[CBSE] Q. 49 Cash Flow Statement TS Grewal Class 12 2023-24

Solution of Question number 49 of the Cash Flow Statement of TS Grewal Book 2023-24 session?

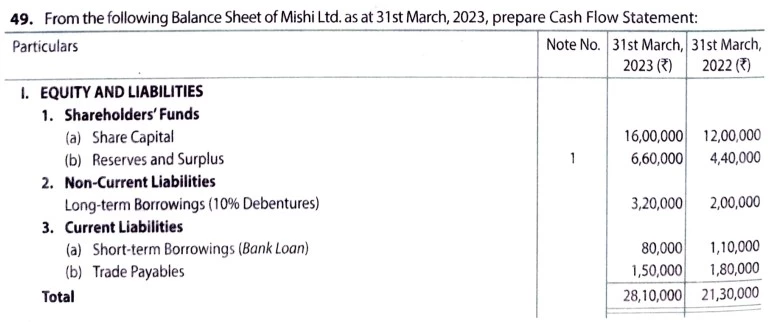

From the following Balance Sheet of Mishi Ltd. as at 31st March, 2023, prepare Cash Flow Satement:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

| Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus | 16,00,000 6,60,000 | 12,00,000 4,40,000 |

| Non-Current Liabilities Long-term Borrwings (10% Debentures) | 3,20,000 | 2,00,000 |

| Current Liabilities (a) Short-term Borrowings (Bank Loan) (b) Trade Payables | 80,000 1,50,000 | 1,10,000 1,80,000 |

| Total | 28,10,000 | 21,30,000 |

| II. Assets | ||

| Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: -Property, Plant and Equipment (b) Non-Current Investments | 19,00,000 2,70,000 | 12,10,000 2,00,000 |

| Current Assets (a) Current Investments (b) Trade Receivables (c) Cash and Cash Equivalents | 1,60,000 1,80,000 3,00,000 | 80,000 4,00,000 2,40,000 |

| Total | 28,10,000 | 21,30,000 |

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| Reserves and Surplus Securities Premium General Reserve Surplus,i.e., Balance in Statement of Profit & Loss | 20,000 3,00,000 3,40,000 | – 2,40,000 2,00,000 |

| 6,60,000 | 4,40,000 | |

| Property, Plant and Equipment Machinery (Cost) Less: Accumulated Depreciation | 21,40,000 (2,40,000) | 14,00,000 (1,90,000) |

| 19,40,000 | 12,10,000 | |

| Cash and Cash Equivalents Cash in Hand Bank Balance | 1,40,000 1,60,000 | 1,10,000 1,30,000 |

| 3,00,000 | 2,40,000 |

Additional Information:

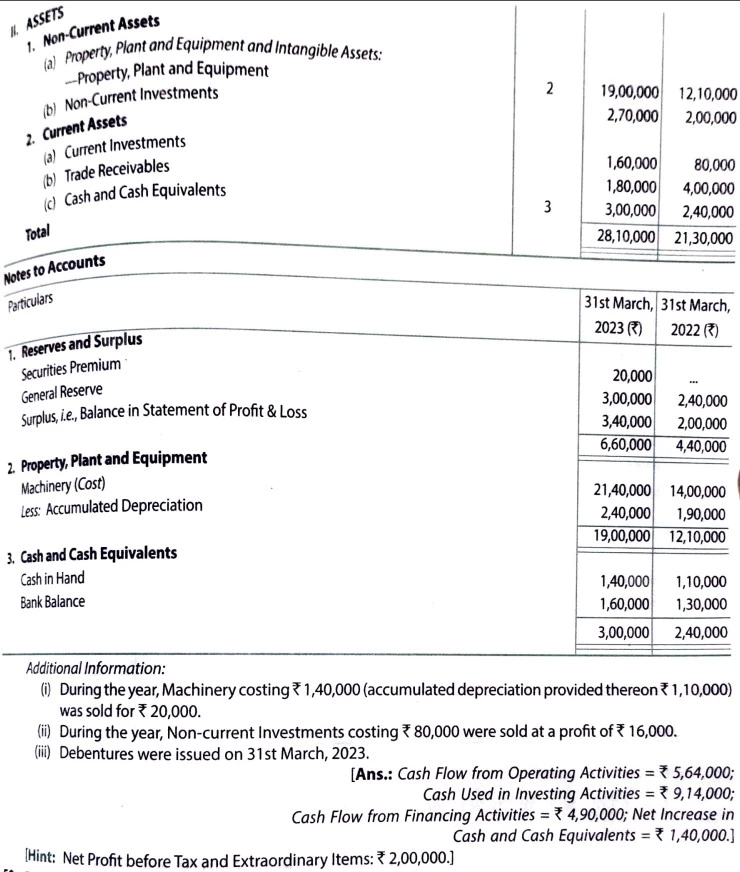

(i) During the year, Machinery costing ₹ 1,40,000 (accumulated depreciation provided thereon ₹ 1,10,000) was sold for ₹ 20,000.

(ii) During the year, Non-Current Investments costing ₹ 80,000 were sold at a profit of ₹ 16,000.

(iii) Debentures were issued on 31st March, 2023.

[Ans.: Cash Flow from Operating Activities = ₹ 5,64,000; Cash Used in Investing Activities = ₹ 9.14,000; Cash Flow from Financing Activities = ₹ 4,90,000; Net increase in Cash and Cash Equivalents = ₹ 1,40,000.]

[Hint: Net Profit before Tax and Extraordinary Items: ₹ 2,00,000.]

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |