[CBSE] Q 12 Accounting Equation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 12 of Accounting Equation chapter TS Grewal class 11 CBSE Board 2022-23?

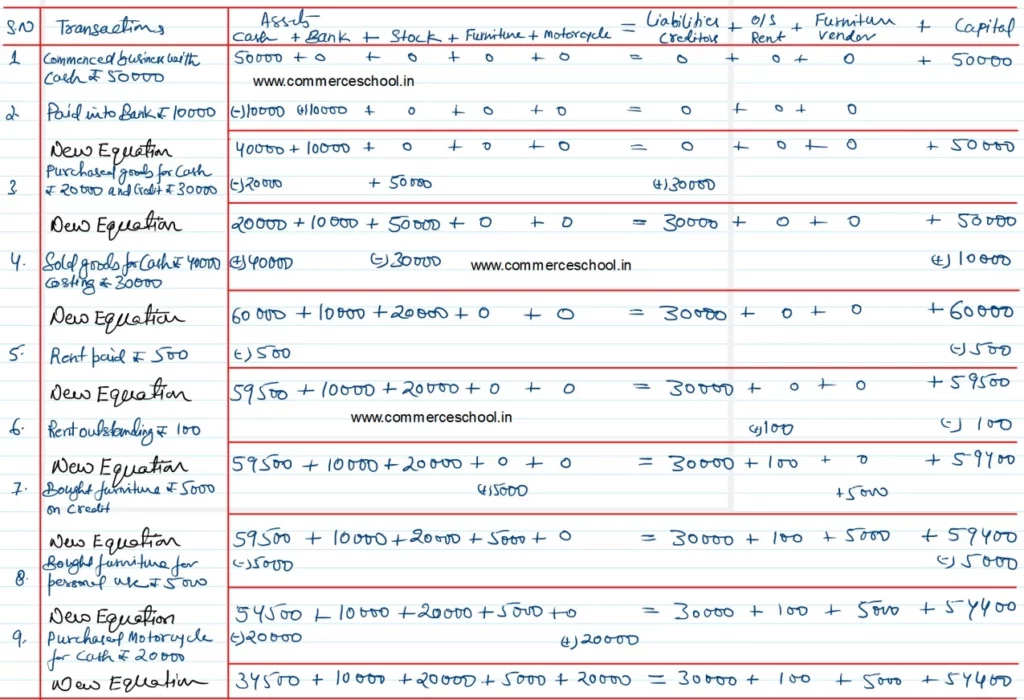

Raghunath had the following transactions in an accounting year:

(i) Commenced business with cash ₹ 50,000.

(ii) Paid into bank ₹ 10,000.

(iii) Purchased goods for cash ₹ 20,000 and credit ₹ 30,000.

(iv) Sold goods for cash ₹ 40,000 costing ₹ 30,000.

(v) Rent paid ₹ 500.

(vi) Rent outstanding ₹ 100.

(vii) Bought furniture ₹ 5,000 on credit.

(viii) Bought refrigerator for personal use ₹ 5,000.

(ix) Purchased motorcycle for cash ₹ 20,000.

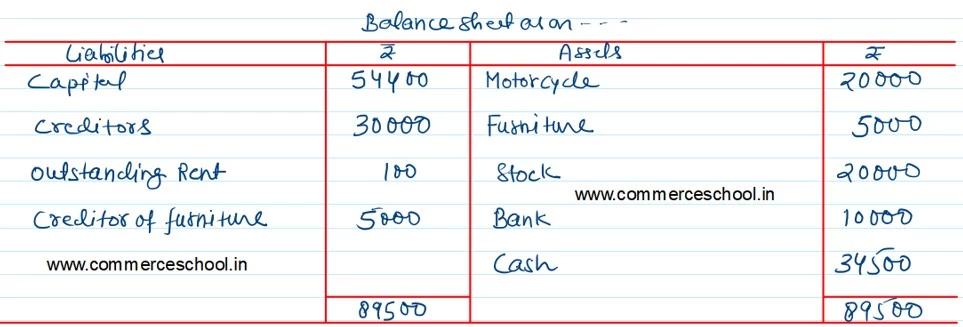

Create an Accounting Equation to show the effect of the above and also show his Balance Sheet.

[Assets: Cash ₹ 34,500 + Bank ₹ 10,000 + Stock ₹ 20,000 + Furniture ₹ 5,000 + Motorcycle ₹ 20,000 = Liabilities: Creditors ₹ 30,000 + Outstanding Rent ₹ 100 + Vendor for Furniture ₹ 5,000 + Capital: ₹ 54,400.]

Solution:-

Below are the links of all solutions

| S.N | Solution |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solution |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |