Deficient Demand and Excess Demand Class 12

In this lecture, I will discuss what is Deficient Demand and Excess Demand in Macroeconomics as per the syllabus of Class 12.

This topic is concerned with the Determination of Income and Employment unit of Macroeconomics.

What is Deficient Demand in simple words (Class 12)

In simple words, demand is said to be deficient, when it is lower than what is required for the fuller utilization of the available resources.

You can understand this concept in three ways.

- AD is deficient when there is excess capacity in the economy implying underutilisation of the resources.

- AD is deficient when it does not permit fuller utilisation of the production capacity.

- AD is deficient when it is lower than what is required for fuller utilisation of the available resources.

Let’s understand it with a simple example.

Deficient Demand with a simple Example

Let’s assume, there are 100 labours in an economy. The responsibility of the government is to employ all.

Further, suppose, 1 person can produce 1 product. If 100 products are produced in an economy. All 100 people would be employed.

It is termed as, full employment in an economy. The main objective is to provide employment opportunities to all involuntary unemployed.

See, the Supplier is ready to produce maximum output. It can reduce and increase its output as per the demand in an economy.

But, the situation is not favorable this time. There is only a demand for 80 products in the market.

In this case, producers are bound to employ only 80 people to produce 80 products. The 20 people remain unemployed.

However, they are capable and willing to work.

In this example, Aggregate demand is not enough to materialize full employment.

Such demand is called deficient demand.

So, the demand is said to be a deficient demand, when it is less than what is required to achieve full employment in an economy.

Definition of Deficient Demand as per class 12

According to Keynes, AD is deficient when it is less than AS corresponding to full employment in the economy.

TR Jain

Deficient demand refers to the situation when aggregate demand (AD) is less than the aggregate supply (AS) corresponding to the full employment level of output in the economy.

Sandeep Garg

When, at full employment income level, AD is lower than AS, the deficiency in AD is called deficient demand.

S.K Aggarwal

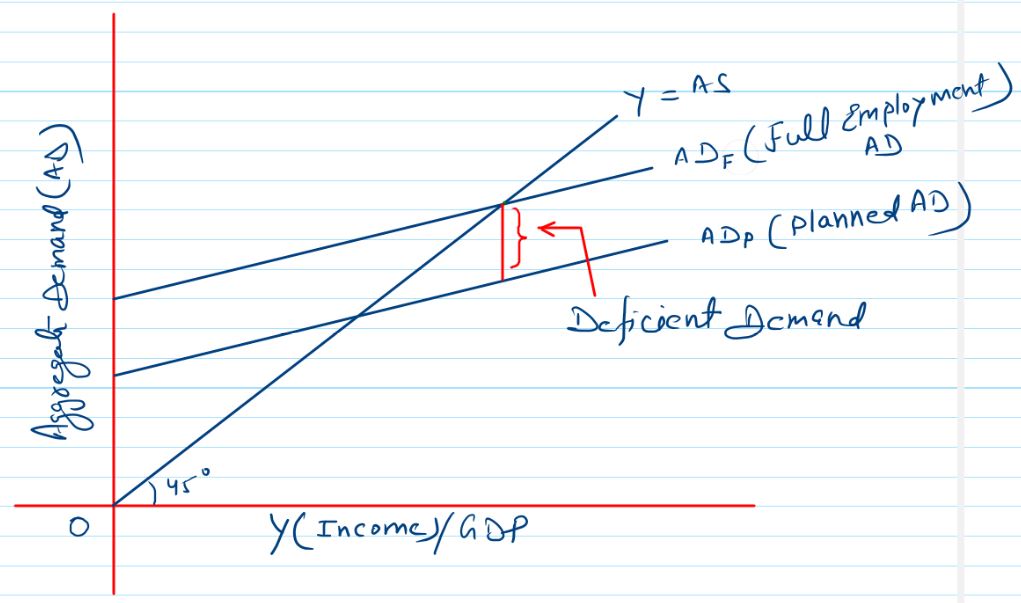

Graphical Representation of Deficient Demand

Causes of Deficient Demand

There are many causes of it. But the main causes can be divided into two categories. As we study economic variables in various contexts.

Causes in Two Sector Economy (Closed Economy)

Causes in a two-sector closed economy. The deficiency of AD occurs largely due to two factors.

Reduction in Private Final Consumption Expenditure (C):-

It’s the main component of AD. Reduction in the private final consumption expenditure severely impacts the AD.

There are two main reasons for the reduction in private final consumption expenditure.

- Reduction in propensity to consume (MPC).

- Increase in propensity to save (MPS).

Reduction in Private Investment Expenditure (I):-

It also reduces AD. Private Investment Expenditure can be decreased due to situations of poor business expectations.

Causes in four sector economy (Open Economy):-

Causes in a four-sector open economy. Apart from the above two factors. The following factors also contribute to deficiency in AD.

Reduction in government expenditure:-

The government may reduce its consumption and investment expenditure due to budget constraints. It severely impacts overall aggregate demand.

A decline in Exports (X):-

Exports are also an important component of AD. A fall in exports implies a reduction in domestic production. It results in deficient AD.

A rise in Imports (M):-

A rise in imports implies a reduction in domestic productions. It leads to unemployment and further results in deficient AD.

Increases in Tax Rates:-

An increase in tax rates leads to lesser disposable income with the people. It reduces the expenditure capacity even when MPC is intact.

Consequences (Impact) of Deficient AD

Deficiency of AD Leads to four critical situations in the economy as under:-

Underemployment Equilibrium

Deficient AD results in underemployment Equilibrium in the economy. Due to less demand, producers are not able to fully employ the available resources.

In other words, a producer can not fully utilize its production capacity.

Thus planned output remains less than the potential output.

Deflationary Gap

The deficiency of demand creates a deflationary gap in the economy. It is a situation of deflationary vicious pressure in an economy.

Low level of demand results in low investment. low investment leads to low output. low output leads to low income. Further low income leads to a low level of demand.

This cycle is called a deflationary spiral or low level of equilibrium trap.

Effect on output

The planned output will fall due to the low level of AD.

Undesired Stocks

Due to the low level of AD. there will be an increase in the inventory stock.

Effect on Employment:-

Deficient demand causes involuntary unemployment in the economy due to a fall in the planned output.

Loss of Profits

Due to the low level of AD. A producer is not able to sell their stocks. Unsold stock leads to an increase in losses.

Fall in the general price level:-

Deficient demand causes the general prices to fall due to low aggregate demand.

Measures to correct Deficient Demand (Deflationary gap)

In order to maintain economic stability, it is required to correct the deficient demand situations as soon as possible.

But how to handle it.

This situation is handled by two bodies.

- Government

- Central Bank

The Government overcomes it by its revenue expenditure (fiscal) policy. The RBI handles it through its monetary policy.

Types of Measures

There are two types of Measures

Fiscal Measures:-

Fiscal measures are taken by the government through its revenue expenditure (fiscal policy). The government uses its legal power to impose taxes and spend in order to achieve economic objectives.

Imposing tax affects the purchasing power of the people. Changing government expenditure affects the government’s demand for goods and services.

Thus by modifying tax and spending government controls the deficient demand.

1. Increase in Spending by Government:-

It is a fiscal measure. The government incurs expenditure on administrative and welfare activities.

If the government increases its spending, it increases the income. with the increase in income, there is an increase in AD. Increasing AD help in closing the deflationary gap.

2. By Reducing Taxes:-

It is also a fiscal measure. Reduction in taxes leads to more disposable income in the hand of people.

The rise in disposable income increases consumption expenditure. It raises overall aggregate demand and helps in closing the deflationary gap.

Monetary Measures:-

(for 2021-22 session this topic is out of syllabus)

Such measures are taken by the central bank with the government’s direction. through the monetary policy central bank tries to influence the money supply to achieve economic objectives.

The deflationary gap (deficient demand) can be overcome by increasing the money supply. The prime purpose is just to increase the disposable income of the people.

1 Lowering the Bank Rate:-

By lowering the bank rate, the central bank forces the commercial banks to reduce rate of interest on loans. It raises the demand for loans for conusmption and investment purpose. More disposable income raises the AD.

2 Decreasing CRR

Decreasing CRR increases funds available with commercial banks for credit creation. It raises the borrowing from the bank. the purchasing capacity of the buyers increases thus AD increases.

3. Decreasing SLR

Decreasing SLR increases funds available with commercial banks for credit creation. It raises the borrowing from the bank. the purchasing capacity of the buyers increases thus AD increases.

4. Decreasing Repo Rate (RR)

By lowering the repo rate, the central bank forces the commercial banks to reduce the rate of interest on loans. It raises the demand for loans for consumption and investment purpose. More disposable income raises the AD.

5. Decreasing Reverse Repo Rate (RRR)

Decreasing RRR discourages commercial banks from parking their fund with the central bank. It raises the liquidity, so is its credit creation capacity. borrowing increases purchasing capacity of the people. It increases AD.

6. Open Market Operations (Purchase of securities by the central bank):-

When the Central bank purchases government securities from the market. It makes the money payment to the public.

Public deposits its payment into the commercial banks. commercial banks liquidity increases, so is its credit creation capacity. borrowing increases purchasing capacity of the people. It increases AD.

7. Lowering Margin requirement:-

Lowering the Margin requirement raises the borrowing from the bank. It increases the purchasing power of the people. AD rises.

What is Excess Demand in simple words (Class 12)

Excess demand is a situation when AD is more than what is required for the fuller utilisation of the available resources.

According to Keynes, AD is excess when it is more than AS corresponding to full employment in the economy.

AD > AS (Corresponding to full employment in the economy)

You can understand the situation of AD in two ways.

- AD is Excess when it is more than what is required for the fuller utilisation of the resources.

- AD is Excess When it crosses its full employment level.

Definition of Excess Demand as per Class 12

“Excess demand refers to the situation when aggregate demand (AD) is more than the aggregate supply (AS) corresponding to full employment level of output in the economy.”

Sandeep Garg

“According to Keynes, AD is excess when it is more than AS corresponding to full employment in the economy.”

TR Jain

“When, at full employment income level, AD is higher than AS, the excess of AD over AS is called excess demand.”

S.K Aggarwal

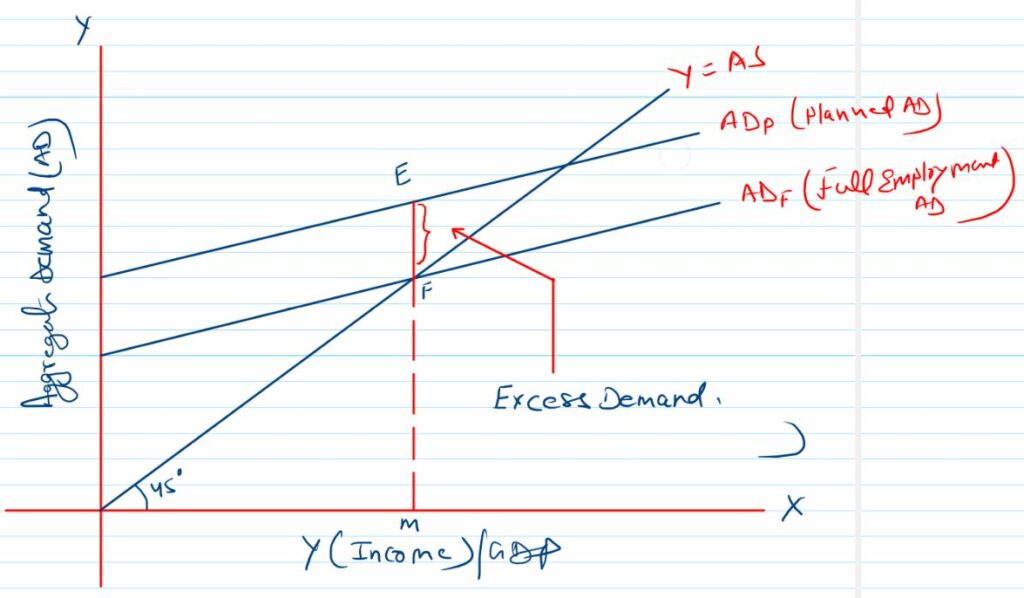

Graphical Representation of Excess Demand

Causes of Excess Demand

There are many causes of it. But the main causes can be divided into two categories. As we study economic variables in various contexts.

Causes in Two Sector Economy (Closed Economy)

Causes in a two-sector closed economy. The deficiency of AD occurs largely due to two factors.

Increase in Private Final Consumption Expenditure (C):-

Its the main component of AD. An increase in the private final consumption expenditure severely impacts the AD.

There are two main reasons for the increase in private final consumption expenditure.

- Increase in propensity to consume (MPC)

- Decrease in Propensity to save (MPS)

Increase in Private Investment Expenditure (I):-

It also Increases AD. Private Investment Expenditure can be increased if producers expect high returns from their investment.

Causes in four sector economy (Open Economy):-

Apart from the above two causes, in an open economy following causes also may result in excess demand.

Increase in Government Expenditure:-

Increase in exports:-

Decrease in Imports:-

Decrease in tax rates:-

Consequences (Impact) of Excess AD

There are few impacts due to excess demand.

Inflationary Gap:-

As we already have discussed, excess demand is more than what is required for the full employment of resources. It is a situation where output can not be increased as all available resources are already in use.

But, excess demand generates pressure on the existing resources. It increases the cost of production, which leads to a rise in the general price level in the economy.

This situation is identified by Keynes as an ‘Inflationary gap’ in the economy.

GDP does not rise:-

As all resources are fully employed. The output can not be increased further as all available factors all fully and efficiently involved.

It is a situation when higher demand fails to generate higher GDP in the economy. There is no excess capacity in the economy.

Note:- Here GDP, mean real GDP. real GDP does not rise. But Nominal GDP rises due to rise in prices. The quantity of goods produced remaining constant, though the market value of goods and services tends to rise.

Effect on Employment:-

There will be no change in the level of employment as all available resources are already fully employed.

Effect on General Price Level:-

Excess demand leads to a rise in the general price level.

Measures to correct Excess Demand (Inflationary gap)

In order to maintain economic stability, it is required to correct the excess demand situations as soon as possible.

But how to handle it.

This situation is handled by two bodies.

- Government

- Central Bank

The Government overcomes it by its revenue expenditure (fiscal) policy. The RBI handles it through its monetary policy.

Types of Measures

There are two types of Measures

Fiscal Measures:-

Fiscal measures are taken by the government through its revenue expenditure (fiscal policy). The government uses its legal power to impose taxes and spend in order to achieve economic objectives.

Imposing tax affects the purchasing power of the people. Changing government expenditure affects the government’s demand for goods and services.

Thus by modifying tax and spending government controls the deficient demand.

1. Decrease in Spending by Government:-

It is a fiscal measure. The government incurs expenditure on administrative and welfare activities.

If the government decreases its spending, it decreases the income. with the decrease in income, there is a decrease in AD. decreasing AD help in closing the inflationary gap.

2. By Increasing Taxes:-

It is also a fiscal measure. Increment in taxes leads to less disposable income in the hand of people.

The fall in disposable income reduces consumption expenditure. It reduces overall aggregate demand and helps in closing the inflationary gap.

Monetary Measures:-

(for 2021-22 session this topic is out of syllabus)

Such measures are taken by the central bank with the government’s direction. through the monetary policy central bank tries to influence the money supply to achieve economic objectives.

The Inflationary gap (Excess demand) can be overcome by decreasing the money supply. The prime purpose is just to decrease the disposable income of the people.

1 Increasing the Bank Rate:-

By increasing the bank rate, the central bank forces the commercial banks to increase rate of interest on loans. It reduces the demand for loans for consumption and investment purpose. less disposable income reduces the AD.

2 Increasing CRR:-

Increasing CRR decreases funds available with commercial banks for credit creation. It reduces borrowing from the bank. the purchasing capacity of the buyers reduces thus AD falls.

3. Increasing SLR:-

Increasing SLR reduces funds available with commercial banks for credit creation. It reduces borrowing from the bank. the purchasing capacity of the buyers reduces thus AD falls.

4. Increasing Repo Rate (RR):-

By increasing the repo rate, the central bank forces the commercial banks to increase the rate of interest on loans. It reduces the demand for loans for consumption and investment purpose. less disposable income reduces the AD.

5. Increasing Reverse Repo Rate (RRR)

Increasing RRR encourages commercial banks for parking their fund with the central bank. It reduces the liquidity, so is its credit creation capacity. less borrowing decreases purchasing capacity of the people. It reduces AD.

6. Open Market Operations (Sale of securities by the central bank):-

When the Central bank sell government securities in the market. It accepts the money payment from the public.

Public withdraw their deposits from commercial banks. Commercial bank’s liquidity decreases so is its credit creation capacity. borrowing decreases purchasing capacity of the people. It decreases AD.

7. Raising Margin requirement:-

Raising the Margin requirement reduces the borrowing from the bank. It reduces the purchasing power of the people. AD falls.