Assertion Reason MCQs of Accounting Ratios Class 12

Looking for important assertion reason MCQs of Accounting Ratios (Ratio Analysis) chapter of Accountancy class 12 CBSE, ISC, and State Board

We have compiled very important assertion reason multiple-choice questions of Accounting Ratios chapter of Accountancy class 12

Assertion Reason Multiple Choice Questions of Accounting Ratios of class 12 Accountancy

Let’s Practice

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): The accounting ratio is an expression of the arithmetical relationship between two related items of accounting data.

Reason(R): A ratio is an analytical tool of data. When ratio analysis is applied to accounting data, the result is termed as accounting ratio.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False but Reason (R) is True.

Ans – a)

Assertion (A): A ratio is quantitative aspects of results.

Reason (R): Ratio analysis establishes relationship between two related items of financial statements.

Options:

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (b)

Assertion (A): Liquidity Ratios are used to assess the short-term financial obligations of the firm.

Reason (R): Current Ratio and Acid test Ratio are two liquidity ratios which measure the firm’s ability to meet its current obligations in time.

In the context of the above two statements, which of the following is correct?

Options:-

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct but (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – a)

Assertion (A): Long-term financial position of a firm is assessed from Liquidity Ratios.

Reason (R): Liquidity Ratios, i.e., Current Ratio and Quick Ratio help in assessing Short-term financial position of the firm.

Options:

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (d)

Assertion (A): The firm’s ability to meet its short-term financial obligations is known from Liquidity Ratios.

Reason(R): Current Ratio and Quick ratio are two Liquidity Ratios That help in assessing the financial position of a firm to meet its short term financial obligations in time.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False but Reason (R) is True.

Ans – a)

Assertion (A): Debt means Long-term External Liabilities.

Reason (R): Debt includes both Long-term and Short-term External Liabilities.

Options:

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (c)

Assertion (A): Long term financial position of a firm is assessed from Liquidity Ratios:

Reason (R): Liquidity Ratios, i.e, Current Ratio and Quick Ratio help in assessing Long term financial position of the firm.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – d)

Assertion (A): Current Ratio of 2 : 1 is supposed to be an ideal Current Ratio.

Reason (R): Quick Ratio of 1 : 1 is supposed to be an ideal Quick Ratio.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(C) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – a)

Assertion (A): Total Assets to Debt Ratio shows the financing of assets from Long-term Borrowings.

Reason (R): The formula for calculating the ratio is Total Assets/Debt. Thus, it shows Long-term Funds invested in the assets of the enterprise.

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (b)

Assertion (A): Activity Ratios are indicators of efficient use of resources by a firm.

Reason (R): Activity Ratios, i.e., Inventory Turnover Ratio, Trade Receivables Turnover Ratio, Trade Payables Turnover Ratio, and Working Capital Ratio are the ratios that show how effectively the resources of the firm were used during the year.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – a)

Assertion (A): Proprietary Ratio shows the proprietor’s funds invested in total assets.

Reason (R): The formula for calculating the ratio is Proprietors’ Funds/Total Assets. Thus, it shows investment of Proprietors’ Funds in total assets

Options:

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (b)

Assertion (A): An ideal Current Ratio is 2 : 1

Reason (R): Current Ratio of 2 : 1 indicates that Current Asset of a business should, at least, be twice of its Current Liabilities, so that if half the amount is realised from current assets on time, the firm can still meet its current liabilities in full.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct but (R) is not the correct reason of (A)

(C) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – a)

Assertion (A): Operating Ratio + Operating Profit Ratio = Revenue from Operations.

Reason (R): Operating cost when deducted from Revenue from Operations gives the operating Profit.

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (d)

Assertion (A): Profitability Ratios are the indicators of profitability of the firm.

Reason (R): Profitability Ratios, i.e., Gross Profit Ratio, Operating Ratio, Operating Profit Ratio, Net Profit Ratio, and Return on Investment Ratio help in assessing efficient use of firm’s resources to generate profit.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – a)

Assertion (A): Operating Ratio is calculated to assess the operating efficiency of the enterprise.

Reason (R): Operating Ratio shows the percentage of Revenue from Operations absorbed as cost. If the ratio is low, it is considered to be better as it means operating expenses are less.

Options:-

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (b)

Assertion (A): Current Ratio is calculated by dividing current assets by current liabilities and current assets include loose tools, stores, and spares and provision for doubtful debts.

Reason (R): The formula for the Current Ratio is Current Assets/Current Liabilities. Loose Tools, Stores and Spares, and Provision for Doubtful Debts are included in Current Assets.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – d)

Explanation:- Current assets do not include Looose Tools, Stores and Spares and Provision for Doubtful Debts

Assertion (A): Inventory and prepaid expenses are current assets but not liquid assets.

Reason (R): liquid assets are those assets that are either in the form of cash or can be converted into cash in a short time. Inventory can not be converted into cash in a short time while prepaid expenses are not convertible into cash. Thus, they are excluded from Liquid Assets.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – a)

Assertion (A): Higher the Gross Profit Ratio, higher will be the profitability of a company.

Reason (R): Profitability Ratio includes not only Gross Profit RAtio and Net Profit Ratio but also includes all ratios assessing the profitability.

Options:

a) Assertion (A) and Reason (R) are correct and Reason (R) is not the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is not correct but the Reason (R) is correct

Ans – (a)

Assertion (A): The biggest drawback of the Current Ratio is that it is susceptible to ‘window-dressing’.

Reason (R): Current Ratio of more than 1 : 1 can be improved by an equal decrease in both Current Assets and Current Liabilities. Hence, it is liable to be affected by window-dressing.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A).

(b) Both (A) and (R) are correct and (R) is not the correct reason of (A).

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – a)

Assertion (A): Current assets when divided by current liabilities, the resultant ratio is termed as Liquid Ratio.

Reason (R): The formula for Liquid Ratio is Liquid Assets/Current Liabilities.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is true.

Ans – d)

Assertion (A): Inventory and Prepaid Expenses are Current Assets but not Liquid Assets.

Reason (R): Inventory and Prepaid Expenses are not included in Liquid Assets because it takes time before inventory can be converted into cash and prepaid expenses can not be converted into cash.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): Redemption of Debentures does not affect the Current Ratio.

Reason (R): Redemption of Debentures affects Current Ratio because Debentures that are redeemable within 12 months of within the period of Operating Cycle from the date of Balance Sheet are shown as Current Liabilities. Redemption of such Debentures reduces Current Liabilities.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is true.

Ans – d)

Assertion (A): If Current Ratio is 2 : 1, repayment of debentures due for redemption for ₹ 1,00,000 will result in increase in Current Ratio.

Reason (R): Debentures which are redeemable within 12 months from the date of Balance Sheet are shown as Current Liabilities. As such, redemption of debentures reduces both the Current Assets as well as Current Liabilities resulting in increase in Current Ratio.

In the context of the above two statements, which of the following is correct?

Options:

(a) (A) and (R) both are correct and (R) correctly explains (A)

(b) Both (A) and (R) are correct but (R) does not explain (A)

(c) Both (A) and (R) are incorrect

(d) (A) is correct but (R) is incorrect

Ans – a)

Assertion (A): Working Capital, if deducted from Current Assets, gives the amount of Current Liabilities.

Reason (R): Working Capital = Current Assets – Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is correct.

Ans – a)

Assertion (A): If Current Ratio is 1.5 : 1, purchase of Loose Tools for cash will not reduce the Current Ratio because one Current Asset (cash) is replaced by another Current Asset (Loose Tools).

Reason (R): Purchase of Loose Tools will reduce the Current Ratio because Looses Tools are not included in the Current Assets.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct but (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – c)

Assertion (A): If working Capital is ₹ 2,40,000, Current Assets are ₹ 4,00,000, including inventory of ₹ 2,00,000. The Current Ratio will be 2.5 : 1

Reason (R): Current Ratio = Current Assets/Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is correct.

Ans – a)

Explanation:-Current Liabilities = Current Assets – Working Capital, i.e., ₹ 4,00,000 – ₹ 2,40,000 = ₹ 1,60,000, CR = ₹ 4,00,000/₹ 1,60,000 = 2.5 : 1

Assertion (A): If Current Ratio is 2 : 1, purchase of goods of ₹ 1,00,000 on credit will reduce the ratio.

Reason (R): Purchase of goods on credit will result in increase in both Current Assets as well as Current Liabilities by the same amount. Thus, Current Ratio will improve.

In the context of the above two statements, which of the following is correct?

Options:-

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct but (R) is not the correct reason of (A)

(c) Only (A) is correct

(d) Both (A) and (R) is wrong

Ans – c)

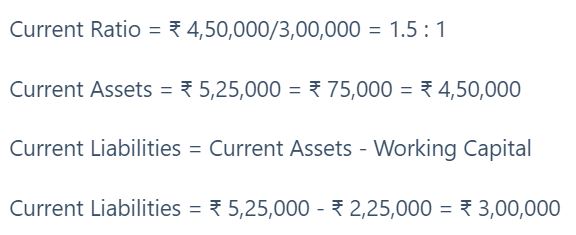

Assertion (A): If current Assets are ₹ 5,25,000, including inventory of ₹ 2,00,000 (including Losse Tools ₹ 75,000) and working capital is ₹ 2,25,000, Current Ratio will be 1.83 : 1

Reason (R): Current Ratio = Current Assets/Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is correct.

Ans – d)

Explanation:-

Assertion (A): If Current Ratio is 2 : 1, bill receivable endorsed to a creditor will improve the ratio.

Reason (R): Current Ratio will improve because both the Current Assets as well as Current Liabilities are decreased by the same amount.

In the context of the above statements, which on of the following is correct?

Options:-

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

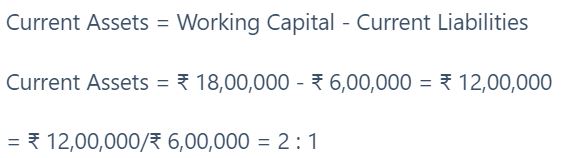

Assertion (A): If Trade Payables are ₹ 60,000, Working Capital is ₹ 18,00,000, Current Liabilities are ₹6,00,000, Current Ratio will be 3 : 1.

Reason (R): Current Ratio = Current Assets/Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – d)

Ans – d)

Assertion (A): If Quick Ratio is 0.8 : 1, cash paid to trade payables will increase the quick ratio.

Reason (R): Quick Ratio will be reduced because both the liquid assets as well as current liabilities are decreased by the same amount.

In the context of the above two statements, which of the following is correct?

Options

(a) (A) is correct but (R) is wrong

(b) Both (A) and (R) are correct

(c) (A) is wrong but (R) is correct

(d) Both (A) and (R) are wrong

Ans – c)

Assertion (A): If the Current Ratio is 2 : 1, payment of the Current Liability of ₹ 10,000 will improve the ratio.

Reason (R): Payment of Current Liability of ₹ 10,000 will reduce current Assets (Cash) and also current liability by the same amount. Thus, the Current ratio will decrease.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – c)

Explanation:- When current ratio is more than one and same amount is deducted from denominator and nominator. The denominator that is already less than the numerator get reduced more than the numerator in percentage. Thus overall ratio will improve.

Assertion (A): Liquid ratio is considered more dependable than Current Ratio.

Reason (R): Liquid Ratio is more dependable because it includes only those assets which can be easily and readily converted into cash. Inventory is not included in Liquid Assets because it may take a lot of time before it is converted into cash.

In the context of the above statements, which one of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(C) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): If the current Ratio is 2 : 1, the purchase of goods for cash of ₹ 20,000 will reduce the ratio.

Reason (R): Purchase of Goods of ₹ 20,000 in cash will reduce Current Assets (Cash) and increase another current asset (Goods) by the same amount. Thus, the current ratio will not change.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – d)

Assertion (A): If Current Ratio is 2 : 1 and Liquid Ratio 1.2 : 1, purchase of goods on credit will result in decline in both the Current as well as Liquid Ratio.

Reason (R): Both Current as well as Liquid Ratio will decline. Current Ratio will decline because there is equal increase in Current Assets as well as Current Liabilities. Liquid Ratio will also decline because Liquid Assets remain unchanged whereas Current Liabilities will increase.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): If the current Ratio is 2 : 1, the sale of office equipment in cash for ₹ 10,000 (Book value ₹ 15,000) will improve the ratio.

Reason (R): The sale of office equipment for cash will increase the current assets (cash) but current liabilities remain unchanged. Thus, the Current ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – a)

Assertion (A): If Current Ratio is 2 : 1 and Liquid Ratio is 1.2 : 1, sale of goods costing ₹ 2,00,000 for ₹ 1,80,000 on credit will result in decline in both the current as well as liquid ratio.

Reason (R): Current Ratio will decline because one Current Asset (debtors) has increased by ₹ 1,80,000 whereas another Current Asset (inventory) has decreased by ₹ 2,00,000. Liquid Ratio will improve because Liquid Assets have increased whereas Current Liabilities remain unchanged.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – d)

Assertion (A): If the Current Ratio is 2 : 1, the purchase of goods of ₹ 50,000 on credit will reduce the ratio.

Reason (R): Purchase of goods on credit for ₹ 50,000 will increase both current assets (Goods ) and Current Liabilities (Creditors). Thus, the Current Ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – c)

Assertion (A): Debt to Equity Ratio expresses the relationship between Long term Debts and Shareholder’s Funds and indicates the long-term financial soundness of the firm.

Reason (R): Debt to Equity Ratio is calculated to assess the ability of the firm to meet its long term liabilities. A higher Debt-Equity Ratio indicates that large amount of funds invested in business are provided by long-term lenders which is an indication of risky financial position.

In the context of the above statements, which one of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation Of (A).

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(C) Both (A) and (R) are false

(d) (A) is true, but (R) is false

Ans – b)

Assertion (A): If the Current Ratio is 2 : 1, the sale of goods for ₹ 25,000 (cost ₹ 20,000) in cash will reduce the ratio.

Reason (R): The sale of goods for ₹ 25,000 will increase current assets (Cash/Trade Debtors) by ₹ 25,000 and reduce current (goods) by ₹ 20,000. As a result, current assets will increase by ₹ 5,000, and thus, the current ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – d)

Assertion (A): Proprietary Ratio measures the long-term solvency of the enterprise.

Reason (R): Interest Coverage Ratio is a profitability ratio.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct but (R) is not the correct reason of (A)

(c) Only (A) is correct

(d) Both (A) and (R) are wrong

Ans – c)

Assertion (A): If the Current Ratio is 2 : 1, payment of dividends of ₹ 1,25,000 will improve the ratio.

Reason (R): Payment of current liability (Dividend) will reduce current liability and also a current asset (Bank) by the same amount. Thus, the current ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – a)

Assertion (A): If Proprietary Ratio is 0.6 : 1 and Debt-Equity Ratio is 2 : 1, conversion of debentures into Preference Shares will increase the Proprietary as well as Debt-Equity Ratio.

Reason (R): Proprietary Ratio will increase because there is increase in Shareholder’s Funds but Debt-Equity Ratio will decrease because the Long-term Debts are decreased and Shareholder’s Funds (equity) are increased by the same amount.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct and (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – c)

Assertion (A): If the Current Ratio is 2 : 1, the redemption of debentures of ₹ 1,00,000 will reduce the ratio.

Reason (R): Debentures redeemable within 12 months or within the period of the Operating Cycle from the Date of Balance Sheet are Current Liabilities. As a result, both Current Assets and Current Liabilities decrease by the same amount. Thus, the Current Ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is True.

Ans – d)

Assertion (A): If Operating Profit Ratio is 20%, purchase of goods for ₹ 1,00,000 will decrease the ratio.

Reason (R): There will be equal increase in Purchases and Closing Inventory and hence Cost of Revenue from Operations remain unchanged. Since Revenue from Operations also does not change, the Operating Ratio will not change.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are correct and (R) is the correct reason of (A).

(b) Both (A) and (R) are correct but (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – c)

Assertion (A): Activity Ratios are the ratios that are calculated for measuring the efficiency of operations of business based on effective utilisation of resources.

Reason (R): Current ratio and Quick Ratio are liquidity ratios

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – b)

Assertion (A): If Gross Profit Ratio is 25%, purchase of goods of ₹ 1,00,000 on credit will decrease the Gross Profit Ratio.

Reason (R): Purchase of goods either on credit or for cash will not change the Gross Profit Ratio because there will be equal increase in Purchases and Closing Inventory and hence Cost of Revenue from Operations remain unchanged.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct and (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – c)

Assertion (A): The limitations of financial statements also form the limitations of the ratio analysis.

Reason (R): Since the ratios are derived from the financial statements, any weakness in the original financial statements will also creep in the derived analysis in the form of Accounting Ratios.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – a)

Assertion (A): If Gross Profit Ratio is 25%, goods costing ₹ 20,000 withdrawn for personal use will decrease the Gross Profit Ratio.

Reason (R): Goods withdrawn for personal use will not change the ratio because there will be equal decrease in Purchases and Closing Inventory and hence Cost of Revenue from Operations will remain unchanged.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct and (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – c)

Assertion (A): If the debt-equity ratio is 1:2, it is considered to be safe.

Reason (R): From a Security point of view, a capital structure with less debt and more equity is considered favourable as it reduces the changes of bankruptcy.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – d)

Assertion (A): If Proprietary Ratio is 0.6 : 1 and Debt-Equity Ratio is 2 : 1, sale of a Fixed Asset costing ₹ 5,00,000 for ₹ 4,00,000 will decrease the Proprietary as well as Debt-Equity Ratio.

Reason (R): Proprietary Ratio will decrease because Shareholder’s Funds have decreased by the amount of loss but Debt-Equity Ratio will increase because Long-term Debts remain unchanged but Shareholder’s Funds have decreased.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are correct and (R) is the correct reason of (A).

(b) Both (A) and (R) are correct and (R) is not the correct reason of (A).

(C) Only (R) is correct.

(d) Both (A) and (R) are wrong.

Ans – c)

Assertion (A): Interest Coverage Ratio expresses the relationship between profits available for payment of interest and the amount of interest payable.

Reason (R): A higher ratio ensures lesser safety of interest on debts.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – c)

Assertion (A): A low Total Assets to Debt Ratio indicates risky financial position

Reason (R): A low Total Assets to Debt Ratio implies the use of higher debts in financing the assets of the business. Hence, it indicates a risky financial position.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct and (R0 is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong.

Ans – a)

Assertion (A): Ratio analysis is an indispensable part of the interpretation of results revealed by the financial statements

Reason (R): Ratio analysis, is a technique that involves regrouping of data by application of arithmetical relationships, though its interpretation is a complex relationship.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – b)

Assertion (A): Activity Ratio indicate how efficiently the Working Capital and Inventory are being used by the firm.

Reason (R): Activity Ratio, i.e., Inventory Turnover Ratio, Trade Receivables Turnover Ratio. Trade Payables Turnover Ratio and Working Capital Turnover Ratio indicate how efficiently the Working Capital and Inventory were used during the year.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): Activity Ratio indicates the speed at which the activities of the business are being performed.

Reason (R): Lower turnover ratio means better utilization of assets and signifies improved efficiency and profitability.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – c)

Assertion (A): While calculating Trade Receivables Turnover Ratio, Provision for Doubtful Debts is not deducted from Trade Receivables

Reason (R): Provision for Doubtful Debts is not deducted from Trade Receivables because it it is deducted than Trade Receivables will be reduced which will give a higher Trade Receivables Turnover Ratio and it will give a false impression that Trade Receivables are being collected quickly.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is true, but (R) is false

Ans – b)

Assertion (A): Higher Trade Receivable Turnover means speedy collections from trade receivable.

Reason (R): Trade Receivable Turnover Ratio indicates the number of times the receivables are turned over and converted into cash in an accounting period.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – a)

Assertion (A): Operating Ratio is a measurement of the operating efficiency and profitability of the enterprise.

Reason (R): Operating Ratio indicates the percentage of Revenue from Operations absorbed by the Cost of Revenue from Operations. Lower the operating ratio, the better it is, because it means operating cost is less.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): Personal bias can be reflected in ratio analysis.

Reason (R): Different people may interpret the same ratio in different ways, which affects its trustability.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is false but Reason (R) is true

d) Assertion (A) is true but Reason (R) is false

Ans – a)

Assertion (A): A high Operating Ratio indicates a favourable position.

Reason (R): A high Operating Ratio leaves a high margin to meet Non-operating Expenses.

In the context of the above two statements, which of the following is correct?

Options:

(a) (A) and (R) both are correct and (R) correctly explains (A)

(b) Both (A) and (R) are correct but (R) does not explain (A)

(c) Both (A) and (R) are incorrect

(d) (A) is correct but (R) is incorrect.

Ans – c)

Assertion (A): Inventories and prepaid expenses are not considered as quick assets.

Reason (R): Inventories take some time before it is converted into cash while prepaid expenses can be converted into cash.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is false but Reason (R) is true

d) Assertion (A) is true but Reason (R) is false

Ans – d)

Assertion (A): If Operating Ratio is 75%, purchase of goods of ₹ 1,00,000 will not change the ratio.

Reason (R): There will be equal increase in Purchases and Closing Inventory and hence the Cost of Revenue from Operations and Operating Ratio will remain unchanged.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): The debt to equity ratio will increase at the time of the issue of equity shares for cash.

Reason (R): The issue of equity shares will increase the shareholder’s funds but the long-term debts will remain the same.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is false but Reason (R) is true

d) Assertion (A) is true but Reason (R) is false

Ans – c)

Assertion (A): If Operating Ratio is 75%, sale of goods for ₹ 40,000 will not change the ratio.

Reason (R): Since Operating Ratio of the Company is 75%, increase in Revenue from Operations by ₹ 40,000 will result in decrease in Closing Inventory by 75% of ₹ 40,000. Hence, Cost of Revenue from Operations will increase by ₹ 30,000 and Revenue from Operations will increase by ₹ 40,000. Thus Operating Ratio will remain unchanged.

In the context of the above two statements, which of the following is correct?

Options:

(a) (A) and (R) both are correct and (R) correctly explains (A)

(b) Both (A) and (R) are correct but (R) does not explain (A)

(c) Both (A) and (R) are incorrect

(d) (A) is correct but (R) is incorrect

Ans – a)

Assertion (A): Current ratio is computed to assess the short-term financial position of the enterprise.

Reason (R): Current ratio explains the relation between long-term assets and current liabilities of a business.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c) Assertion (A) is false but Reason (R) is true

d) Assertion (A) is true but Reason (R) is false

Ans – d)

Assertion (A): If Gross Profit Ratio is 25%, sale of goods for ₹ 2,00,000 will increase the ratio.

Reason (R): There will be no change in Gross Profit Ratio because Gross Profit will increase by the same percentage i.e. 25%

In the context of the above statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – d)

Assertion (A): If Gross Profit Ratio is 20%, goods for ₹ 50,000 sold to employees at cost will decrease the ratio.

Reason (R): There will be no change in Gross Profit Ratio, because both Cost of Revenue from Operations and Revenue from Operations will increase by the same amount.

In the context of the above two statements, which of the following is correct?

Options:

(a) (A) and (R) both are correct and (R) correctly explains (A)

(b) Both (A) and (R) are correct but (R) does not explain (A)

(c) Both (A) and (R) are incorrect

(d) (A) is correct but (R) is incorrect

Ans – d)

Assertion (A): If Gross Profit Ratio is 20%, goods costing ₹ 3,00,000 sold for ₹ 4,00,000 will increase the ratio.

Reason (R): Gross Profit = ₹ 4,00,000 – ₹ 3,00,000 = ₹ 1,00,000, G.P. Ratio = 1,00,000/4,00,000 x 100 = 25%, Since existing G.P. Ratio is 20%, it will increase.

In the context of the above two statements, which of the following is correct?

Options:

(a) (A) and (R) both are correct and (R0 correctly explains (A)

(b) Both (A) and (R) are correct but (R) does not explain(A)

(c) Both (A) and (R) are incorrect.

(d) (A) is correct but (R) is incorrect

Ans – a)

Assertion (A): If Gross Profit Ratio is 20%, goods costing ₹ 1,70,000 sold for ₹ 2,00,000 will increase the ratio.

Reason (R): Gross Profit = ₹ 2,00,000 – ₹ 1,70,000 = ₹ 30,000

G.P Ratio = 30,000/2,00,000 x 100 = 15%

Since existing ratio is 20%, the Gross Profit Ratio will decrease.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true, and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – d)

Assertion (A): Capital Employed = Non-Current Assets + Current Assetes – Current Liabilities

Reason (R): Capital Employed = Shareholder’s Funds + Non-Current Liabilities

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): Increasing the Value of Closing Inventory increases Profit.

Reason (R): Increasing the Value of closing Inventory reduces cost of goods sold.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are correct and (R) is the correct reason of (A).

(b) Both (A) and (R) are correct and (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are wrong

Ans – a)

Assertion (A): The focus of calculation of Working Capital revolves around managing the Operating Cycle of the business.

Reason (R): It is because the concept of Operating Cycle is required to ascertain the liquidity of assets and urgency of payments to liabilities.

In the context of the above two statements, which of the following is correct?

Options

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is the correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): Issue of bonus shares will not effect the debt-equity ratio.

Reason (R): Bonus shares are issued out of accumulated profits and thus neither affect debt nor equity.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Both (A) and (R) are correct, but (R) is not the correct reason of (A)

(c) Only (R) is correct

(d) Both (A) and (R) are incorrect

Ans – a)

Assertion (A): Interest Coverage Ratio is a measure of security of interest payable on long-term debts.

Reason (R): Interest Coverage Ratio expresses the relationship between profits available for payment of interest and the amount of interest payable.

In the context of the above two statements, which of the following is correct?

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A).

(b) Both (A) and (R) are correct, but (R) is not the correct reason of (A)

(c) Both (A) and (R) are incorrect.

(d) (A) is correct, but (R) is incorrect

Ans – a)

Assertion (A): Current Ratio establishes relationship between Current Assets and Current Liabilities.

Reason (R): The objective of this ratio is to measure the ability of the firm to meet its short term obligations as and when due without relying upon the realisation of inventories.

In the context of the above two statements, choose the correct options

Option:

(a) (A) is true but (R) is false

(b) Both (A) and (R) are true, and (R) is a correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – a)

Assertion (A): Return on investment explains the overall utilization of funds by a business enterprise.

Reason (R): It measures return (Net Profit before Interest and Tax) on total funds (Capital employed)

In the context of these statements, choose the correct option.

Options

(a) Both (A) and (R) are true, but (R) is not the correct explanation of (A)

(b) Both (A) and (R) are true and (R) is correct explanation of (A)

(c) Both (A) and (R) are false

(d) (A) is false, but (R) is true

Ans – b)

Assertion (A): Profitability ratios are calculated to analyse the earning capacity of the business.

Reason (R): Profitability ratios are calculated to determine the ability of the business to service its debt in the long run.

In the light of the above two statements which of the following is correct:

Options:

(a) Both (A) and (R) are correct

(b) Both (A) and (R) are wrong

(c) (A) is correct but (R) is wrong

(d) (A) is wrong but (R) is correct

Ans – c)

Assertion (A): ‘Sale of goods for Cash’ does not effect Debt-Equity Ratio.

Reason (R): ‘Sale of goods on cash basis’ neither affect ‘Debt nor ‘Equity’.

In the context of the above statements, which of the following is correct:

Options:

(a) Both (A) and (R) are correct and (R) is the correct reason of (A)

(b) Only (A) is correct

(c) Only (R) is correct

(d) Both (A) and (R) are incorrect

Ans – a)

Assertion (A): Operating Ratio is = 100 – Operating Profit Ratio.

Reason (R): Operating ratio is computed to reveal the operating margin on products sold.

In the context of the above statements, which of the following is correct:

Options

(a) Both Statements are incorrect

(b) (A) is correct but (R) is incorrect

(c) (A) is incorrect but (R) is correct

(d) Both (A) and (R) are correct and (R) is the correct reason of (A)

Ans – b)

Assertion (A): Decreasing the value of closing inventory decreases profit.

Reason (R): Decrease in the value of closing inventory increases the cost of revenue from operations.

In the light of the above statements, choose the most appropriate answer from the options given below:

(a) Both (A) and (R) are correct and (R) is the correct explanation of (A)

(b) Both (A) and (R) are correct but (R) is not the correct explanation of (A)

(c) (A) is correct but (R) is not correct

(d) (A) is not correct but (R) is correct

Ans – a)