[ISC] Q. 4 solution of Fundamentals of Partnership Firms TS Grewal Book ISC 2023-24 Edition

Solution of Question number 4 of the Fundamentals of partnership Accounts (Firm) chapter TS Grewal Book 2023-24 Edition ISC Board.

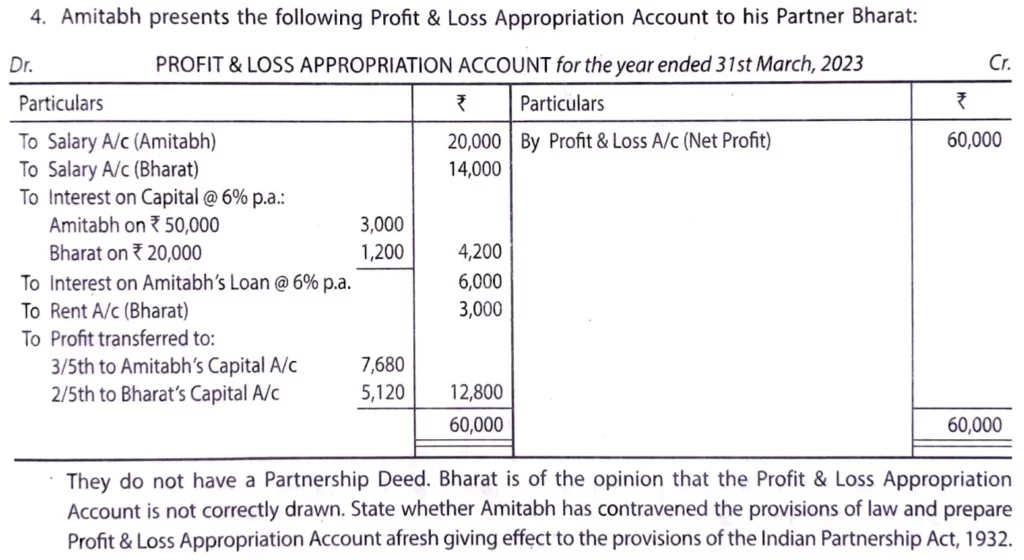

Amitabh presents the following Profit and Loss Appropriation Account to his Partner Bharat:

Profit & Loss Appropriation Account for the year ended 31st March, 2023

| Particulars | ₹ | Particulars | ₹ |

| To Salary A/c (Amitabh) To Salary A/c (Bharat) To Interest on Capital @ 6% p.a.: Amitabh on ₹ 50,000 Bharat on ₹ 20,000 To Interest on Amitabh’s Loan @ 6% p.a. To Rent A/c (Bharat) To Profit transferred to: 3/5th to Amitabh’s Capital A/c 2/5th to Bharat’s Capital A/c | 20,000 14,000 3,000 1,200 6,000 3,000 7,680 5,120 | By Profit & Loss A/c (Net Profit) | 60,000 |

| 60,000 | 60,000 |

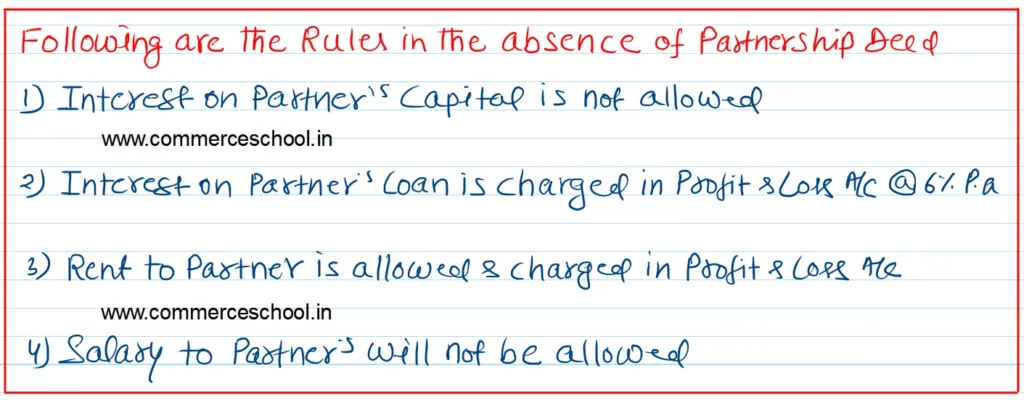

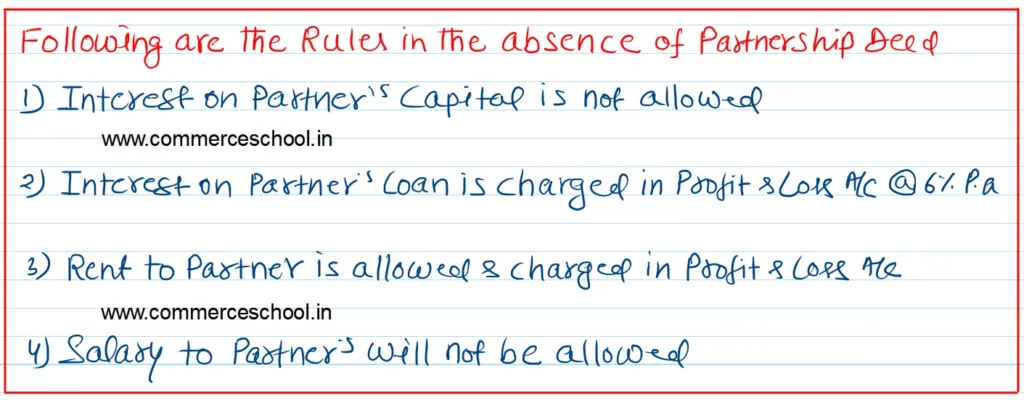

They do not have a Partnership Deed. Bharat is of the opinion that the Profit & Loss Appropriation Account is not correctly drawn. State whether Amitabh has contravened the Provisions of Law and Prepare, Profit and Loss Appropriation Account afresh giving effect to the provisions of the Indian Partnership Act, 1932.

Solution:-

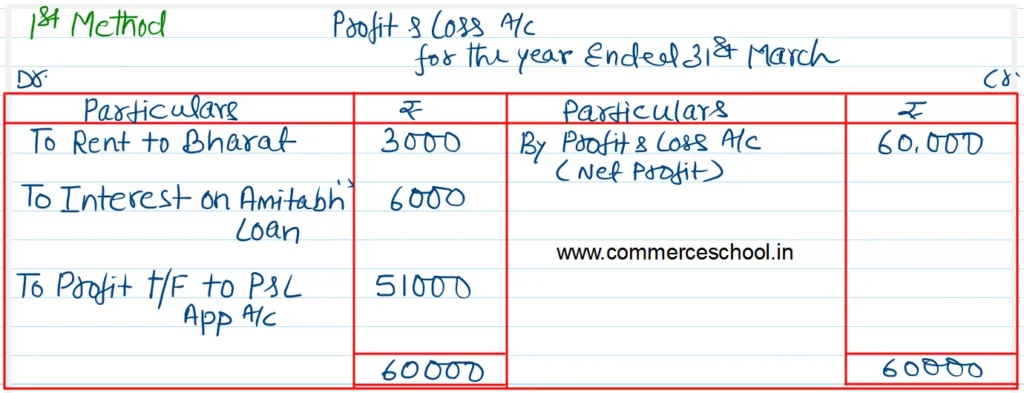

1st Method

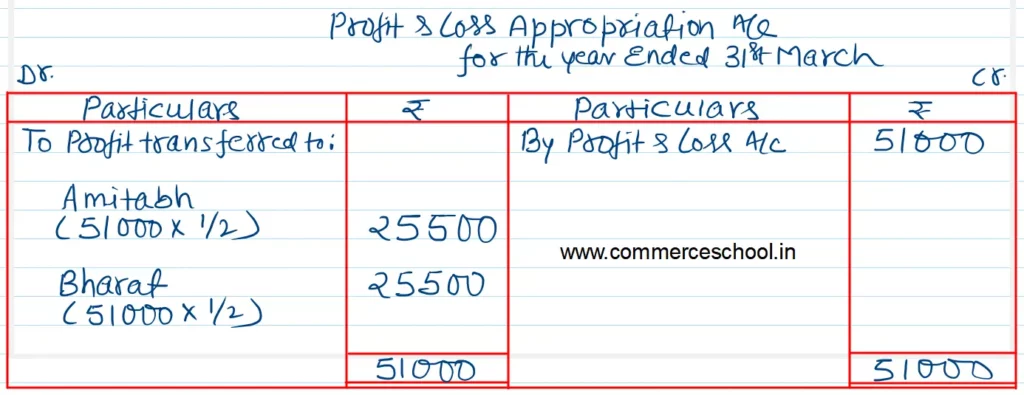

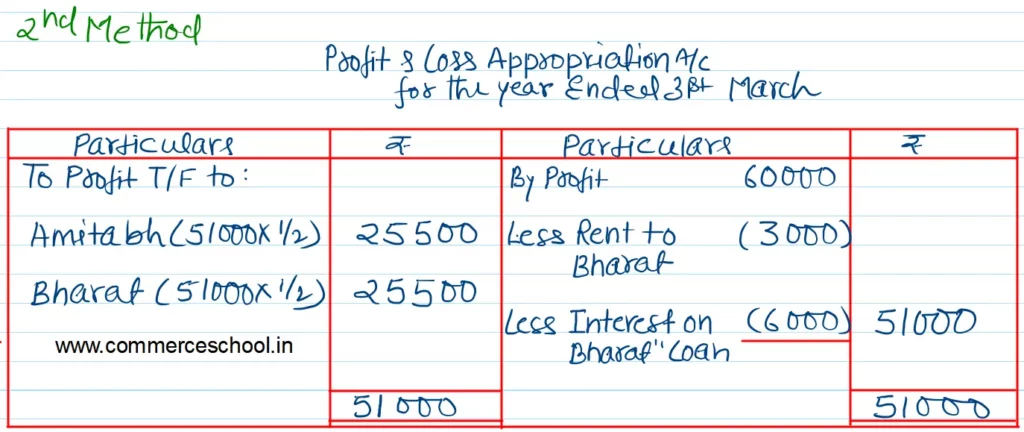

2nd Method

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |