[CBSE] Q. 103 Solution of Accounting for Share Capital TS Grewal Class 12 (2023-24)

Are you looking for the solution to Question number 103 of the Accounting for Share Capital chapter of TS Grewal Book 2023-24 Edition CBSE Board?

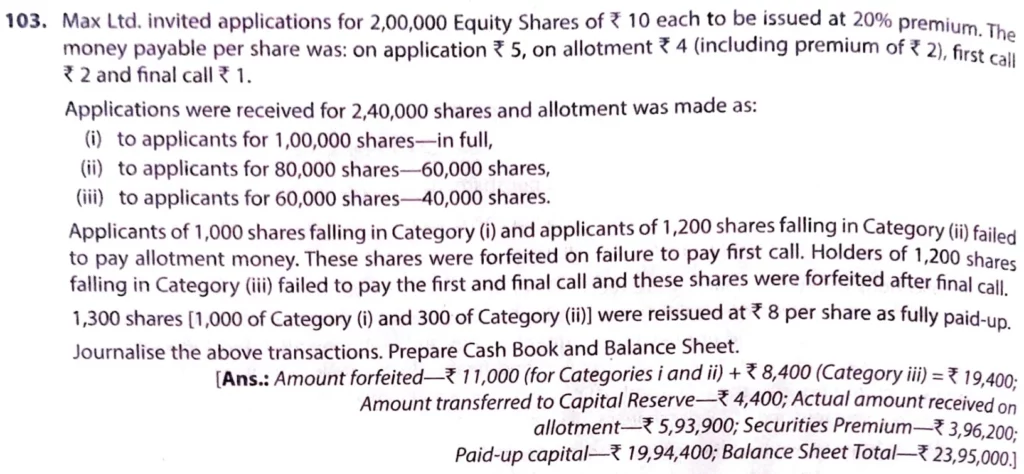

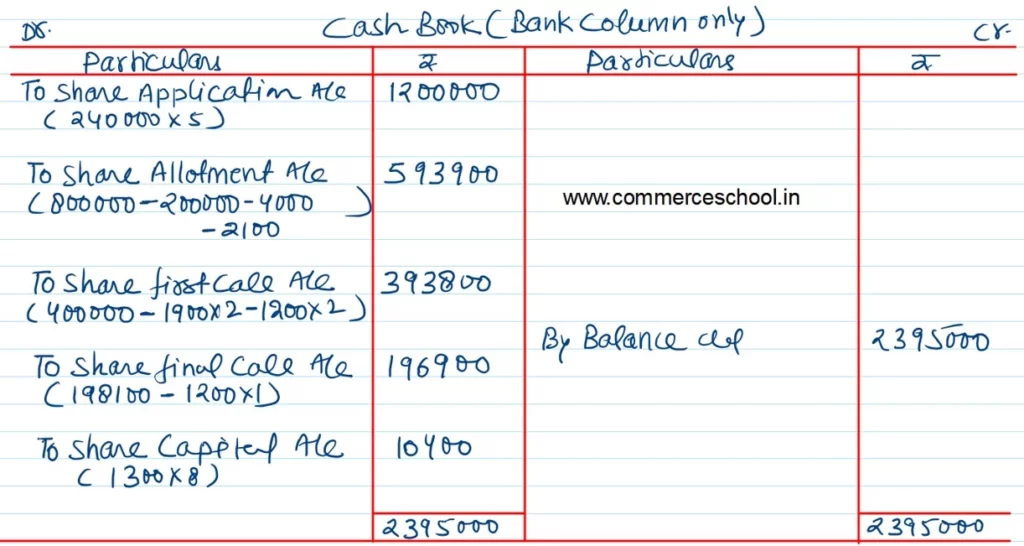

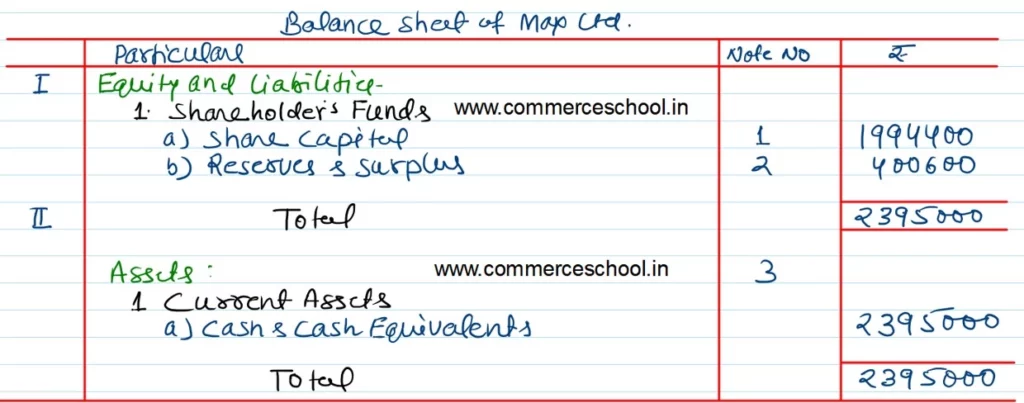

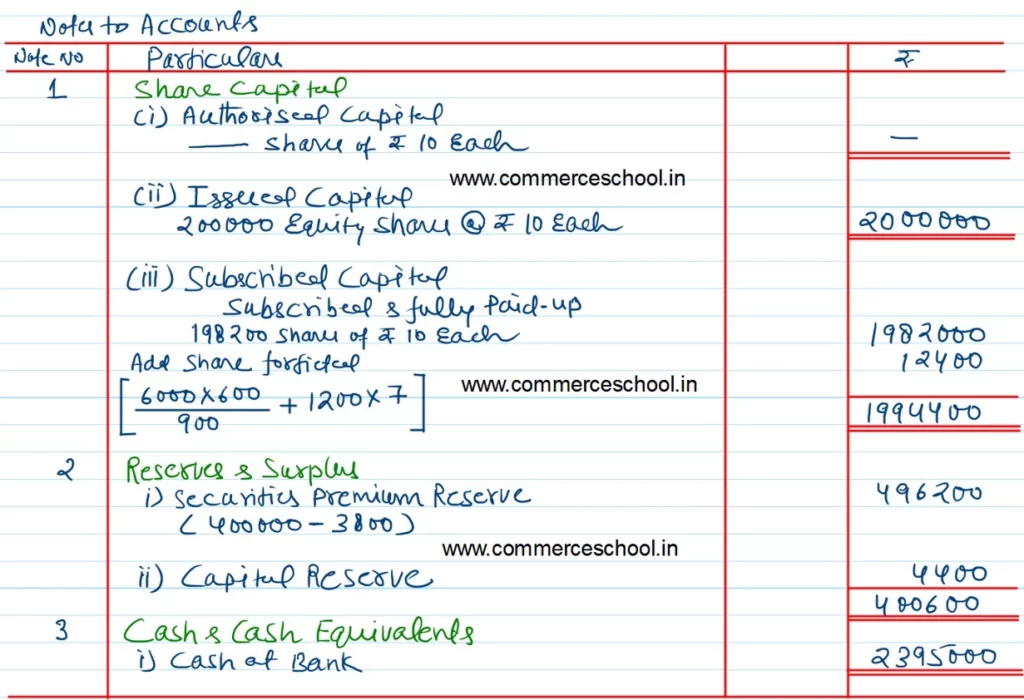

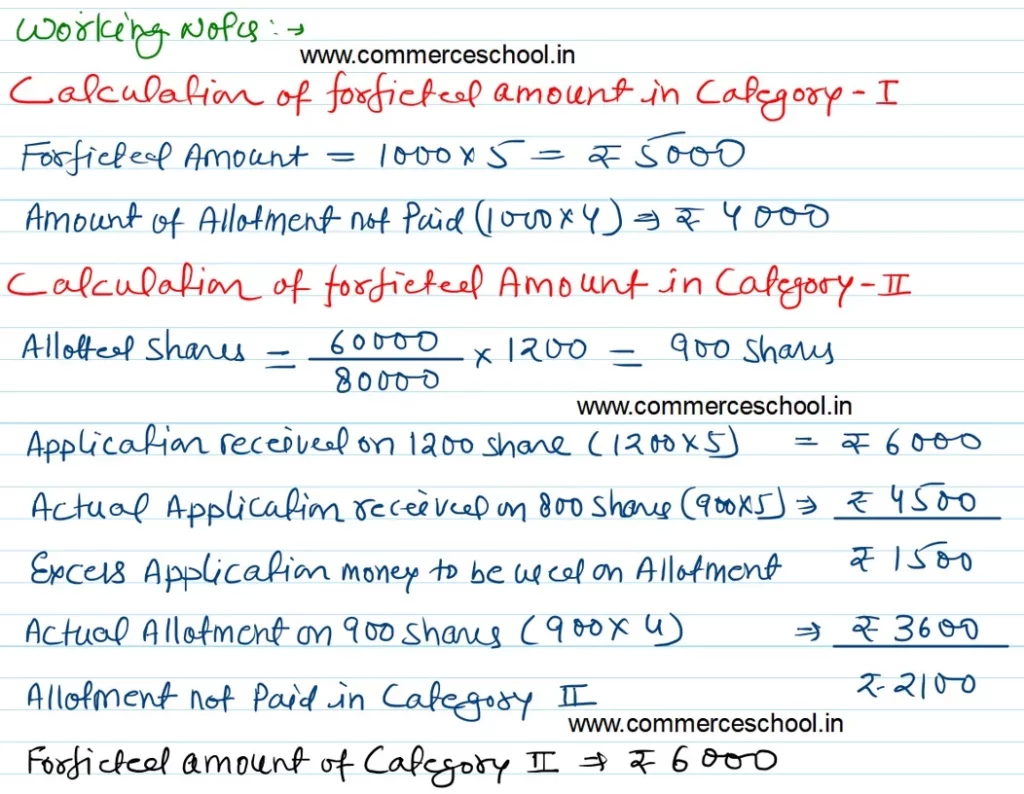

Max Ltd. invited applications for 2,00,000 Equity Shares of ₹ 10 each to be issued at 20% premium. The money payable per share was: on application ₹ 5, on allotment ₹ 4 (including premium of ₹ 2), first call ₹ 2 and final call ₹ 1.

Applications were received for 2,40,000 shares and allotment was made as:

(i) to applicants for 1,00,000 shares – in full,

(ii) to applicants for 80,000 shares – 60,000 shares,

(iii) to applicants for 60,000 shares – 40,000 shares.

Applicants of 1,000 shares falling in Category (i) and applicants of 1,200 shares falling in Category (ii) failed to pay allotment money. These shares were forfeited on failure to pay first call. Holders of 1,200 shares falling in Category (iii) failed to pay the first and final call and these shares were forfeited after final call.

1,300 shares [1,000 of Category (i) and 300 of Category (ii)] were reissued at ₹ 8 per share as fully paid-up.

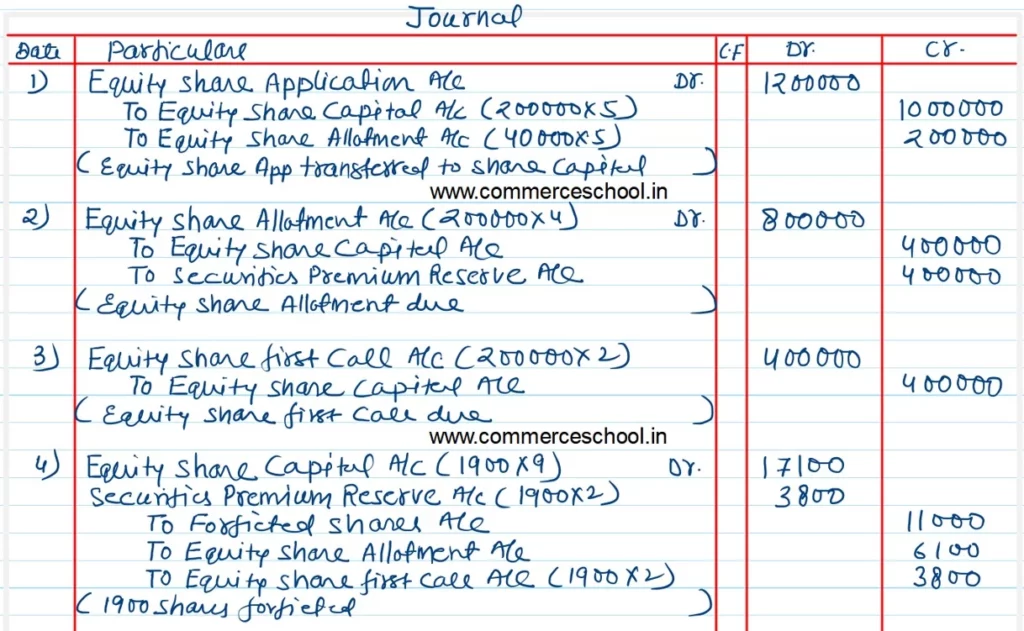

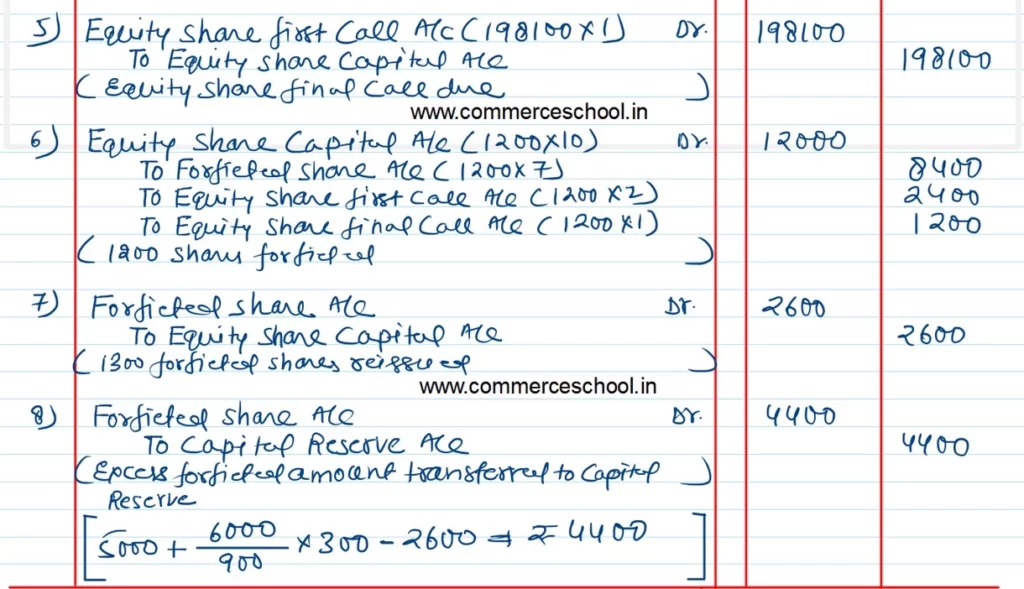

Journalise the above transactions. Prepare Cash Book and Balance Sheet.

[Ans.: Amount forfeited – ₹ 11,000 (for Categories i and ii) + ₹ 8,400 (Category iii) = ₹ 19,400; Amount transferred to Capital Reserve – ₹ 4,400; Actual amount received on allotment – ₹ 5,93,900; Securities Premium – ₹ 3,96,200; paid-up capital – ₹ 19,94,400; Balance Sheet Total – ₹ 23,95,000.]

Solution:-

Following is the list

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Questions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |