[ISC] Q. 64 solution of Fundamentals of Partnership Firms TS Grewal Book ISC 2023-24 Edition

Solution of Question number 64 of the Fundamentals of partnership Accounts (Firm) chapter TS Grewal Book 2023-24 Edition ISC Board.

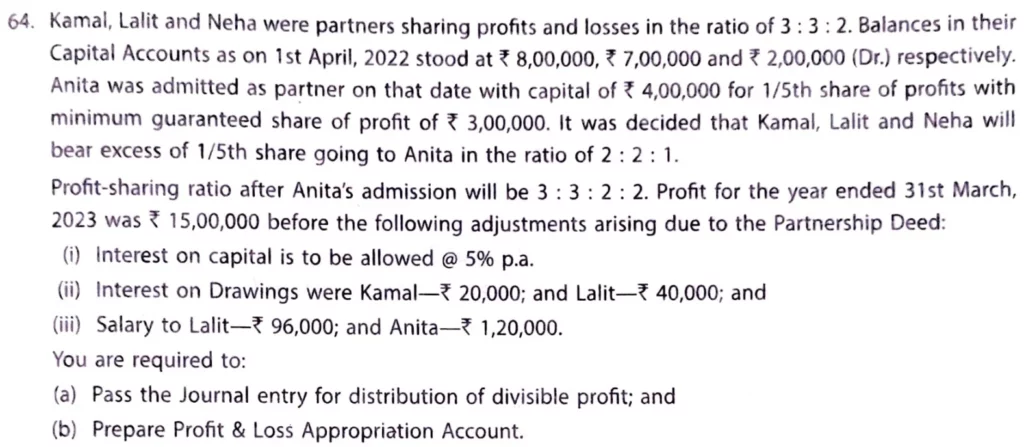

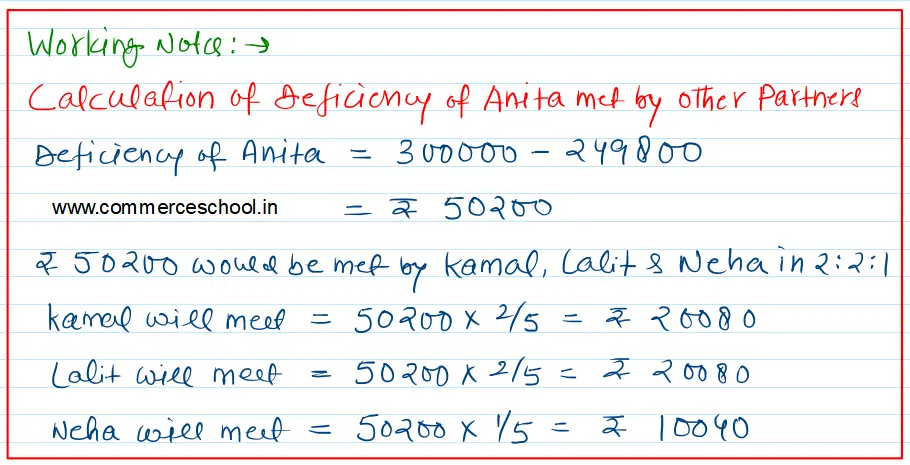

Kamal, Lalit and Neha were partners sharing profits and losses in the ratio of 3 : 3 : 2. Balances in their Capital Accounts as on 1st April, 2022 stood at ₹ 8,00,000, ₹ 7,00,000 and ₹ 2,00,000 (Dr.) respectively. Anita was admitted as partner on that date with capital of ₹ 4,00,000 for 1/5th share of profits with minimum guaranteed share of profit of ₹ 3,00,000. It was decided that Kamal, Lalit and Neha will bear excess of 1/5th share going to Anita in the ratio of 2 : 2 : 1.

Profit sharing ratio after Anita’s admission will be 3 : 3 : 2 : 2. Profit for the year ended 31st March, 2023 was ₹ 15,00,000 before the following adjustments arising due to the Partnership Deed:

(i) Interest on capital is to be allowed @ 5% p.a.

(ii) Interest on Drawings were Kamal – ₹ 20,000; and Lalit – ₹ 40,000: and

(iii) Salary to Lalit – ₹ 96,000; and Anita – ₹ 1,20,000.

You are required to:

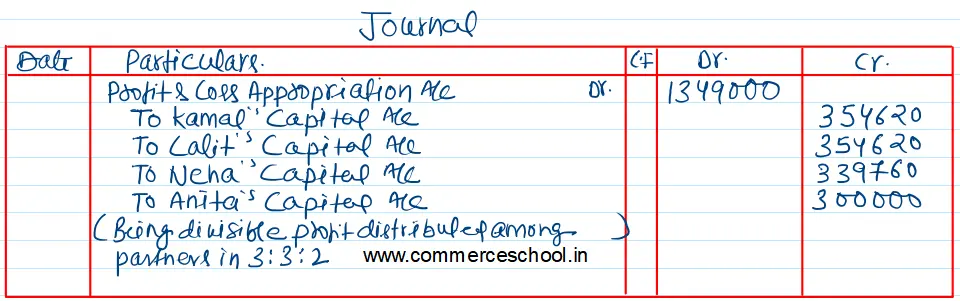

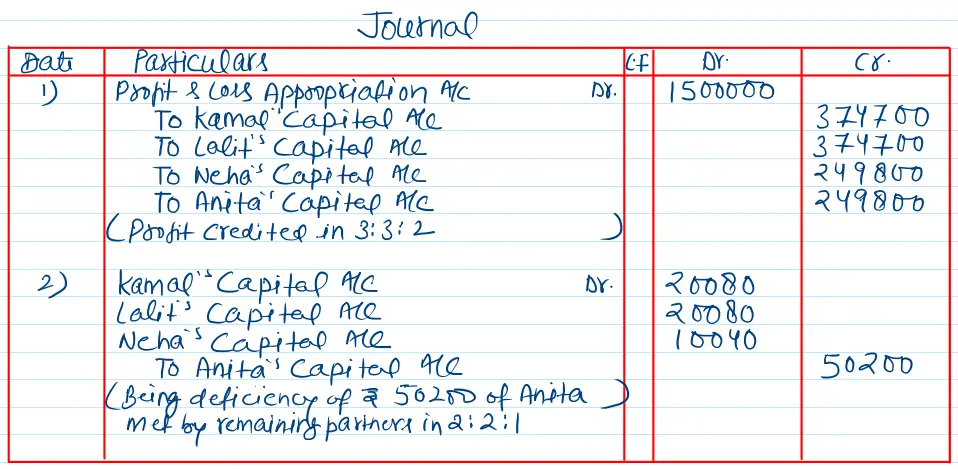

(a) Pass the Journal entry for distribution of divisible profit; and

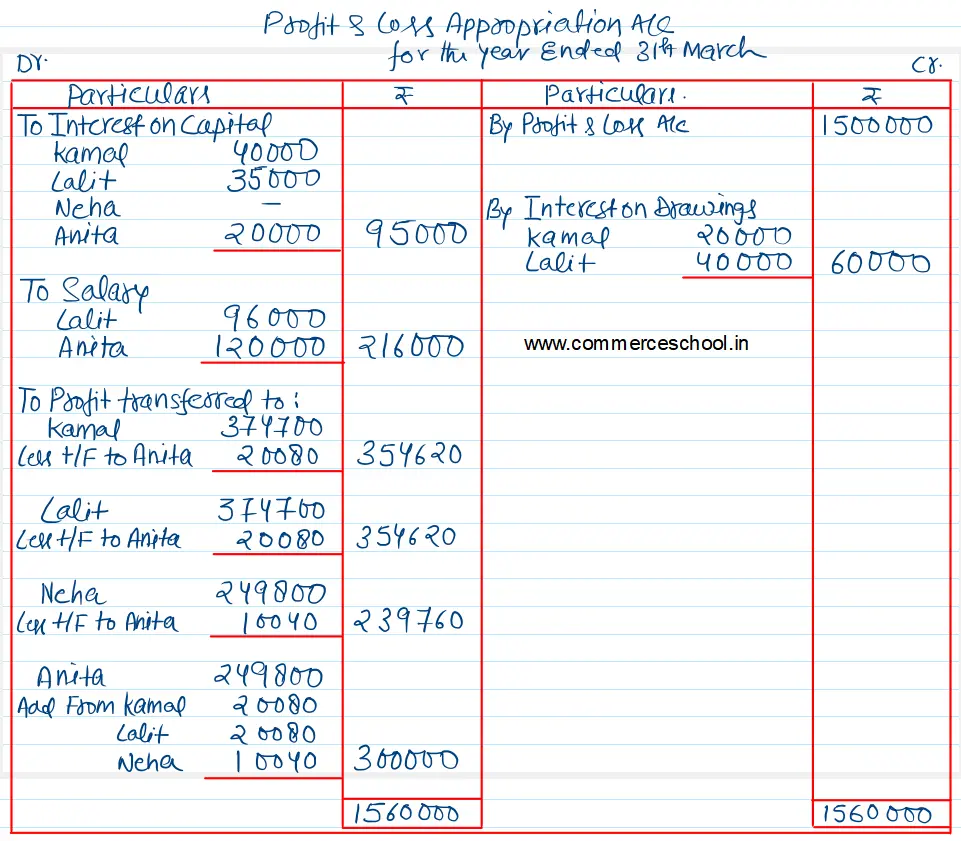

(b) Prepare Profit & Loss Appropriation Account.

Solution:-

Alternative of Journal Entry

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |