose accounting year is a financial year, purchased on 1st July, 2019 machinery costing ₹ 30,000.

It purchased further machinery on 1st January, 2020 costing ₹ 20,000 and on 1st October, 2020 costing ₹ 10,000.

On 1st April, 2021, one-third of the machinery installed on 1st July, 2019 became obsolete and was sold for ₹ 3,000.

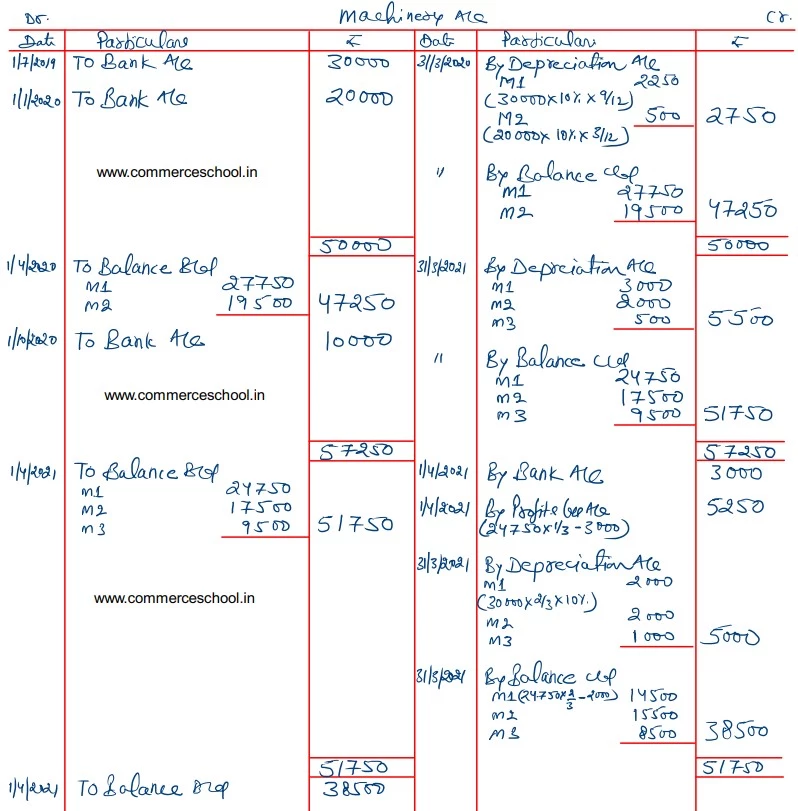

Show how Machinery Account would appear in the books of the company. It being given that machinery was depreciated by Fixed Instalment Method at 10% p.a. What would be the value of Machinery Account on 1st April, 2022?

[Depreciation on 31st March,: 2020 – ₹ 2,750; 2021f – ₹ 5,500; and 2022 – ₹ 5,000; Loss on Sale of Machinery – ₹ 5,250; on 1st April, 2022: Balance ₹ 38,500, i.e., in Machinery I (2/3) – ₹ 14,500; Machinery II – ₹ 15,500 and Machinery III – ₹ 8,500.]

Solution:-

Following is the list of all solutions of depreciation chapter of ts Grewal CBSE for the 2022-23 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |