[CBSE] Q. 26 Solution of Accounting for Share Capital TS Grewal Class 12 (2023-24)

Are you looking for the solution to Question number 26 of the Accounting for Share Capital chapter of TS Grewal Book 2023-24 Edition CBSE Board?

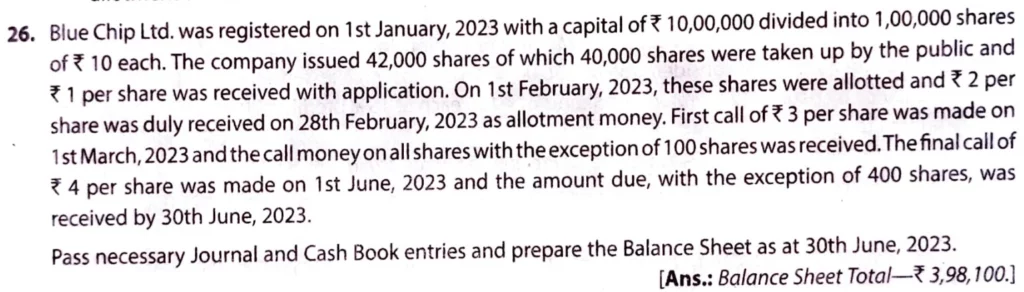

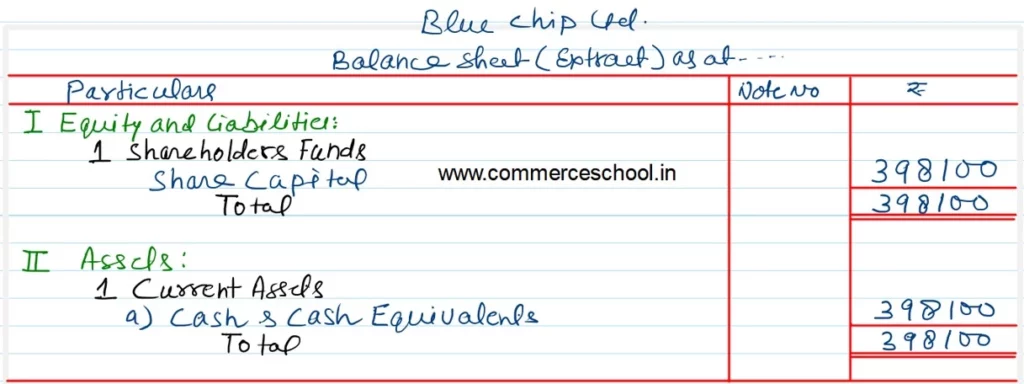

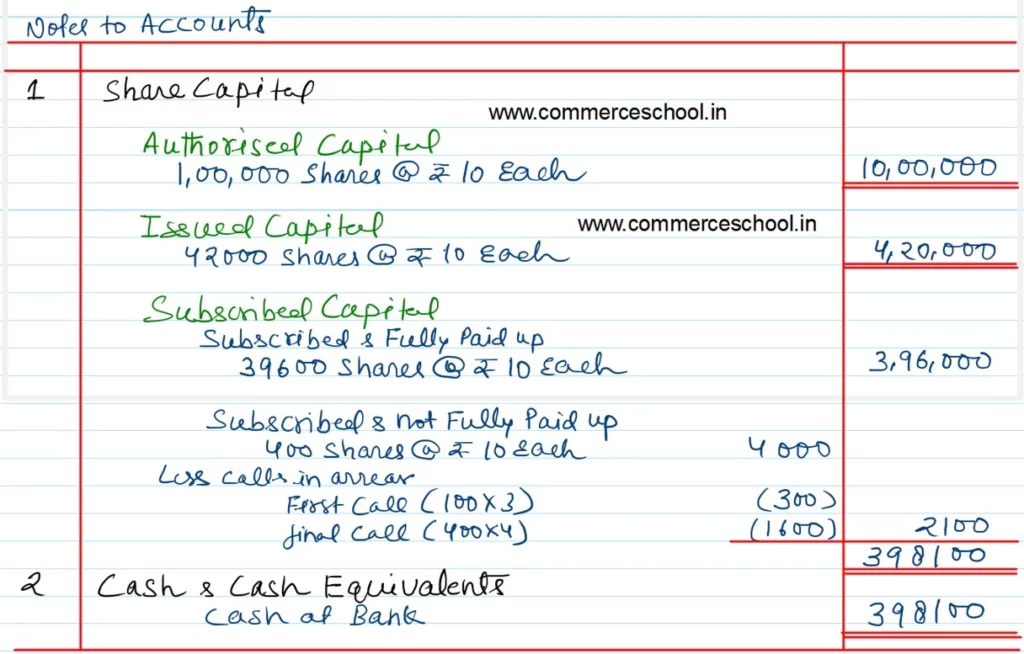

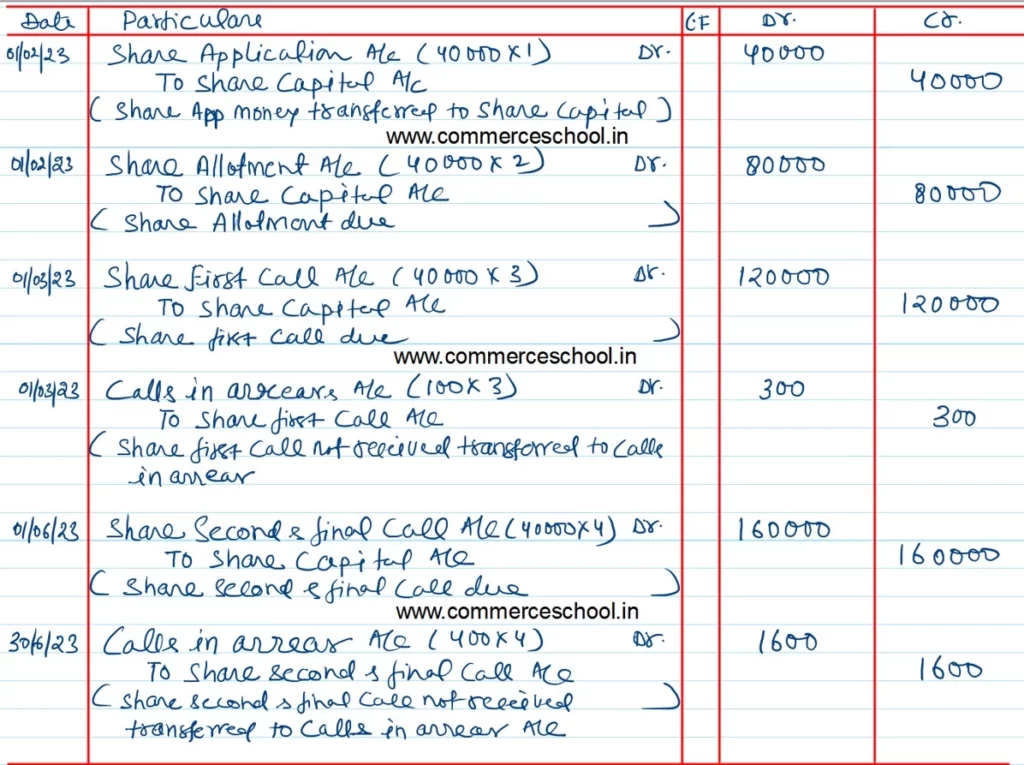

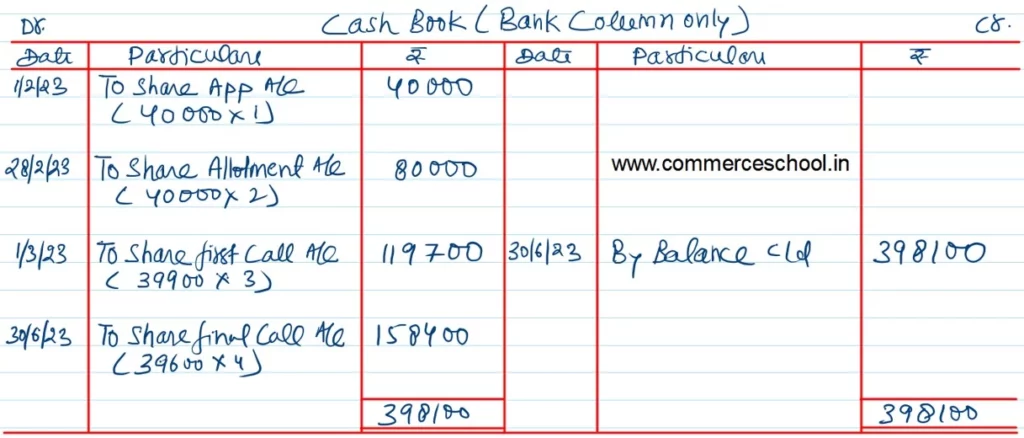

Blue Chip Ltd. was registered on 1st January, 2023 with a capital of ₹ 10,00,000 divided into 1,00,000 shares of ₹ 10 each. The company issued 42,000 shares of which 40,000 shares were taken up by the public and ₹ 1 per share was received with application. on 1st February, 2023, these shares were allotted and ₹ 2 per share was duly received on 28th February, 2023 as allotment money. First call of ₹ 3 per share was made on 1st March, 2023 and the call money on all shares with the exception of 100 shares was received. The final call of ₹ 4 per share was made on 1st June, 2023 and the amount due, with the exception of 400 shares, was received by 30th June, 2023.

Pass necessary Journal and Cash Book entries and prepare the Balance Sheet as at 30th June, 2023.

[Ans.: Balance Sheet Total – ₹ 3,98,100.]

Solution:-

Journal

Following is the list

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Questions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |