[CBSE] Q 21 Depreciation Solutions TS Grewal Class 11 (2023-24)

Are you looking for a solution of Question number 21 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2023-24 Session.

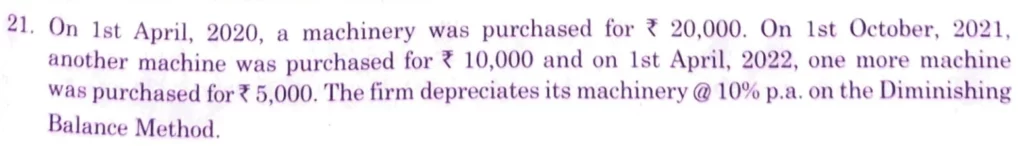

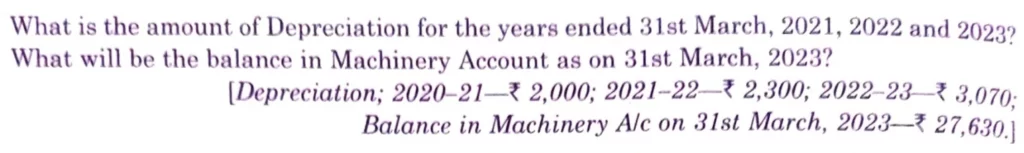

On 1st April, 2020, a machinery was purchased for ₹ 20,000. On 1st October, 2021, another machine was purchased for ₹ 10,000 and on 1st April, 2022, one more machine was purchased for ₹ 5,000. The firm depreciates its machinery @ 10% p.a. on the Diminishing Balance Method.

What is the amount of Depreciation for the years ended 31st March, 2021, 2022 and 2023?

What will be the balance in Machinery Account as on 31st March, 2023?

[Depreciation; 2020 – 21 – ₹ 2,000; 2021 – 22 – ₹ 2,300; 2022 – 23 – ₹ 3,070; Balance in Machinery A/c on 31st March, 2023 – ₹ 27,630.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the 2023-24 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |