[CBSE] Q 15 Accounting Equation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 15 of Accounting Equation chapter TS Grewal class 11 CBSE Board 2022-23?

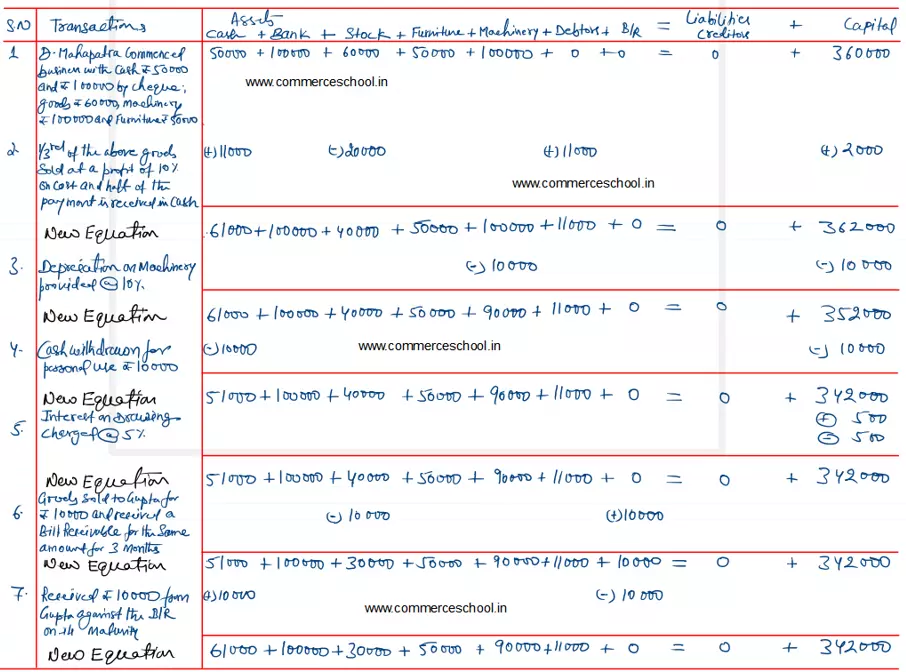

Show an Accounting Equation for the following transactions:

(i) D. Mahapatra commenced business with cash ₹ 50,000 and ₹ 1,00,000 by cheque; goods ₹ 60,000; machinery ₹ 1,00,000 and furniture ₹ 50,000.

(ii) 1/3rd of the above goods sold at a profit of 10% on cost and half of the payment is received in cash.

(iii) Depreciation on machinery provided @ 10%

(iv) Cash withdrawn for personal use ₹ 10,000.

(v) Interest on drawings charged @ 5%.

(vi) Goods sold to Gupta for ₹ 10,000 and received a Bill Receivables for the same amount for 3 months.

(vii) Received ₹ 10,000 from Gupta against the Bills Receivables on its maturity.

[Assets: Cash ₹ 61,000 + Bank ₹ 1,00,000 + Stock (goods) ₹ 30,000 + Machinery ₹ 90,000 + Furniture ₹ 50,000 + Debtors ₹ 11,000 = Liabilities: Nil + Capital: ₹ 3,42,000.]

[Hints: 1. Opening Capital ₹ 3,60,000 = Cash ₹ 50,000 + Bank ₹ 1,00,000 + Stock ₹ 60,000 + Machinery ₹ 1,00,000 + Furniture ₹ 50,000. 2. Liabilities: Nil.]

Solution:-

Below are the links of all solutions

| S.N | Solution |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solution |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |