[ISC] Q. 50 solution of Fundamentals of Partnership Firms TS Grewal Book (2023-24)

Solution of Question number 50 of the Fundamentals of Partnership Accounts (Firm) chapter TS Grewal Book 2023-24 Edition ISC Board?

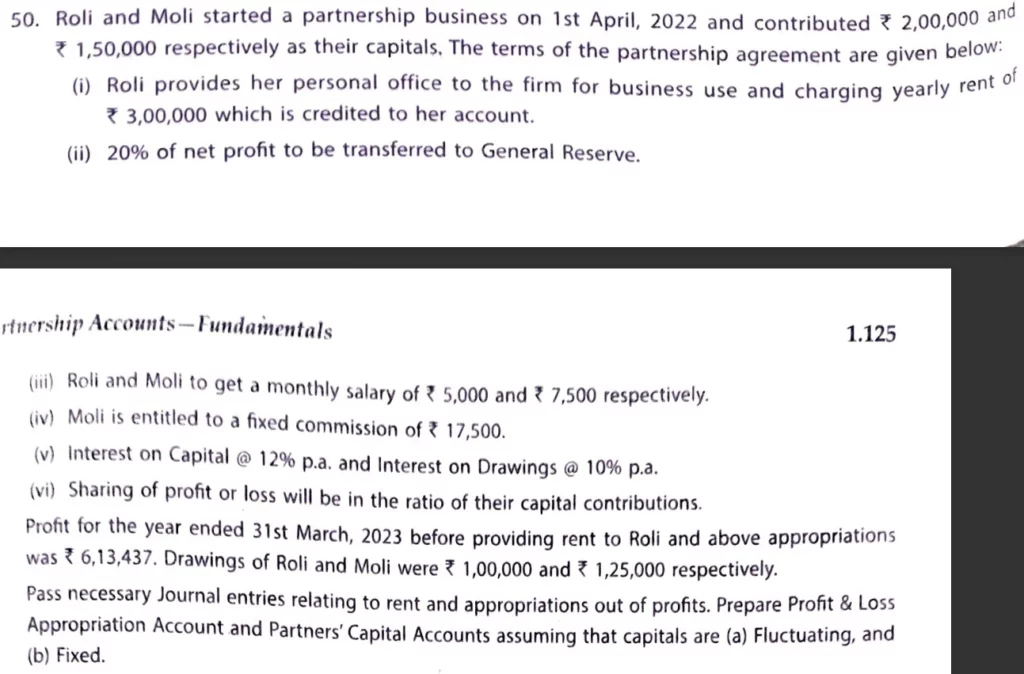

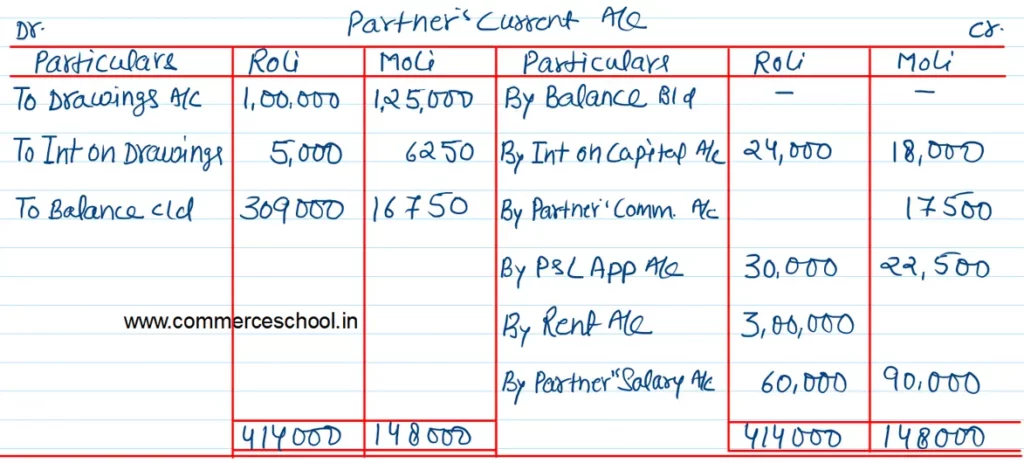

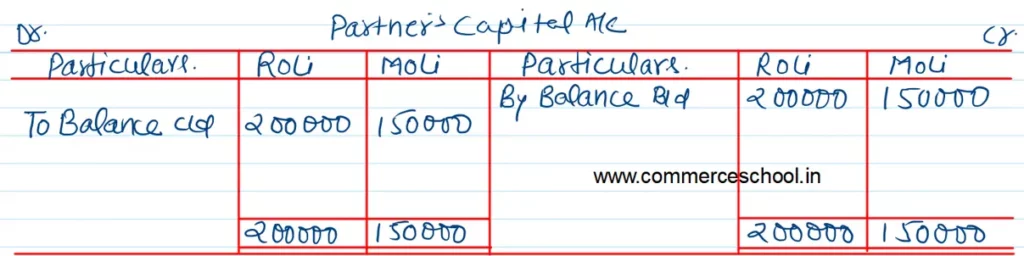

Roli and Moli started a partnership business on 1st April 2022 and contributed ₹ 2,00,000 and ₹ 1,50,000 respectively as their capital. The terms of the partnership agreement are given below:

(i) Roli provides her personal office to the firm for business use and charges yearly rent of ₹ 3,00,000 which is credited to her account.

(ii) 20% of net profit to be transferred to the General Reserve.

(iii) Roli and Moli are to get a monthly salary of ₹ 5,000 and ₹ 7,500 respectively.

(iv) Moli is entitled to a fixed commission of ₹ 17,500.

(v) Interest on Capital @ 12% p.a. and Interest on Drawings @ 10% p.a.

(vi) Sharing of profit or loss will be in the ratio of their capital contributions.

Profit for the year ended 31st March 2023 before providing rent to Roli and above appropriations was ₹ 6,13,437. Drawings of Roli and Moli were ₹ 1,00,000 and ₹ 1,25,000 respectively.

Pass necessary Journal entries relating to rent and appropriation out of profits. Prepare Profit and Loss Appropriation Account and Partner’s Capital Accounts assuming that capitals are (a) Fluctuating, and (b) Fixed.

Solution:-

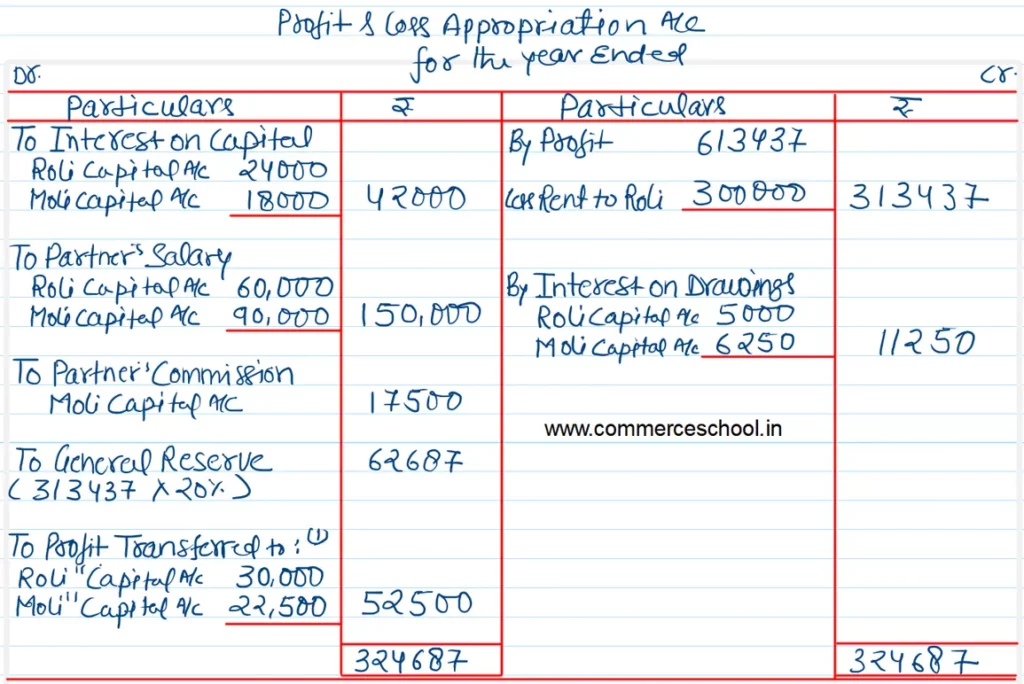

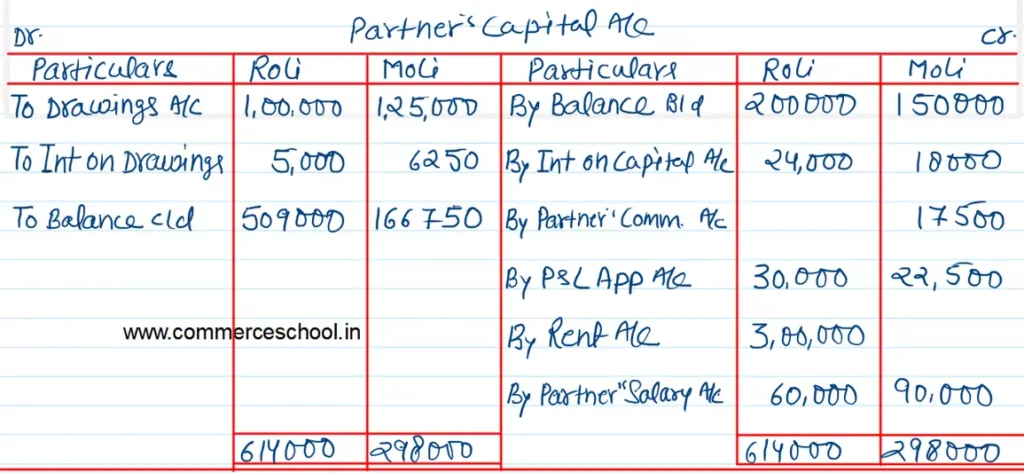

Case – I

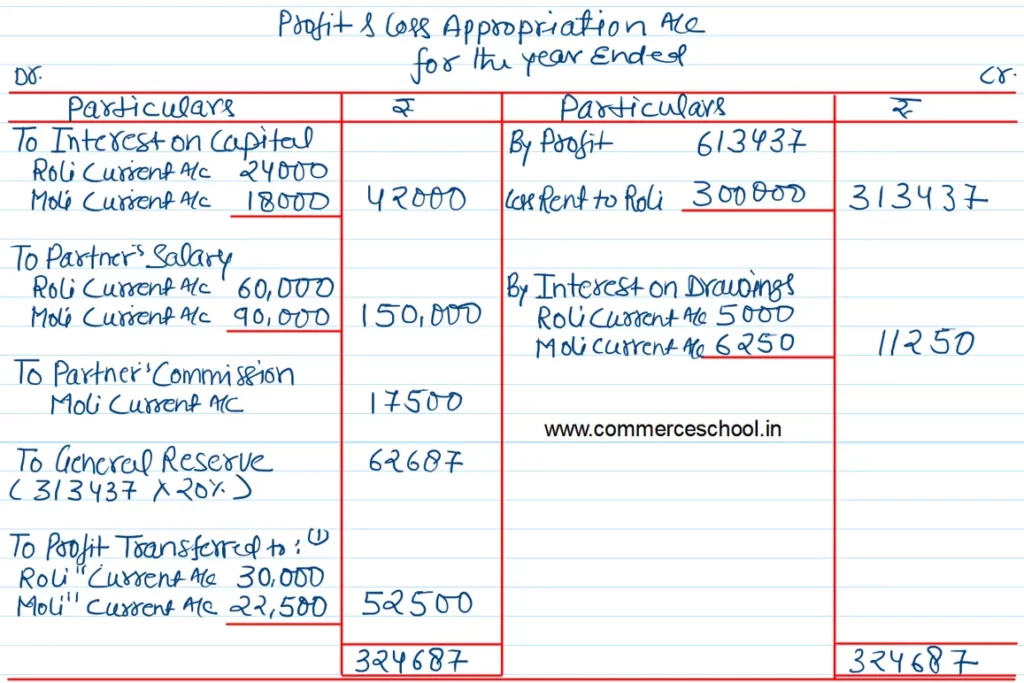

Case – 2 (Fixed Capital Method)

Working Notes:-

Calculation of General Reserve

20% of Net Profit

313437 × 20/100 = ₹ 62687.4

Calculation of Interest on Drawings

Roli:-

1,00,000 × 10% × 6/12 = ₹ 5,000

Moli:-

1,25,000 × 10% × 6/12 = ₹ 6,250

If date of drawings is not given, the interest on the total drawings ic calculated for 6 months on average basis.

Partner’s Profit sharing ratio:-

Capital Ratio = 2,00,00 : 1,50,000 = 4 : 3

Distribution Profit:

Roli:-

2,00,000 × 4/7 = ₹ 30,000

Moli:-

1,50,000 × 3/7 = ₹ 22,500

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |