[CBSE] Q 24 Depreciation Solutions TS Grewal Class 11 (2022-23)

Are you looking for a solution of Question number 24 of the Depreciation chapter TS Grewal Class 11 CBSE Board for the 2022-23 Session?

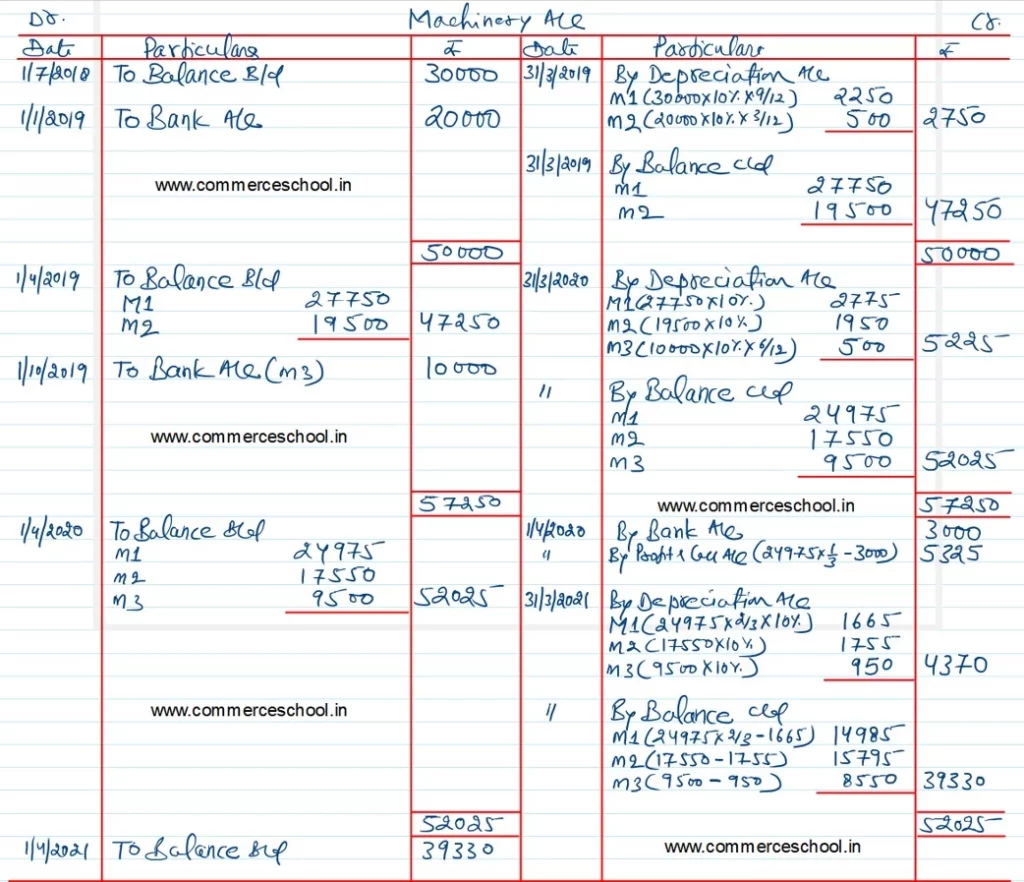

A company purchased on 1st July, 2018 machinery costing ₹ 30,000. It further purchased machinery on 1st January, 2019 costing ₹ 20,000 and on 1st October, 2019 costing ₹ 10,000. On 1st April, 2020, on third of the machinery installed on 1st July, 2018 became obsolete and was sold for ₹ 3,000. The company follows financial year as accounting year.

Show how the Machinery Account would appear in the books of company if depreciation is charged @ 10% p.a. on Written Down Value Method.

[Balance of Machinery A/c – ₹ 39,330 (Mach. I: ₹ 14,985; Mach II: ₹ 15,795; Mach. III. ₹ 8,550); Loss on Sale of Machine (Mach. I) (1/3): ₹ 5,325.]

Solution:-

Following is the list of all solutions of depreciation chapter of ts Grewal CBSE for the 2022-23 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |