[CBSE] Q. 5 solution of Fundamentals of Partnership Firms TS Grewal Book 2022-23 Edition

Are you looking for the solution of Question number 5 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2022-23 Edition?

Question number 5 of Accounting for Partnership Firms – Fundamentals is a theoretical one.

Solution of Question number 5 of Accounting for Partnership Firms – Fundamentals TS Grewal Book CBSE 2022-23 Edition

Q. 5.

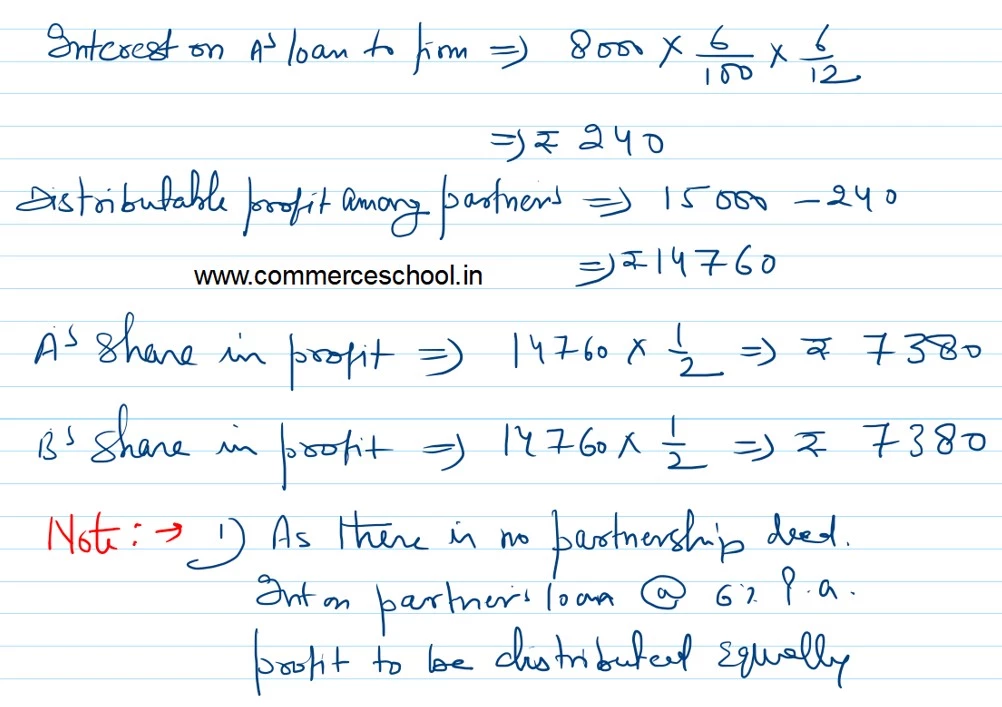

A and B are partners since 1st April, 2021, without a Partnership Deed and they introduced capitals of ₹ 35,000 and ₹ 20,000 respectively. On 1st October, 2021, A gave loan of ₹ 8,000 to the firm without any agreement as to interest. Profit and Loss Account for the year ended 31st March, 2022 shows a profit of ₹ 15,000 but the partners can not agree on payment of interest and on the basis of division of profit.

You are required to divide the profits between them giving reasons for your method.

Answer –

Here is the list of all Solutions.

| S.N | Questions |

| 1. | Question – 1 |

| 2. | Question – 2 |

| 3. | Question – 3 |

| 4. | Question – 4 |

| 5. | Question – 5 |

| 6. | Question – 6 |

| 7. | Question – 7 |

| 8. | Question – 8 |

| 9. | Question – 9 |

| 10. | Question – 10 |

| S.N | Questions |

| 11. | Question – 11 |

| 12. | Question – 12 |

| 13. | Question – 13 |

| 14. | Question – 14 |

| 15. | Question – 15 |

| 16. | Question – 16 |

| 17. | Question – 17 |

| 18. | Question – 18 |

| 19. | Question – 19 |

| 20. | Question – 20 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 31. | Question – 31 |

| 32. | Question – 32 |

| 33. | Question – 33 |

| 34. | Question – 34 |

| 35. | Question – 35 |

| 36. | Question – 36 |

| 37. | Question – 37 |

| 38. | Question – 38 |

| 39. | Question – 39 |

| 40. | Question – 40 |

| S.N | Questions |

| 41. | Question – 41 |

| 42. | Question – 42 |

| 43. | Question – 43 |

| 44. | Question – 44 |

| 45. | Question – 45 |

| 46. | Question – 46 |

| 47. | Question – 47 |

| 48. | Question – 48 |

| 49. | Question – 49 |

| 50. | Question – 50 |

| S.N | Questions |

| 51. | Question – 51 |

| 52. | Question – 52 |

| 53. | Question – 53 |

| 54. | Question – 54 |

| 55. | Question – 55 |

| 56. | Question – 56 |

| 57. | Question – 57 |

| 58. | Question – 58 |

| 59. | Question – 59 |

| 60. | Question – 60 |

| S.N | Questions |

| 61. | Question – 61 |

| 62. | Question – 62 |

| 63. | Question – 63 |

| 64. | Question – 64 |

| 65. | Question – 65 |

| 66. | Question – 66 |

| 67. | Question – 67 |

| 68. | Question – 68 |

| 69. | Question – 69 |

| 70. | Question – 70 |

| S.N | Questions |

| 71. | Question – 71 |

| 72. | Question – 72 |

| 73. | Question – 73 |

| 74. | Question – 74 |

| 75. | Question – 75 |

| 76. | Question – 76 |

| 77. | Question – 77 |

| 78. | Question – 78 |

| 79. | Question – 79 |

| 80. | Question – 80 |

| S.N | Questions |

| 81. | Question – 81 |

| 82. | Question – 82 |

| 83. | Question – 83 |

| 84. | Question – 84 |

| 85. | Question – 85 |

| 86. | Question – 86 |

| 87. | Question – 87 |

| 88. | Question – 88 |