[CBSE] Q. 21 solution of Fundamentals of Partnership Firms TS Grewal Book 2022-23 Edition

Are you looking for the solution of Question number 21 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2022-23 Edition?

Question number 21 of Accounting for Partnership Firms – Fundamentals is a theoretical one.

Solution of Question number 21 of Accounting for Partnership Firms – Fundamentals TS Grewal Book CBSE 2022-23 Edition

Q. 21

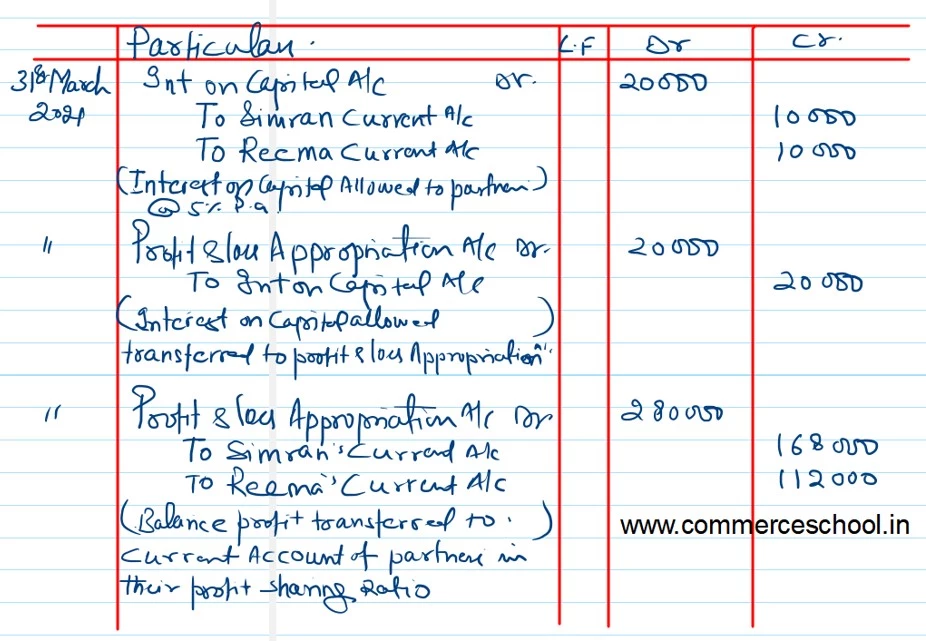

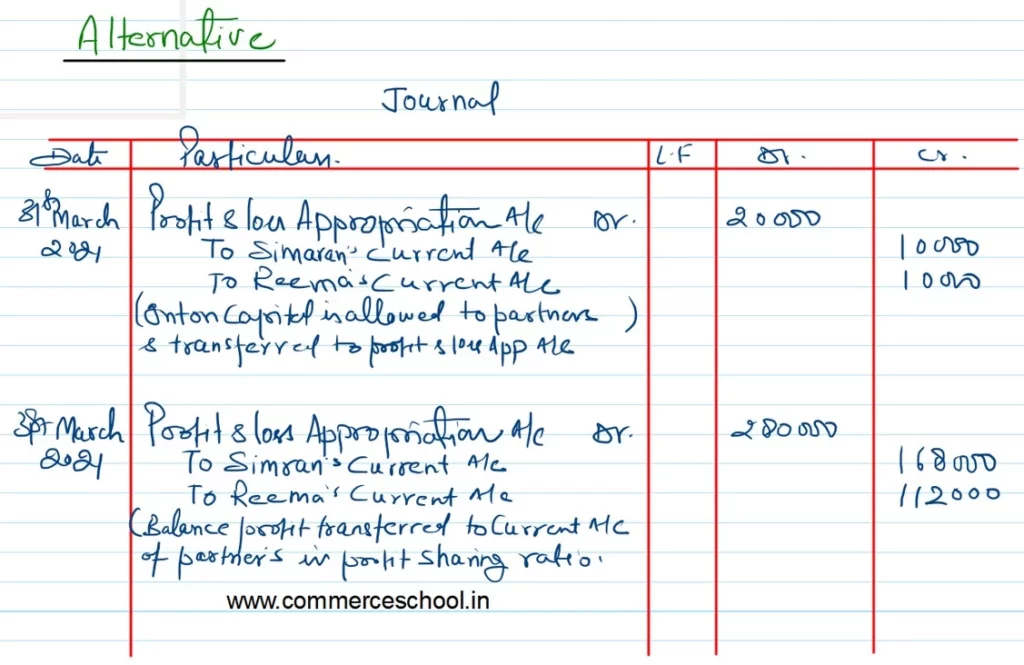

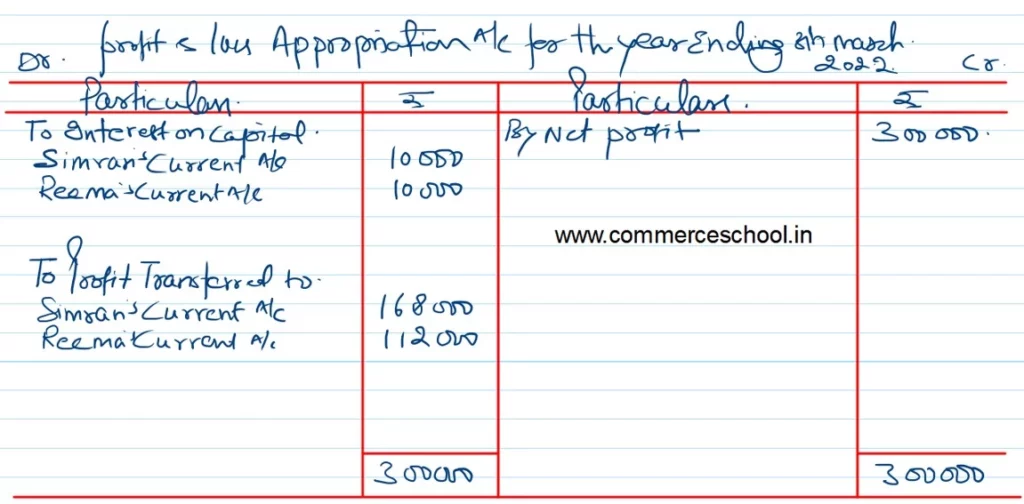

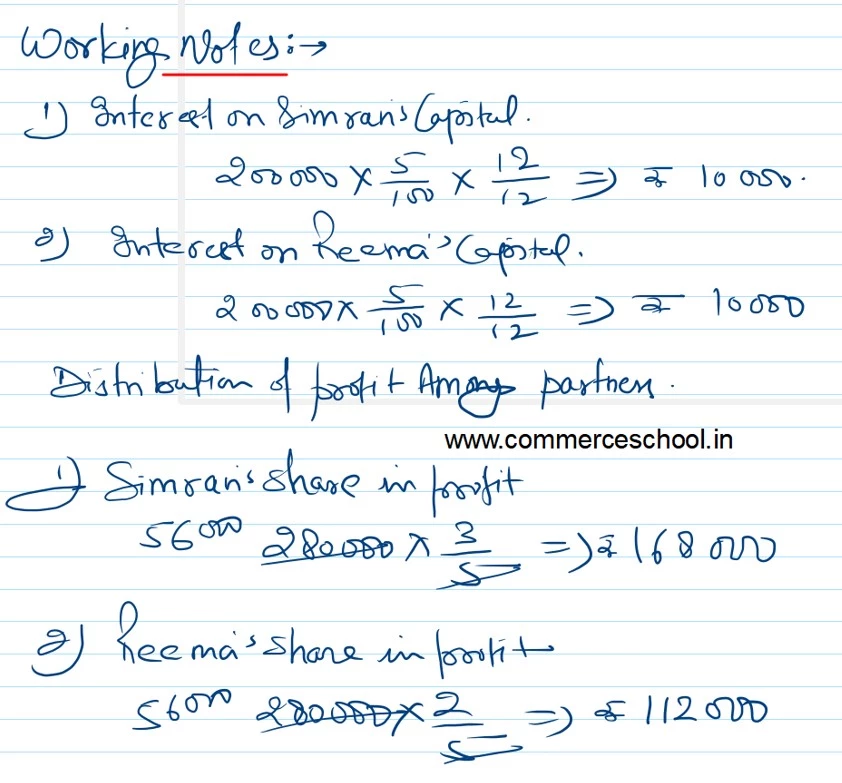

Simran and Reema are partners sharing profits in the ratio of 3:2. Their capitals as on 31st March, 2021 were ₹ 2,00,000 each whereas Current Accounts had balances of ₹ 50,000 and ₹ 25,000 respectively. Interest on capital is to be allowed @ 5% p.a.. The firm earned net profit of ₹ 3,00,000 for the year ended 31st March, 2022.

Pass the Journal entries for interest on capital and distribution of profit. Also prepare Profit and Loss Appropriation Account for the year.

Answer –

Here is the list of all Solutions.

| S.N | Questions |

| 1. | Question – 1 |

| 2. | Question – 2 |

| 3. | Question – 3 |

| 4. | Question – 4 |

| 5. | Question – 5 |

| 6. | Question – 6 |

| 7. | Question – 7 |

| 8. | Question – 8 |

| 9. | Question – 9 |

| 10. | Question – 10 |

| S.N | Questions |

| 11. | Question – 11 |

| 12. | Question – 12 |

| 13. | Question – 13 |

| 14. | Question – 14 |

| 15. | Question – 15 |

| 16. | Question – 16 |

| 17. | Question – 17 |

| 18. | Question – 18 |

| 19. | Question – 19 |

| 20. | Question – 20 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 31. | Question – 31 |

| 32. | Question – 32 |

| 33. | Question – 33 |

| 34. | Question – 34 |

| 35. | Question – 35 |

| 36. | Question – 36 |

| 37. | Question – 37 |

| 38. | Question – 38 |

| 39. | Question – 39 |

| 40. | Question – 40 |

| S.N | Questions |

| 41. | Question – 41 |

| 42. | Question – 42 |

| 43. | Question – 43 |

| 44. | Question – 44 |

| 45. | Question – 45 |

| 46. | Question – 46 |

| 47. | Question – 47 |

| 48. | Question – 48 |

| 49. | Question – 49 |

| 50. | Question – 50 |

| S.N | Questions |

| 51. | Question – 51 |

| 52. | Question – 52 |

| 53. | Question – 53 |

| 54. | Question – 54 |

| 55. | Question – 55 |

| 56. | Question – 56 |

| 57. | Question – 57 |

| 58. | Question – 58 |

| 59. | Question – 59 |

| 60. | Question – 60 |

| S.N | Questions |

| 61. | Question – 61 |

| 62. | Question – 62 |

| 63. | Question – 63 |

| 64. | Question – 64 |

| 65. | Question – 65 |

| 66. | Question – 66 |

| 67. | Question – 67 |

| 68. | Question – 68 |

| 69. | Question – 69 |

| 70. | Question – 70 |

| S.N | Questions |

| 71. | Question – 71 |

| 72. | Question – 72 |

| 73. | Question – 73 |

| 74. | Question – 74 |

| 75. | Question – 75 |

| 76. | Question – 76 |

| 77. | Question – 77 |

| 78. | Question – 78 |

| 79. | Question – 79 |

| 80. | Question – 80 |

| S.N | Questions |

| 81. | Question – 81 |

| 82. | Question – 82 |

| 83. | Question – 83 |

| 84. | Question – 84 |

| 85. | Question – 85 |

| 86. | Question – 86 |

| 87. | Question – 87 |

| 88. | Question – 88 |