[CBSE] Q. 3 Solution of Fundamentals of Partnership Firms TS Grewal 2025-26

Solution of Question number 3 of the Fundamentals of Partnership Firm chapter TS Grewal Book CBSE 2025-26 Edition?

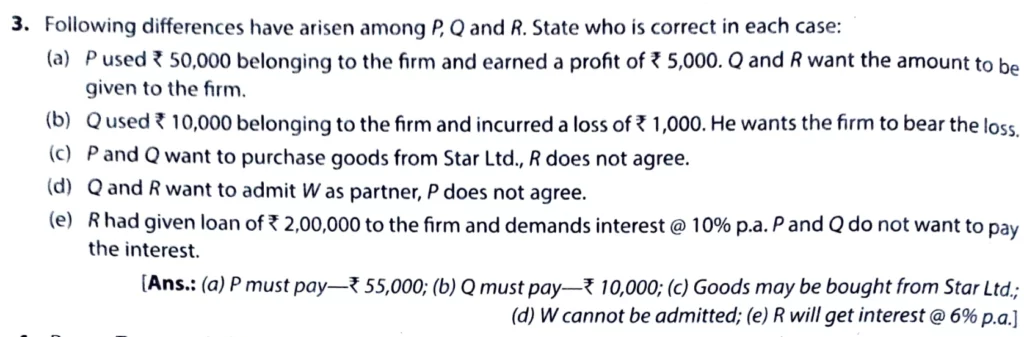

Following difference has arisen among P, Q, and R. State who is correct in each case:

a) P used ₹ 50,000 belonging to the firm and earned a profit of ₹ 5000. Q and R want the amount to be given to the firm.

b) Q used ₹ 10,000 belonging to the firm and incurred a loss of ₹ 1,000. He wants the firm to bear the loss.

c) P and Q want to purchase goods from Star Ltd. R does not agree.

d) Q and R want to admit W as a partner, but P does not agree.

e) R had given a loan of ₹ 2,00,000 to the firm and demanded interest @ 10%. P and Q do not want to pay the interest.

Solution:-

Here is the solution of it.

| Video Solution | Link |

| Watch Video Solution of this Question | Click Here |

a) If any partner uses the money of the firm and earned a profit. He has to pay back the used money with profit. hence, p has to pay ₹ 55,000 to the firm.

It is one of the liabilities of a partner that says:

If a partner earns some profit by using the firm’s property or money, such profit will be paid to the firm.

b) If any partner uses the firm money and incurred a loss. He has to bear the loss and the full amount of money taken by the partner has to return back the firm. hence Q has to pay ₹ 10,000 to the firm.

It is one of the liabilities of a partner that says:

If a partner earns some profit by using the firm’s property or money, such profit will be paid to the firm. On the other hand, if he incurs the loss, it would be borne by the partner himself.

c) Any business decision is decided by the majority. Hence P and Q want to purchase goods from star Ltd is accepted as there are only 3 partners and the majority win.

d) W as a partner can not be admitted as to admit a new partner, all partners must agree.

It is one of the default rights of a partner that says:

A partner has the right not to allow the admission of a new partner.

e) In the absence of a partnership deed. Provisions of the Indian Partnership Act 1932 would apply. Only a 6% p.a rate of interest on the loan of partners to the firm would be charged. Hence. In the place of 10% p.a, only a 6% p.a rate of interest would be allowed.

Reason:- It is one of the rights of a partner and also a Provisions of the Indian Partnership Act 1932 that apply in the absence of a Partnership Deed.

| Video Solution | Link |

| Watch Video Solution of this Question | Click Here |

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |