[CBSE] Q 2 Depreciation Solutions TS Grewal Class 11 (2023-24)

Are you looking for a solution of Question number 2 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2023-24 Session.

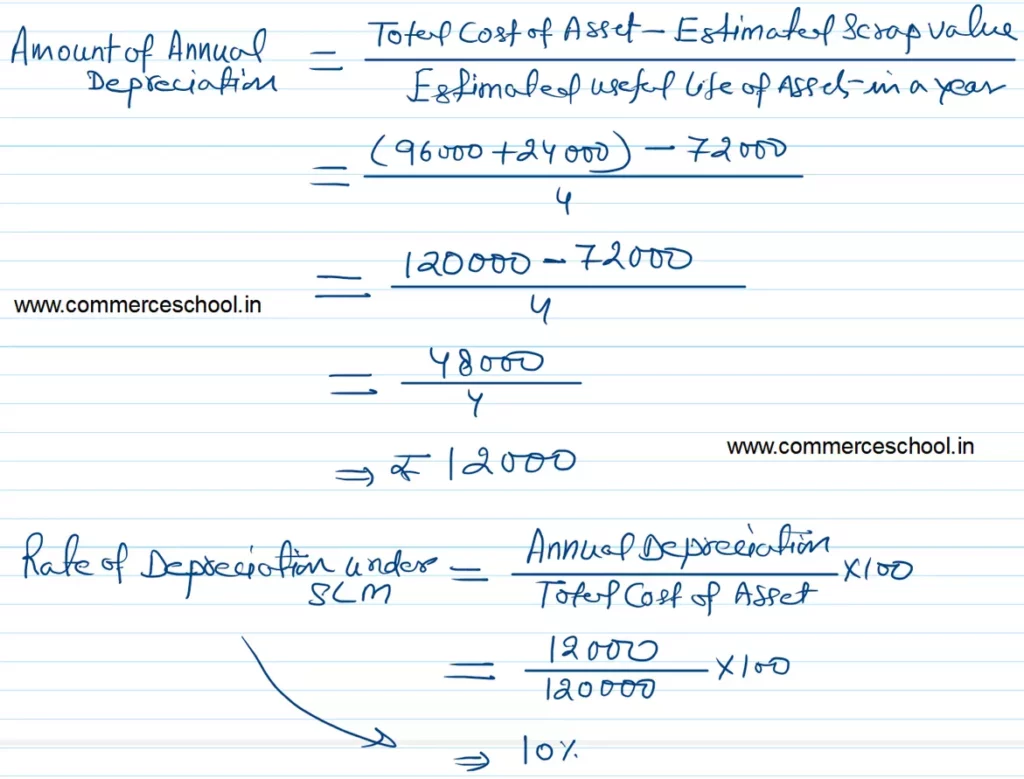

Calculate the Amount of annual Depreciation and Rate of Depreciation under Straight Line Method (SLM) from the following:

Purchased a second -hand machine for ₹ 96,000, spent ₹ 24,000 on its cartage, repairs and installation, estimated useful life of machine 4 years. Estimated residual value ₹ 72,000.

[Annual Depreciation – ₹12,000; Rate of Depreciation -10%.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the 2023-24 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |