[CBSE] Q. 23 Solution of Goodwill TS Grewal Class 12 (2023-24)

Solution to Question number 23 page of the Goodwill Chapter 2 TS Grewal Book CBSE Board 2023-24 Edition?

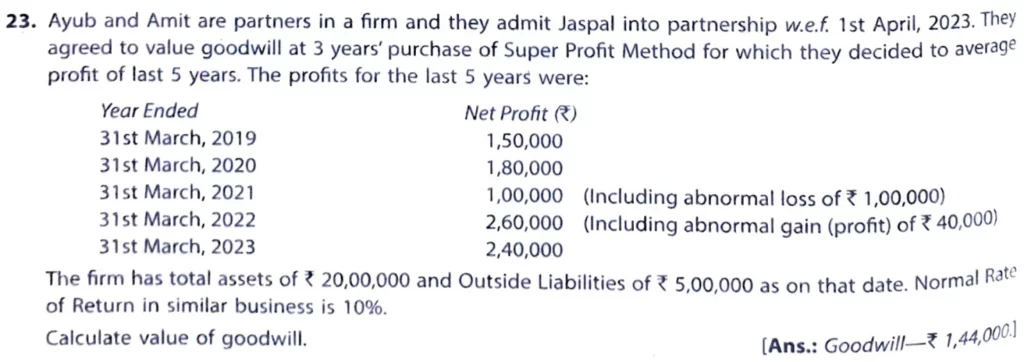

Ayub and Amit are partners in a firm and they admit Jaspal into partnership w.e.f. 1st April 2023. They agreed to value goodwill at 3 years’ purchase of super profit method for which they decided to average profit of last 5 years. The profits for the last 5 years were:

| Year Ended | Net Profit (₹) |

| 31st March 2019 | 1,50,000 |

| 31st March 2020 | 1,80,000 |

| 31st March 2021 | 1,00,000 (including abnormal loss of ₹ 1,00,000) |

| 31st March, 2022 | 2,60,000 (including abnormal gain (profit) of ₹ 40,000) |

| 31st March 2023 | 2,40,000 |

The firm has total assets of ₹ 20,00,000 and Outside Liabilities of ₹ 5,00,000 as on that date Normal Rate of Return in similar businesses is 10%.

Calculate the Value of Goodwill.

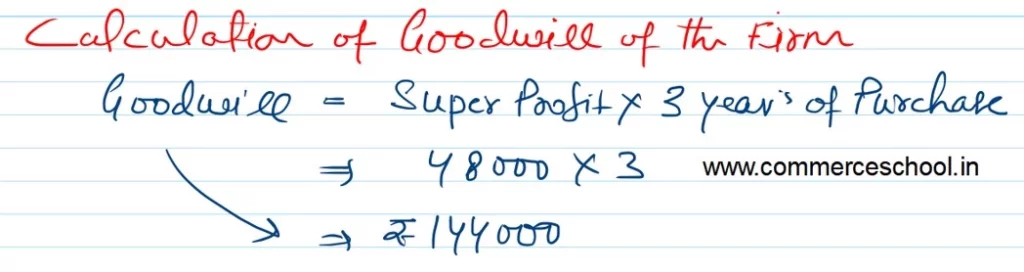

[Ans.: Goodwill – ₹ 1,44,000.]

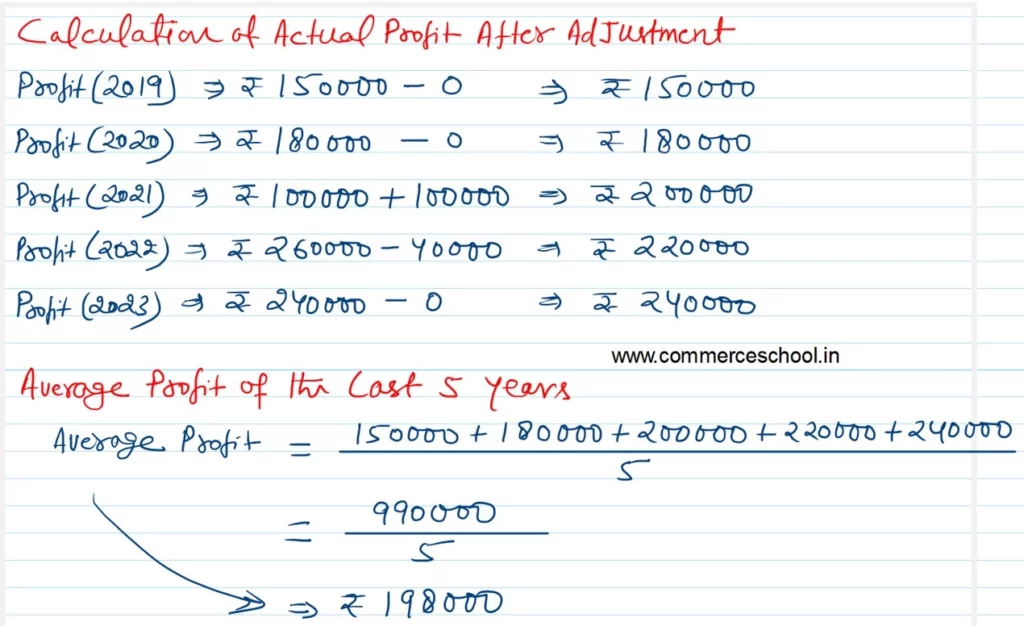

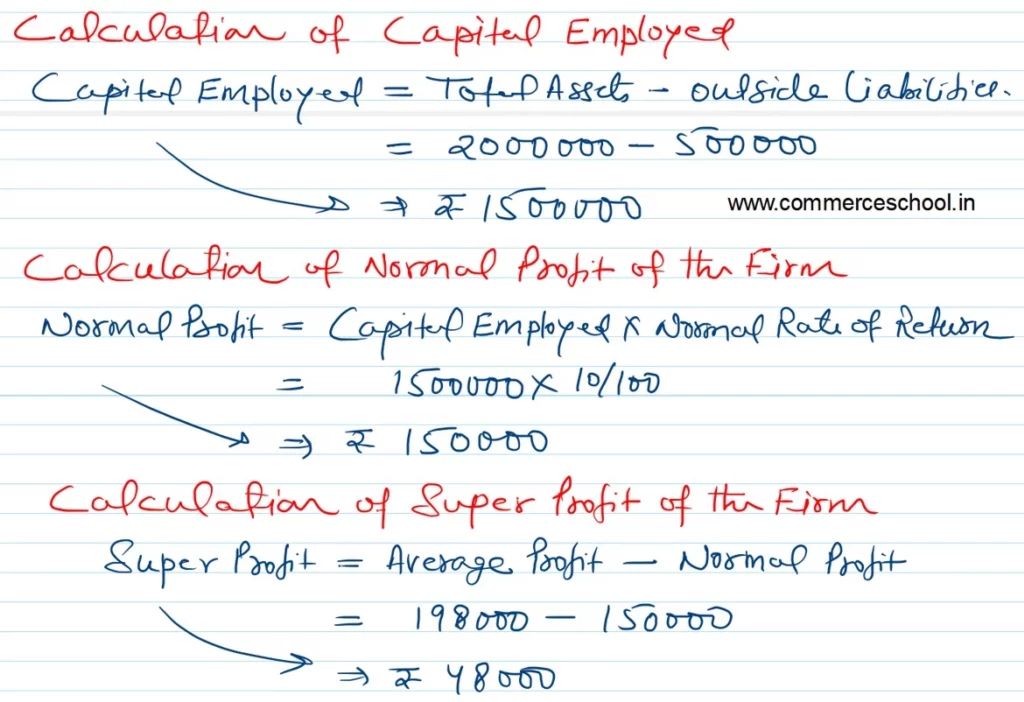

Solution:-

The link to All unsolved questions has been given below.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |