Treatment of Provision for Taxation in Cash Flow Statement

Confused, What is the accounting treatment of Provision for Taxation in the Cash Flow statement

When only a single amount of provision for taxation is given in Question

This is the case where only a single amount of provision for taxation is given in the question. In such a situation Balance sheet is not given in the question.

The given amount of provision for taxation is added to calculate Net profit before tax and extraordinary items. The same amount is deducted as tax paid as the last item to calculate cash flow from operating activities.

| Item | |

| Provision for Taxation (Single amount) | 1. Added to calculate net profit before tax and extraordinary items. 2. subtracted as tax paid at the end to calculate cash flow from operating activities. |

Read More:- Treatment of Proposed Dividend in Cash Flow Statement

Read More:- Treatment of Short Term loans and advances in Cash Flow Statement

When only a single amount of Tax paid is given in the Question.

This is the case where only a single amount of tax paid is given in the question. In such a situation Balance sheet is not given.

The given amount of tax paid is added as a provision for taxation in the current year to calculate Net profit before tax and extraordinary items. The same amount is deducted as tax paid as the last item to calculate cash flow from operating activities.

| Item | |

| Tax Paid (Single amount) | 1. Added to calculate net profit before tax and extraordinary items. 2. subtracted as tax paid at the end to calculate cash flow from operating activities. |

Read More:- Treatment of Interim Dividend in Cash flow statement

Read More:- Treatment of Preliminary Expenses in Cash Flow Statement

When Provision for Taxation for the previous and current year is given in Question (without any additional information)

In this case Provision for taxation of the current year is added to calculate Net Profit Before Tax and Extraordinary item.

The previous year’s Provision for taxation is subtracted as tax paid as the final item to calculate cash flow from operating activity.

| Item | Accounting Treatment |

| Provision for Taxation of Current Year | Added to calculate net profit before tax and extraordinary items. |

| Provision for Taxation of Previous Year | Subtracted as tax paid at the end to calculate cash flow from operating activities. |

Read More:- Treatment of Share Issue Expenses in Cash Flow Statement

Read More:- Treatment of Discount (Loss) on Issue of Debentures in cash flow statement.

When Income Tax Refund is given along with Provision for Taxation of the Previous and current year is given in Question

In this case Provision for taxation of the current year is added and an Income tax refund is subtracted to calculate net profit before taxation and extraordinary items.

The Provision for taxation of the previous year is subtracted and an income tax refund is added as the last item to calculate cash flow from operating activities.

| Item | Accounting Treatment |

| Provision for Taxation of Current Year | Added to calculate net profit before tax and extraordinary items. |

| Provision for Taxation of Previous Year | Subtracted as tax paid at the end to calculate cash flow from operating activities. |

| Income Tax Refund | subtracted to calculate net profit before tax and extraordinary item and added at last item to calculate cash flow from operating activity |

Read More:- Treatment of Capital Reserve in Cash Flow Statement

Read More:- Treatment of Underwriting Commission in Cash Flow Statement

When Provision for Taxation of the previous and current year is given along with the additional information (2 Cases)

Case – I

| Equity and Liabilities | 2021 | 2020 |

| Provision for Taxation | 50,000 | 30,000 |

Additional Information:-

Tax paid during the year ₹ 8,000.

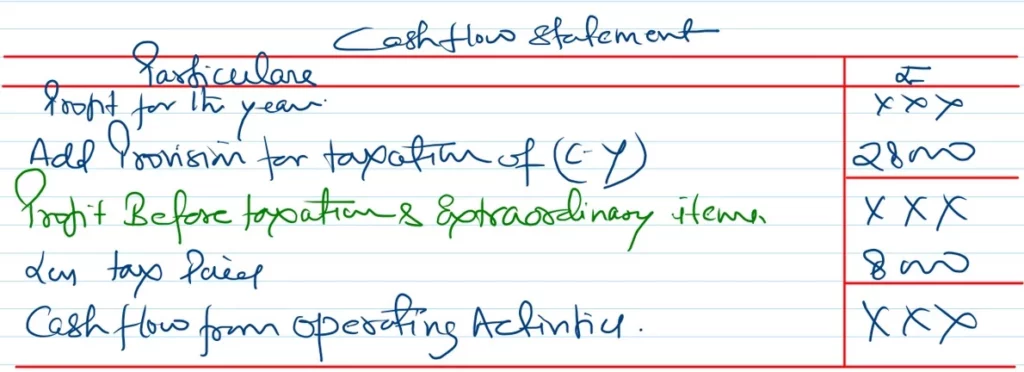

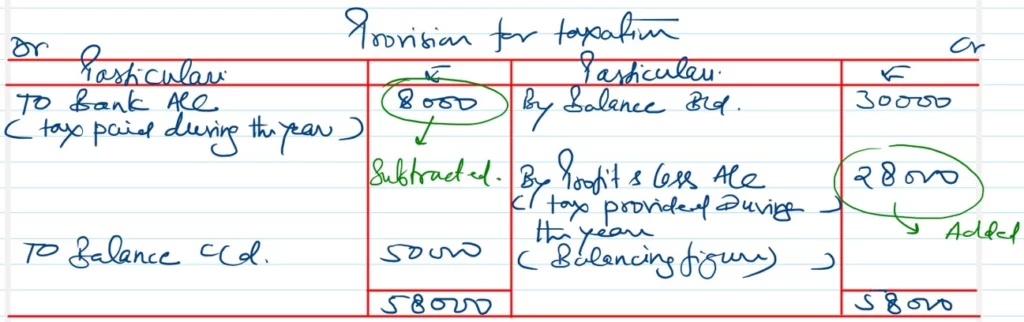

Solution:-

In this case below the provision for taxation, the account is prepared. The credit side ₹ 28000 would be added as a provision for taxation of the current year to calculate net profit before taxation and extraordinary items.

The debit side item ₹ 8000 is subtracted as the last item to calculate cash flow from operating activities.

Solution:-

Working Notes:-

Case – 2

| Equity and Liabilities | 2021 | 2020 |

| Provision for Taxation | 50,000 | 30,000 |

Additional Information:-

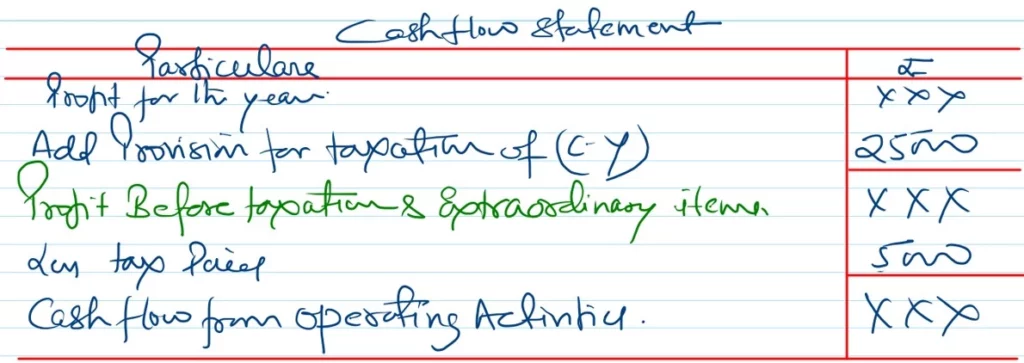

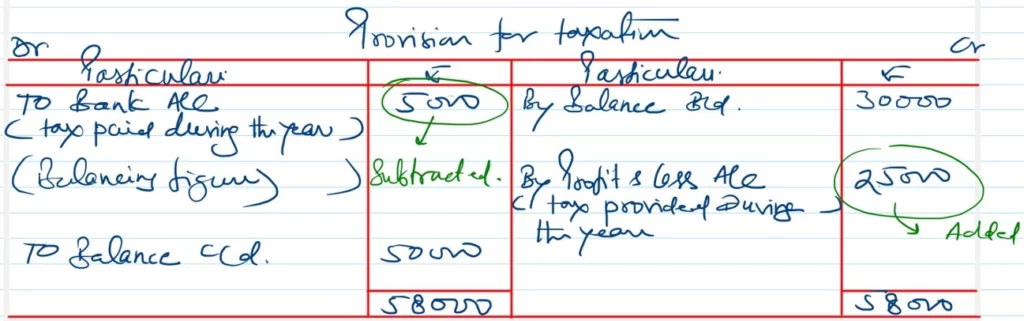

Provision for taxation provided during the year ₹ 25,000.

Solution:-

Working Notes:-

Hi sir, Its such a great presentation. But there is a typo in Case-2 of Provision for taxation, that the amount has been given as Rs. 22,000 provision made, but in the answers u shown it as 25k.

corrected