[ISC] Q. 21 solution of Fundamentals of Partnership Firms TS Grewal Book ISC 2023-24 Edition

Solution of Question number 21 of the Fundamentals of Partnership Accounts (Firm) chapter TS Grewal Book 2023-24 Edition ISC Board.

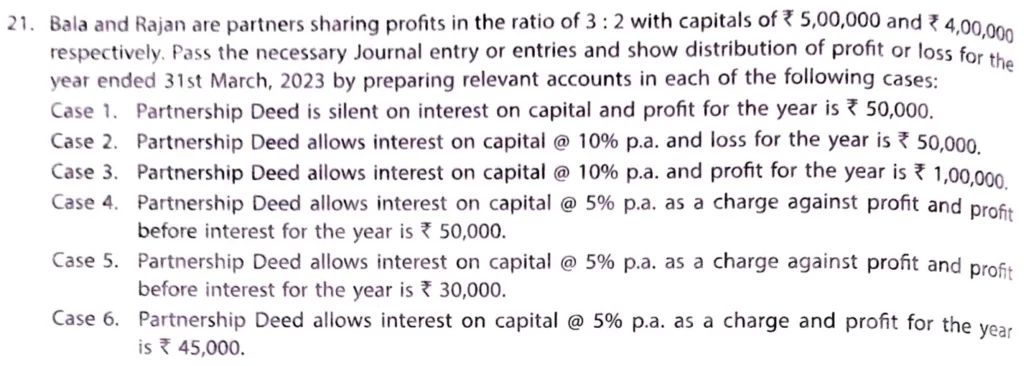

Bala and Rajan are partners sharing profits in the ratio of 3 : 2 with capitals of ₹ 5,00,000 and ₹ 4,00,000 respectively. Pass the necessary Journal entry or entries and show the distribution of profit or loss for the year ended 31sst March 2023 by preparing relevant accounts in each of the following cases:

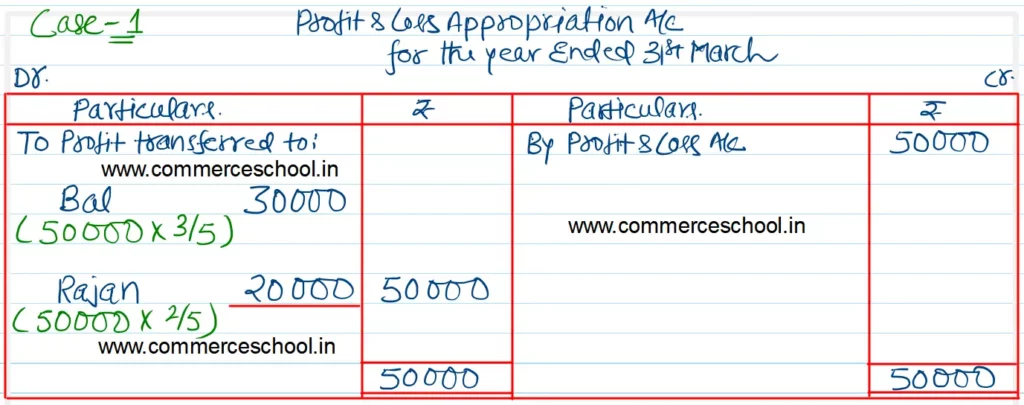

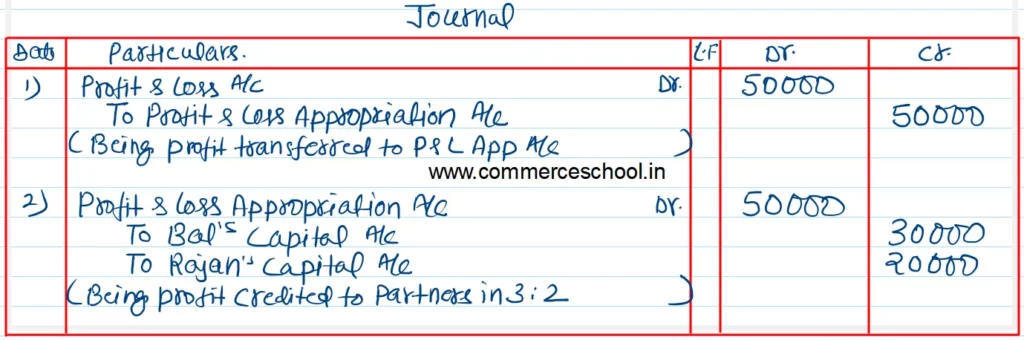

Case – 1: Partnership Deed is silent on interest on capital and profit for the year is ₹ 50,000.

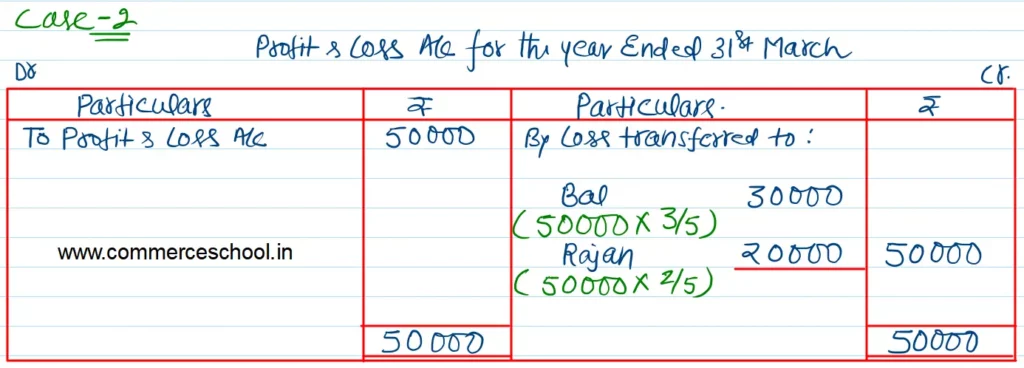

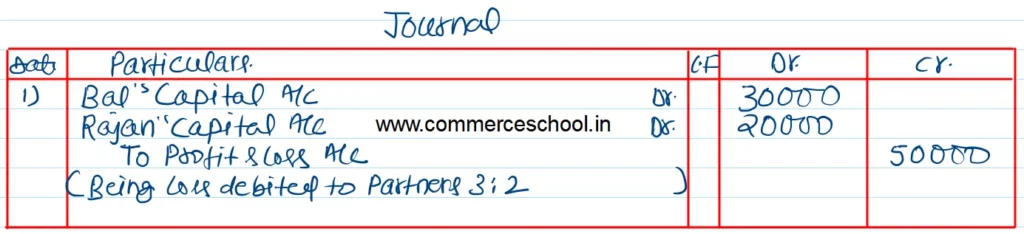

Case – 2: Partnership Deed allows interest on capital @ 10% p.a. and loss for the year is ₹ 50,000.

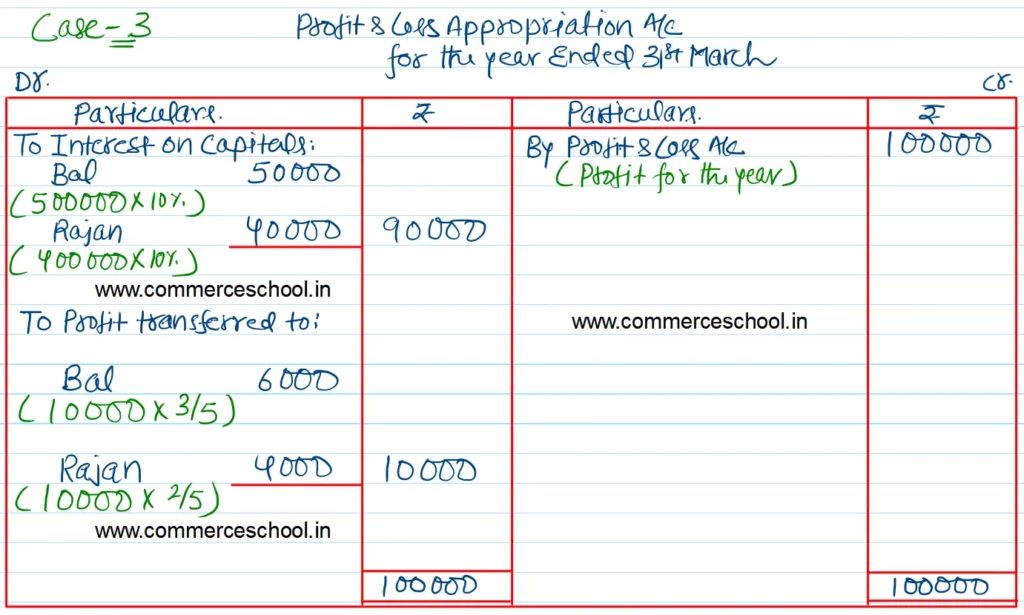

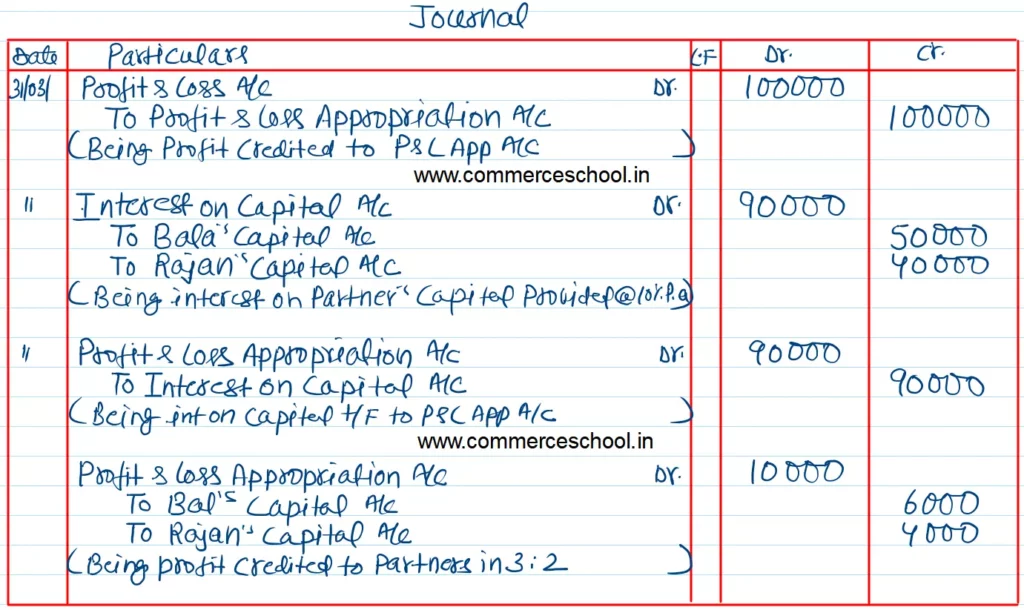

Case – 3: Partnership Deed allows interest on capital @ 10% p.a. and profit for the year is ₹ 1,00,000.

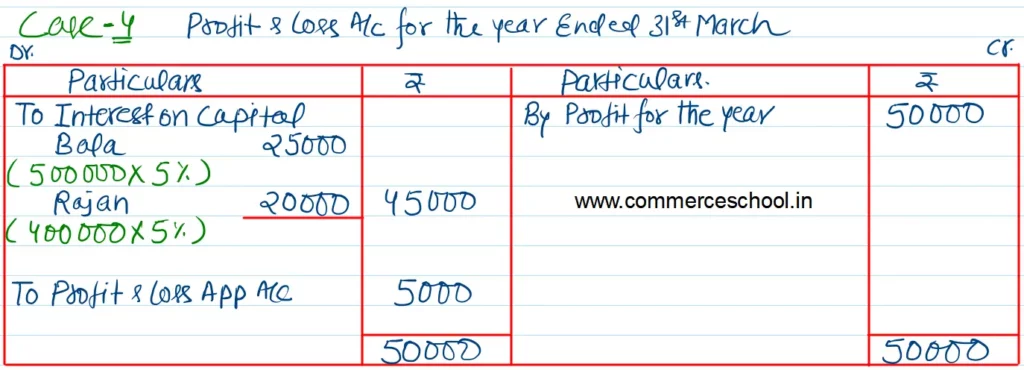

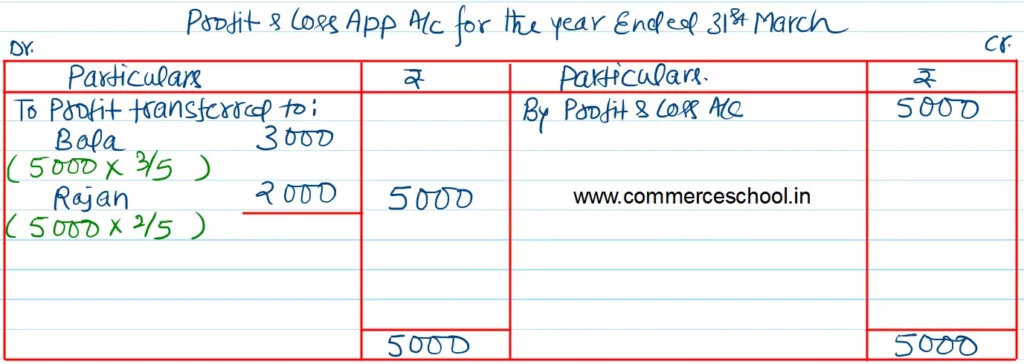

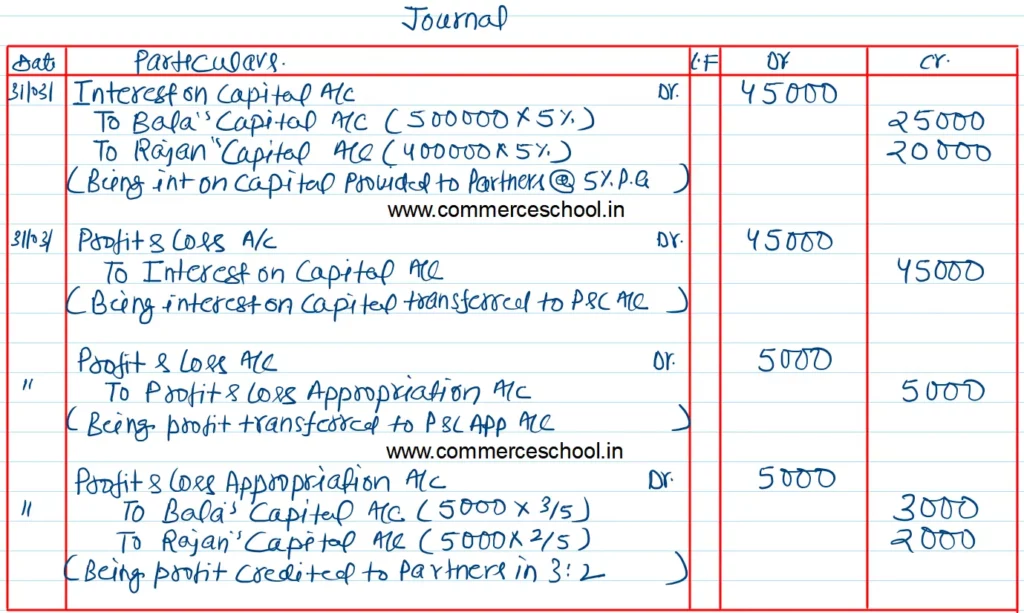

Case – 4: Partnership Deed allows interest on capital @ 5% p.a. as a charge against profit and profit before interest for the year is ₹ 50,000.

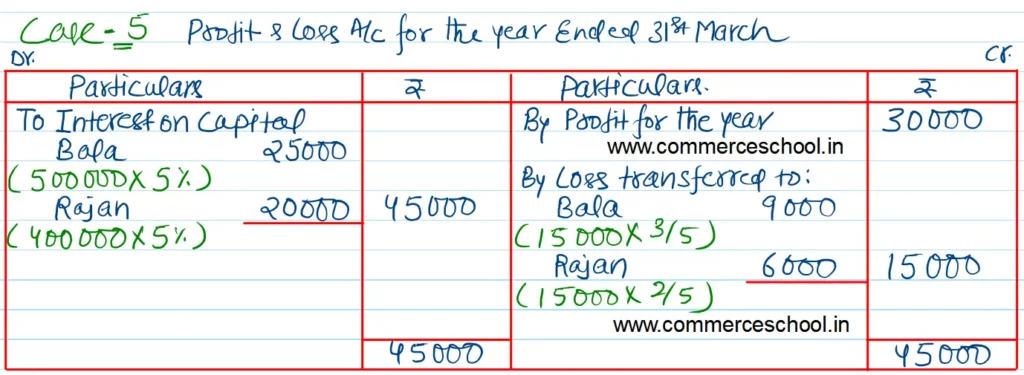

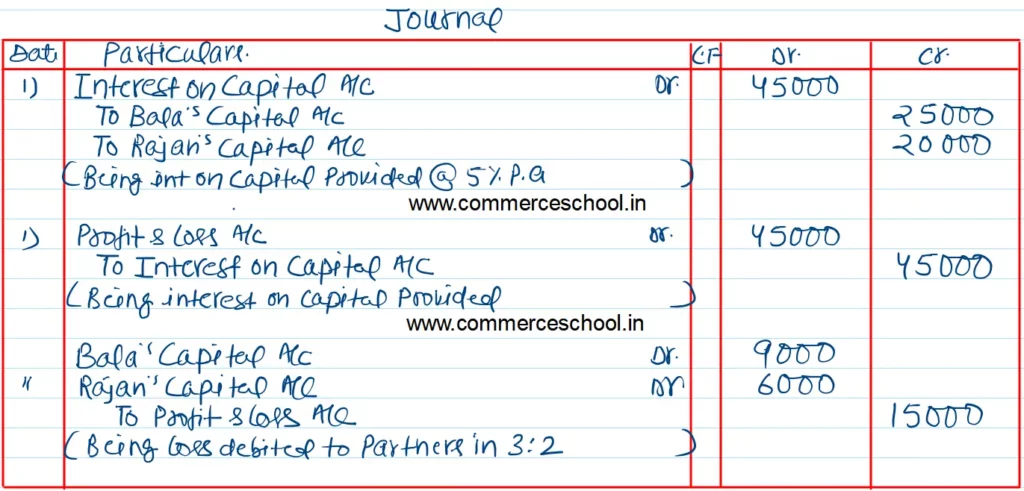

Case – 5: Partnership Deed allows interest on capital @ 5% p.a. as a charge against profit and profit before interest for the year is ₹ 30,000.

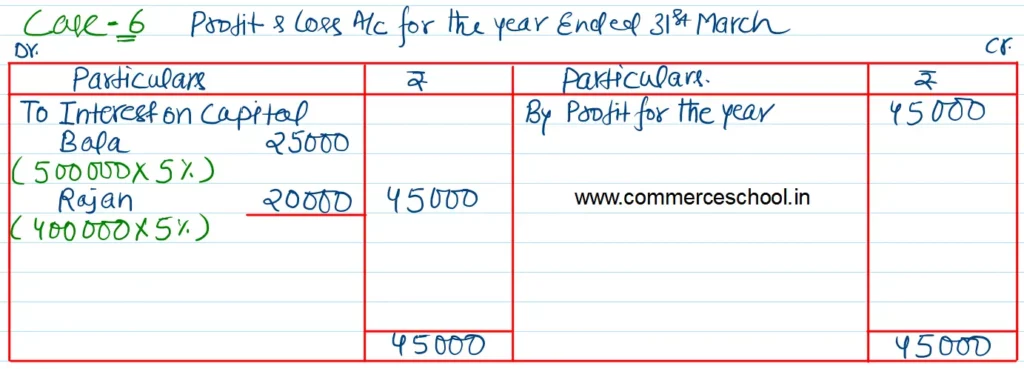

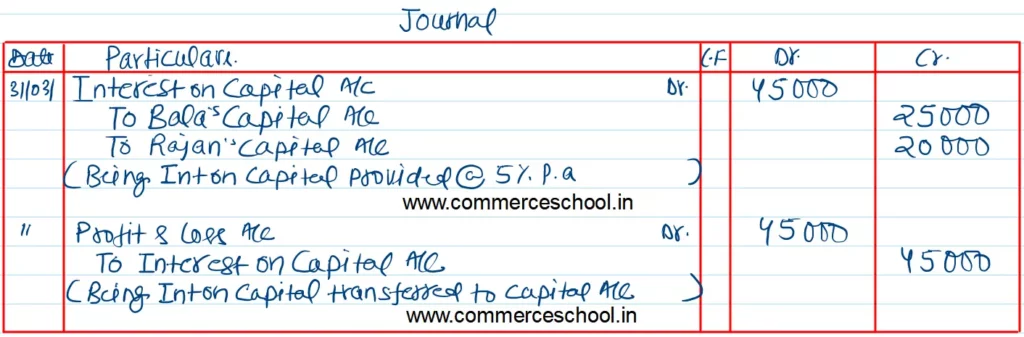

Case – 6: Partnership Deed allows interest on capital @ 5% p.a. as a charge and profit for the year is ₹ 45,000.

Solution:-

Case – 1

Case – 2

Case – 3

Case – 4

Case – 5

Case – 6

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |