[CBSE] Q 7 Depreciation Solutions TS Grewal Class 11 (2022-23)

Are you looking for a solution of Question number 7 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2022-23 Session.

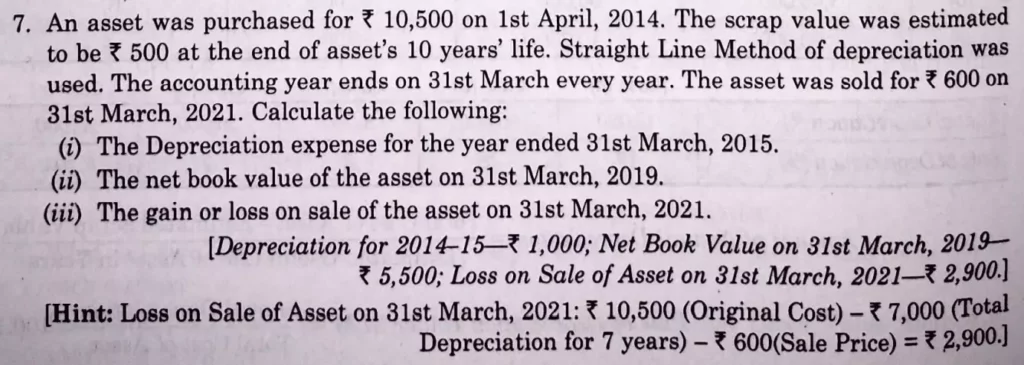

An asset was purchased for ₹ 10,500 on 1st April, 2014. The scrap value was estimated to be ₹ 500 at the end of asset’s 10 year’s life. Straight Line Method of depreciation was used. The accounting year ends on 31st March every year. The asset was sold for ₹ 600 on 31st March, 2021. Calculate the following:

(i) The Depreciatoin expense for the year ended 31st March, 2015.

(ii) The net book value of the asset on 31st March, 2019.

(iii) The gain or loss on sale of the asset on 31st March, 2021.

[Depreciation for 2014 – 15 – ₹ 1,000; Net Book Value on 31st March, 2019 – ₹ 5,500; Loss on Sale of Asset on 31st March, 2021 – ₹ 2,900.]

[Hint: Loss on Sale of Asset on 31st March, 2021: ₹ 10,500 (Original Cost) – ₹ 7,000 (Total Depreciation for 7 years) – ₹ 600 (Sale Price) – ₹ 2,900.]

Solution:-

i) The depreciation expenses in the first year

= (₹ 10,500 – 500)/10 = ₹ 1,000

ii) The net book value of the asset on 31st March 2019

= ₹ 10,500 – 1,000 ✕ 5 = ₹ 5,500

iii) The loss on the sale of the asset on 31st March 2020

= ₹ 10,500 – 1000 ✕ 7 – 600 = ₹ 2,900

Following is the list of all solutions of depreciation chapter of ts Grewal CBSE for the 2022-23 session.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |