[CBSE] Q. 19 Solution of Goodwill TS Grewal Class 12 (2023-24)

Solution to Question number 19 page of the Goodwill Chapter 2 TS Grewal Book CBSE Board 2023-24 Edition?

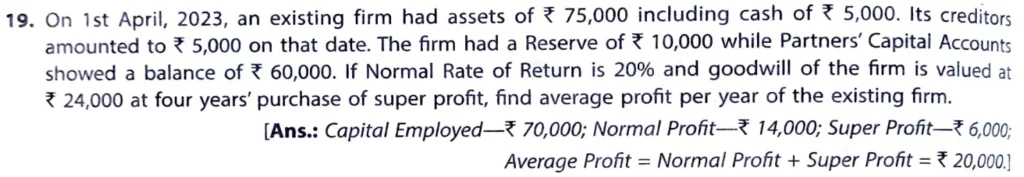

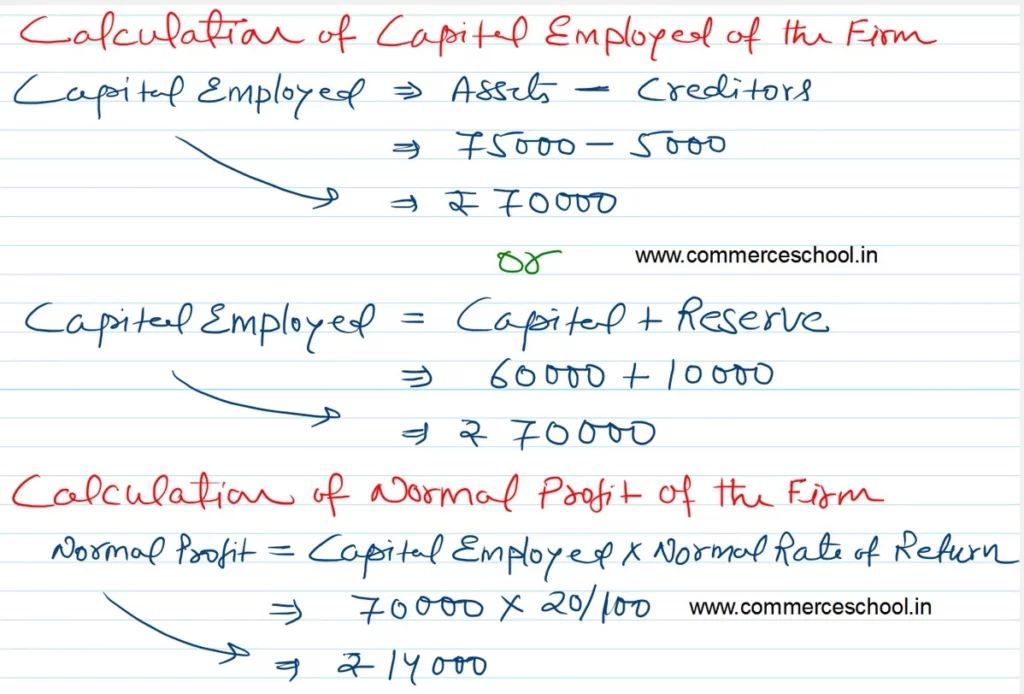

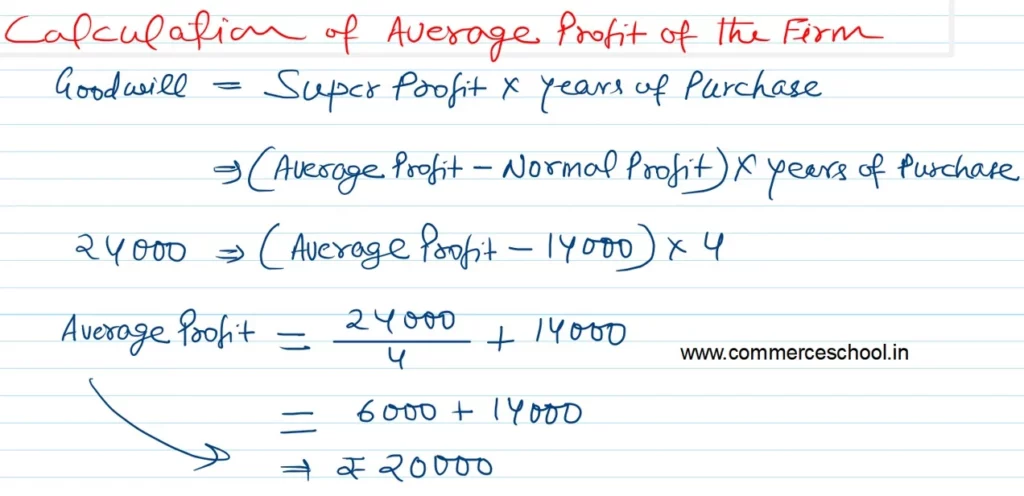

On 1st April 2023, an existing firm had assets of ₹ 75,000 including cash of ₹ 5,000. Its creditors amounted to ₹ 5,000 on that date. The firm had a Reserve of ₹ 10,000 while Partner’s Capital Accounts showed a balance of ₹ 60,000. If the Normal Rate of Return is 20% and the goodwill of the firm is valued at ₹ 24,000 at four years’ purchase of super profit, find the average profit per year of the existing firm.

[Ans.: Capital Employed – ₹ 70,000; Normal Profit – ₹ 14,000; Super Profit – ₹ 6,000; Average Profit = Normal Profit + Super Profit = ₹ 20,000.]

Solution:-

The link to All unsolved questions has been given below.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |