[CBSE] Q. 54 Cash Flow Statement TS Grewal Class 12 2023-24

Solution of Question number 54 of the Cash Flow Statement of TS Grewal Book 2023-24 session?

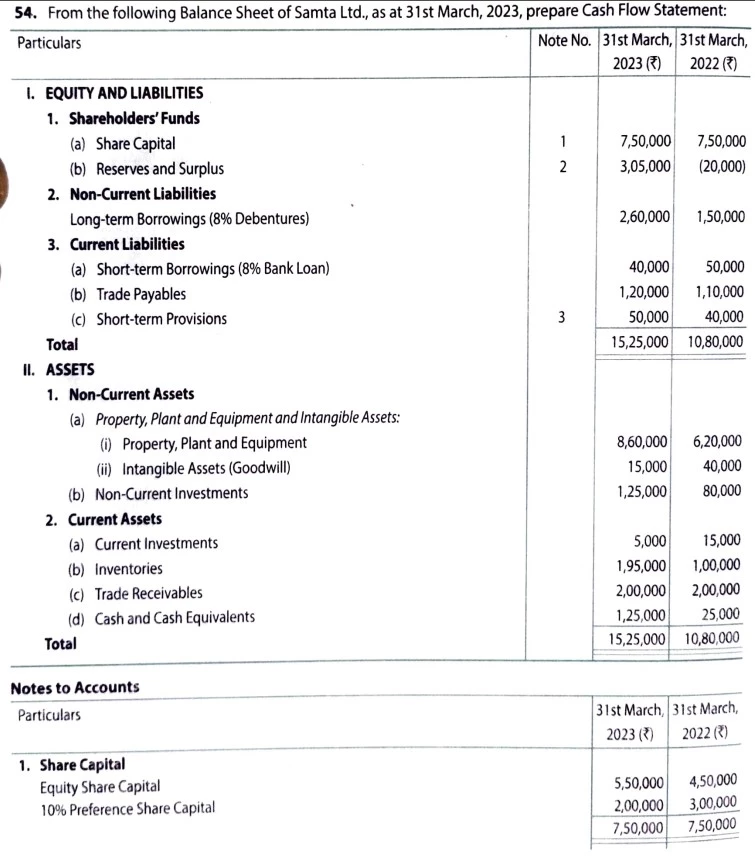

From the following Balance Sheet of Samta Ltd., as at 31st March, 2023, prepare Cash Flow Statement:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

| Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus | 7,50,000 3,05,000 | 7,50,000 (20,000) |

| Non-Current Liabilities Long-term Borrowings (8% Debentures) | 2,60,000 | 1,50,000 |

| Current Liabilities (a) Short-term Borrowings (8% Bank Loan) (b) Trade Payables (c) Short-term Provisions | 40,000 1,20,000 50,000 | 50,000 1,10,000 40,000 |

| Total | 15,25,000 | 10,80,000 |

| II. Assets | ||

| Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: (i) Property, Plant and Equipment (ii) Intangible Assets (Goodwill) (b) Non-Current Investments | 8,60,000 15,000 1,25,000 | 6,20,000 40,000 80,000 |

| Current Assets (a) Current Investments (b) Inventories (c) Trade Receivables (d) Cash and Cash Equivalents | 5,000 1,95,000 2,00,000 1,25,000 | 15,000 1,00,000 2,00,000 25,000 |

| Total | 15,25,000 | 10,80,000 |

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) | |

| Share Capital Equity Sahre Capital 10% Preference Share Capital | 5,50,000 2,00,000 | 4,50,000 3,00,000 | |

| Reserves and Surplus Securities Premium: Less: Premium on Redemption of Preference Shares written off General Reserve Surplus, i.e., Balance in Statement of Profit & Loss | 10,000 5,000 | 5,000 1,50,000 1,50,000 | – 1,20,000 (1,40,000) |

| Short-term Provisions Provision for Tax | 50,000 | 40,000 |

Additional Information:

(i) During the year a piece of machinery costing ₹ 60,000 on which depreciation charged was ₹ 20,000 was sold at 50% of its book value. Depreciation provided on tangible Assets ₹ 60,000.

(ii) Income Tax ₹ 45,000 was provided.

(iii) Additonal Debentures were issued at par on 1st October, 2022 and Bank Loan was repaid on the same date.

(iv) At the end of the year Preference Shares were redeemed at a premium of 5%.

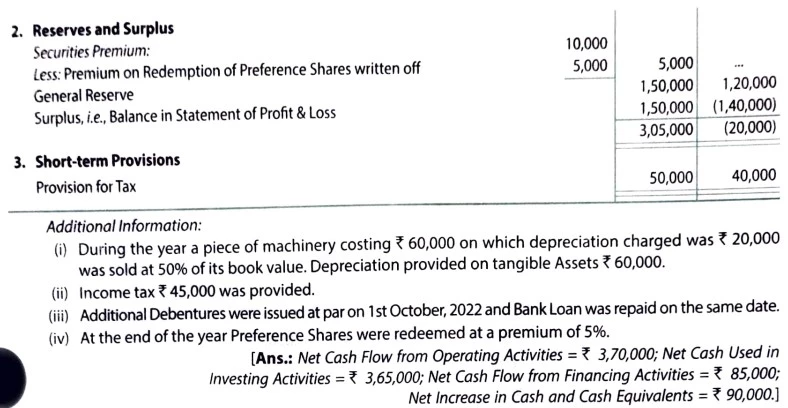

[Ans.: Net Cash Flow Operating Activities = ₹ 3,70,000; Net Cash Used in Investing Activities = ₹ 3,65,000; Net Cash Flow from Financing Activities = ₹ 85,000; Net Increase in Cash and Cash Equivalents = ₹ 90,000.]

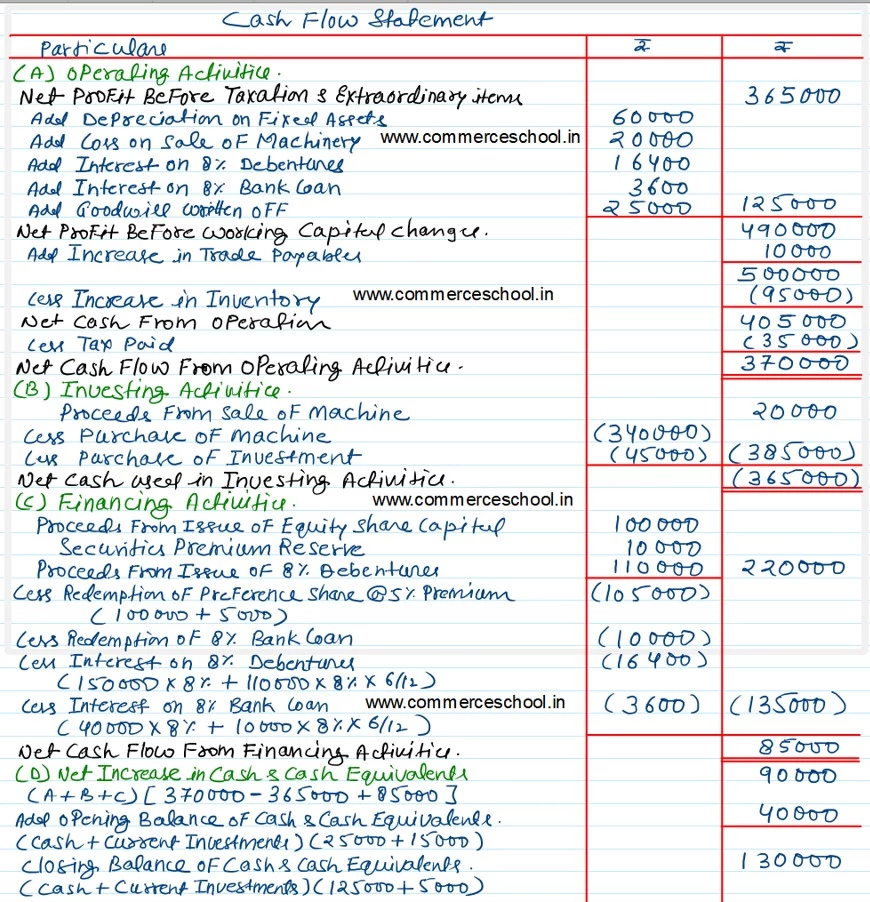

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

sir vo provision for dep nahi tax account ha