Assertion Reason MCQs of Accounting Ratios Class 12

Looking for important assertion reason MCQs of Accounting Ratios chapter of Accountancy class 12 CBSE, ISC, and State Board

We have compiled very important assertion reason multiple-choice questions of Accounting Ratios chapter of Accountancy class 12

Assertion Reason Multiple Choice Questions of Accounting Ratios of class 12 Accountancy

Let’s Practice

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): The accounting ratio is an expression of the arithmetical relationship between two related items of accounting data.

Reason(R): A ratio is an analytical tool of data. When ratio analysis is applied to accounting data, the result is termed as accounting ratio.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False but Reason (R) is True.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): The firm’s ability to meet its short-term financial obligations is known from Liquidity Ratios.

Reason(R): Current Ratio and Quick ratio are two Liquidity Ratios That help in assessing the financial position of a firm to meet its short term financial obligations in time.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False but Reason (R) is True.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Long term financial position of a firm is assessed from Liquidity Ratios:

Reason (R): Liquidity Ratios, i.e, Current Ratio and Quick Ratio help in assessing Long term financial position of the firm.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – d)

Explanation:- Liquidity Ratois assess the short term financial position of the firm.

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Activity Ratios are indicators of efficient use of resources by a firm.

Reason (R): Activity Ratios, i.e., Inventory Turnover Ratio, Trade Receivables Turnover Ratio, Trade Payables Turnover Ratio, and Working Capital Ratio are the ratios that show how effectively the resources of the firm were used during the year.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Profitability Ratios are the indicators of profitability of the firm.

Reason (R): Profitability Ratios, i.e., Gross Profit Ratio, Operating Ratio, Operating Profit Ratio, Net Profit Ratio, and Return on Investment Ratio help in assessing efficient use of firm’s resources to generate profit.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Current Ratio is calculated by dividing current assets by current liabilities and current assets include loose tools, stores, and spares and provision for doubtful debts.

Reason (R): The formula for the Current Ratio is Current Assets/Current Liabilities. Loose Tools, Stores and Spares, and Provision for Doubtful Debts are included in Current Assets.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – d)

Explanation:- Current assets do not include Looose Tools, Stores and Spares and Provision for Doubtful Debts

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Inventory and prepaid expenses are current assets but not liquid assets.

Reason (R): liquid assets are those assets that are either in the form of cash or can be converted into cash in a short time. Inventory can not be converted into cash in a short time while prepaid expenses are not convertible into cash. Thus, they are excluded from Liquid Assets.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Current assets when divided by current liabilities, the resultant ratio is termed as Liquid Ratio.

Reason (R): The formula for Liquid Ratio is Liquid Assets/Current Liabilities.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is true.

Ans – d)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Redemption of Debentures does not affect the Current Ratio.

Reason (R): Redemption of Debentures affects Current Ratio because Debentures that are redeemable within 12 months of within the period of Operating Cycle from the date of Balance Sheet are shown as Current Liabilities. Redemption of such Debentures reduces Current Liabilities.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is true.

Ans – d)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): Working Capital, if deducted from Current Assets, gives the amount of Current Liabilities.

Reason (R): Working Capital = Current Assets – Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is correct.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If working Capital is ₹ 2,40,000, Current Assets are ₹ 4,00,000, including inventory of ₹ 2,00,000. The Current Ratio will be 2.5 : 1

Reason (R): Current Ratio = Current Assets/Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is correct.

Ans – a)

Explanation:-Current Liabilities = Current Assets – Working Capital, i.e., ₹ 4,00,000 – ₹ 2,40,000 = ₹ 1,60,000, CR = ₹ 4,00,000/₹ 1,60,000 = 2.5 : 1

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

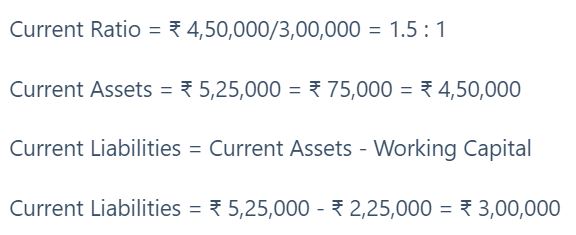

Assertion (A): If current Assets are ₹ 5,25,000, including inventory of ₹ 2,00,000 (including Losse Tools ₹ 75,000) and working capital is ₹ 2,25,000, Current Ratio will be 1.83 : 1

Reason (R): Current Ratio = Current Assets/Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is correct.

Ans – d)

Explanation:-

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

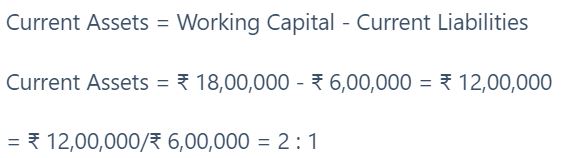

Assertion (A): If Trade Payables are ₹ 60,000, Working Capital is ₹ 18,00,000, Current Liabilities are ₹6,00,000, Current Ratio will be 3 : 1.

Reason (R): Current Ratio = Current Assets/Current Liabilities

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – d)

Ans – d)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If the Current Ratio is 2 : 1, payment of the Current Liability of ₹ 10,000 will improve the ratio.

Reason (R): Payment of Current Liability of ₹ 10,000 will reduce current Assets (Cash) and also current liability by the same amount. Thus, the Current ratio will decrease.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is False.

Ans – c)

Explanation:- When current ratio is more than one and same amount is deducted from denominator and nominator. The denominator that is already less than the numerator get reduced more than the numerator in percentage. Thus overall ratio will improve.

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If the current Ratio is 2 : 1, the purchase of goods for cash of ₹ 20,000 will reduce the ratio.

Reason (R): Purchase of Goods of ₹ 20,000 in cash will reduce Current Assets (Cash) and increase another current asset (Goods) by the same amount. Thus, the current ratio will not change.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – d)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If the current Ratio is 2 : 1, the sale of office equipment in cash for ₹ 10,000 (Book value ₹ 15,000) will improve the ratio.

Reason (R): The sale of office equipment for cash will increase the current assets (cash) but current liabilities remain unchanged. Thus, the Current ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If the Current Ratio is 2 : 1, the purchase of goods of ₹ 50,000 on credit will reduce the ratio.

Reason (R): Purchase of goods on credit for ₹ 50,000 will increase both current assets (Goods ) and Current Liabilities (Creditors). Thus, the Current Ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – c)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If the Current Ratio is 2 : 1, the sale of goods for ₹ 25,000 (cost ₹ 20,000) in cash will reduce the ratio.

Reason (R): The sale of goods for ₹ 25,000 will increase current assets (Cash/Trade Debtors) by ₹ 25,000 and reduce current (goods) by ₹ 20,000. As a result, current assets will increase by ₹ 5,000, and thus, the current ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – d)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If the Current Ratio is 2 : 1, payment of dividends of ₹ 1,25,000 will improve the ratio.

Reason (R): Payment of current liability (Dividend) will reduce current liability and also a current asset (Bank) by the same amount. Thus, the current ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) is False and Reason (R) is True.

Ans – a)

Read the following statements: Assertion and Reason. Choose one of the correct alternatives given below:

Assertion (A): If the Current Ratio is 2 : 1, the redemption of debentures of ₹ 1,00,000 will reduce the ratio.

Reason (R): Debentures redeemable within 12 months or within the period of the Operating Cycle from the Date of Balance Sheet are Current Liabilities. As a result, both Current Assets and Current Liabilities decrease by the same amount. Thus, the Current Ratio will improve.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A)

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is False and Reason (R) is True.

Ans – d)