[CBSE] Q.10 Cash Flow Statement TS Grewal Class 12 2023-24

Solution of Question number 10 of the Cash Flow Statement of TS Grewal Book 2023-24 session?

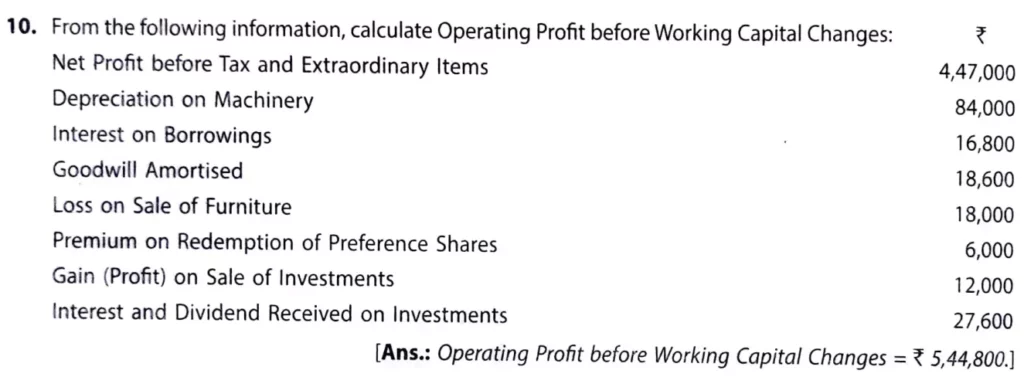

From the following information, Calculate Operating Profit before Working Capital Changes:

| Net Profit before Tax and Extraordinary Items | 4,47,000 |

| Depreciation on Machinery | 84,000 |

| Interest on Borrowings | 16,800 |

| Goodwill Amortised | 18,600 |

| Loss on Sale of Furniture | 18,000 |

| Premium on Redemption of Prefernce Shares | 6,000 |

| Gain (Profit) on Sale of Investments | 12,000 |

| Interest and Dividend Received on Investments | 27,600 |

[Ans.: Operating Profit before working capital changes = ₹ 5,44,800.]

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |