[CBSE] Q 4 Depreciation Solutions TS Grewal Class 11 (2022-23)

Are you looking for a solution of Question number 4 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2022-23 Session.

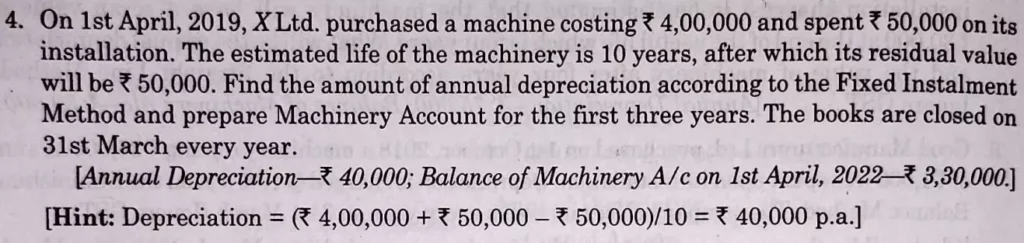

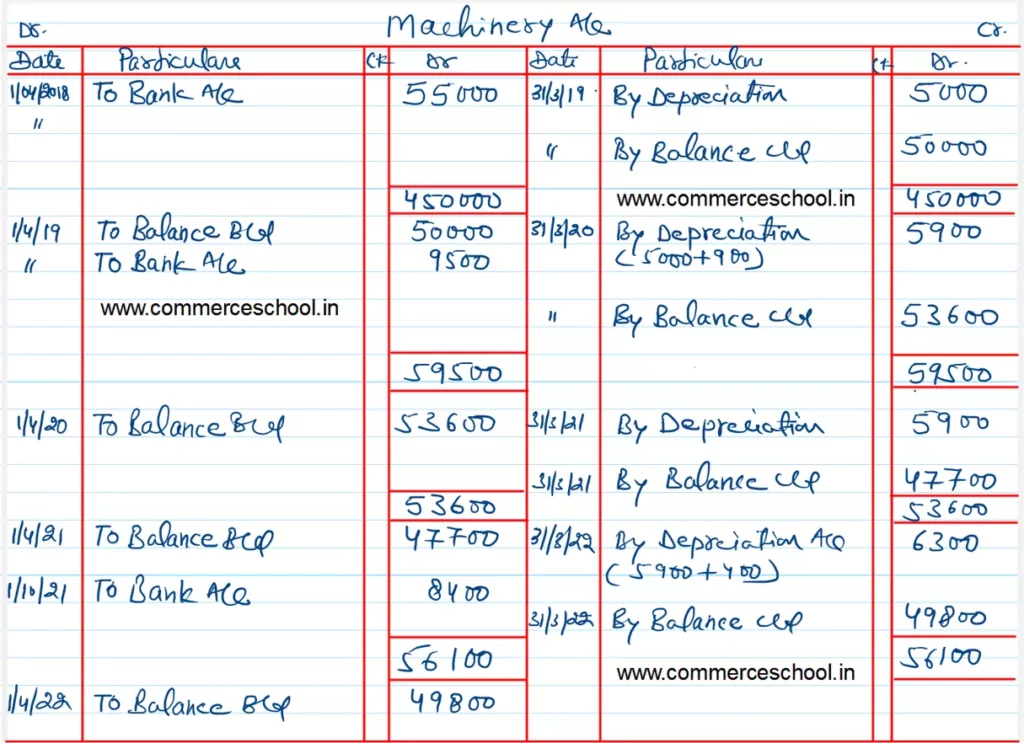

On Ist April, 2019, XLtd. purchased a machine costing ₹ 4,00,000 and spent ₹ 50,000 on its installation. The estimated life the machinery is 10 years, after which its residual value will be ₹ 50,000. Find the amount of annual depreciation according to the Fixed Instalment Method and prepare Machinery Account for the first three years.The books are closed on 31st March every year.

[Annual Depreciation-₹ 40,000; Balance of Machinery A/c on 1st April,2022-₹ 3,30,000.]

Hint: Depreciation = (₹ 4,00,000+ ₹ 50,000 -₹ 50,000)/10= ₹ 40,000 p.a.]

Solution:-

Following is the list of all solutions of depreciation chapter of ts Grewal CBSE for the 2022-23 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |