[CBSE] Q. 72 solution of Fundamentals of Partnership Firms TS Grewal Book (2022-23)

Solution of Question number 72 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2022-23 Edition?

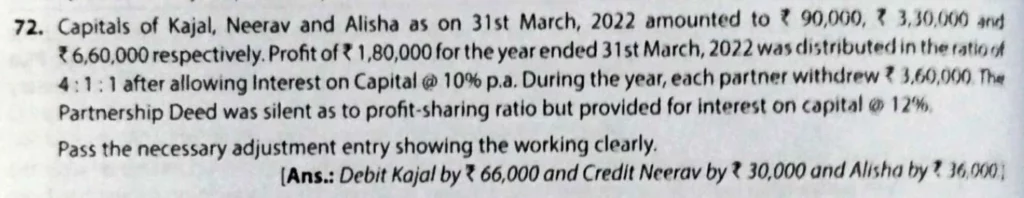

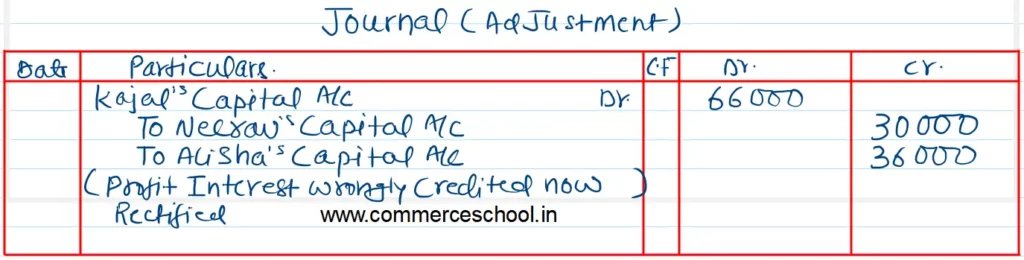

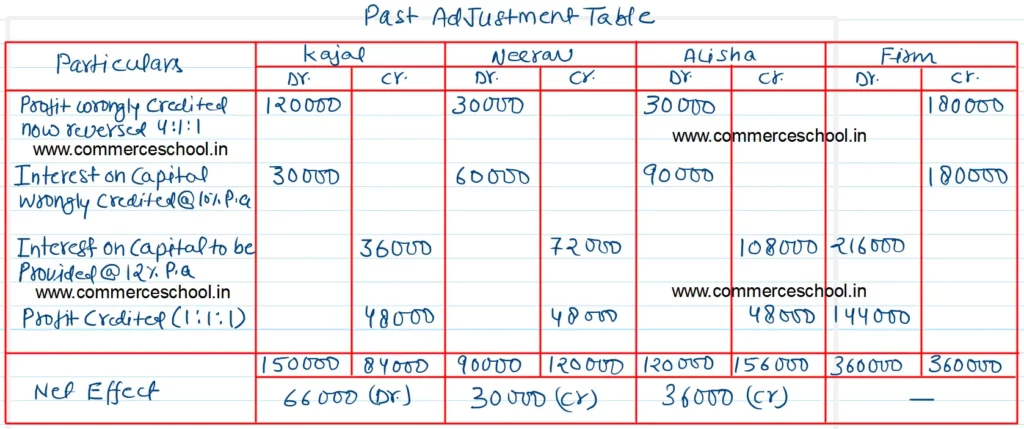

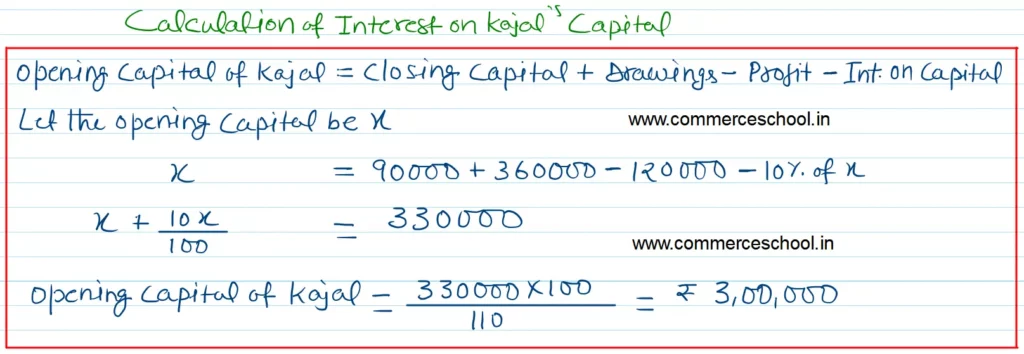

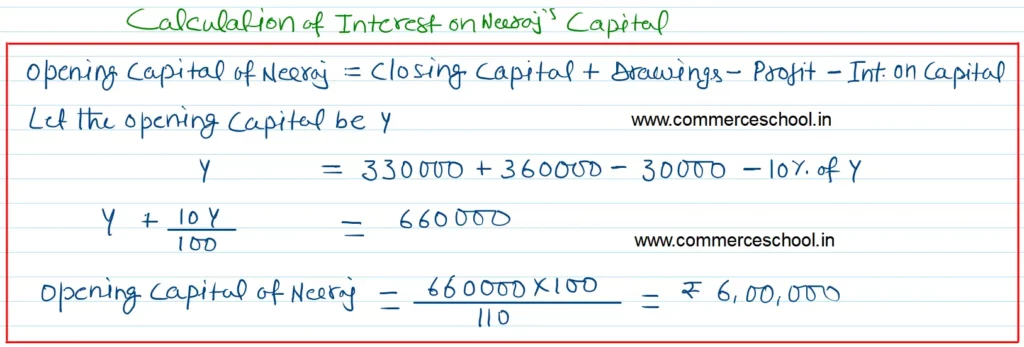

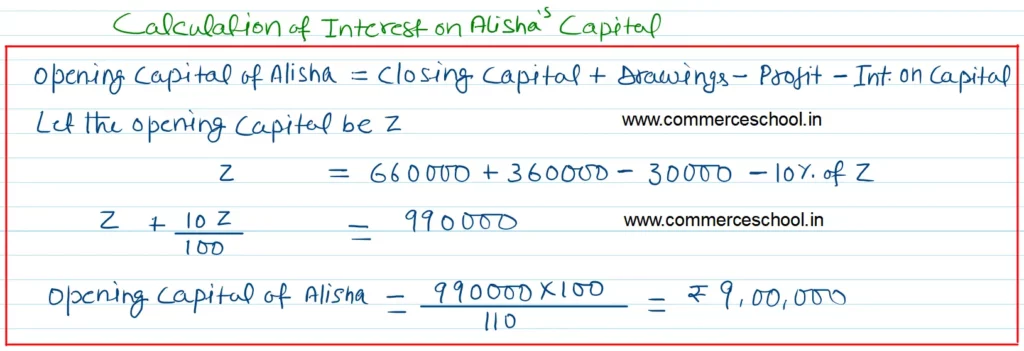

Capitals of Kajal, Neerav, and Alisha as on 31st March 2022 were ₹ 90,000, ₹ 3,30,000, and ₹ 6,60,000 respectively. Profit of ₹ 1,80,000 for the year ended 31st March 2022 was distributed in the ratio of 4:1:1 after allowing interest on capital @ 10% p.a. During the year, each partner withdrew ₹ 3,60,000. The Partnership Deed was silent as to profit sharing ratio bu provided for interest on capital @ 12% p.a. Pass the necessary adjustment entry showing the working clearly.

[Ans.: Debit Kajal by ₹ 66,000 and Credit Neerav by ₹ 30,000 and Alisha by ₹ 36,000.]

Solution:-

Here is the list of all Solutions.

| S.N | Questions |

| 1. | Question – 1 |

| 2. | Question – 2 |

| 3. | Question – 3 |

| 4. | Question – 4 |

| 5. | Question – 5 |

| 6. | Question – 6 |

| 7. | Question – 7 |

| 8. | Question – 8 |

| 9. | Question – 9 |

| 10. | Question – 10 |

| S.N | Questions |

| 11. | Question – 11 |

| 12. | Question – 12 |

| 13. | Question – 13 |

| 14. | Question – 14 |

| 15. | Question – 15 |

| 16. | Question – 16 |

| 17. | Question – 17 |

| 18. | Question – 18 |

| 19. | Question – 19 |

| 20. | Question – 20 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Questions |

| 31. | Question – 31 |

| 32. | Question – 32 |

| 33. | Question – 33 |

| 34. | Question – 34 |

| 35. | Question – 35 |

| 36. | Question – 36 |

| 37. | Question – 37 |

| 38. | Question – 38 |

| 39. | Question – 39 |

| 40. | Question – 40 |

| S.N | Questions |

| 41. | Question – 41 |

| 42. | Question – 42 |

| 43. | Question – 43 |

| 44. | Question – 44 |

| 45. | Question – 45 |

| 46. | Question – 46 |

| 47. | Question – 47 |

| 48. | Question – 48 |

| 49. | Question – 49 |

| 50. | Question – 50 |

| S.N | Questions |

| 51. | Question – 51 |

| 52. | Question – 52 |

| 53. | Question – 53 |

| 54. | Question – 54 |

| 55. | Question – 55 |

| 56. | Question – 56 |

| 57. | Question – 57 |

| 58. | Question – 58 |

| 59. | Question – 59 |

| 60. | Question – 60 |

| S.N | Questions |

| 61. | Question – 61 |

| 62. | Question – 62 |

| 63. | Question – 63 |

| 64. | Question – 64 |

| 65. | Question – 65 |

| 66. | Question – 66 |

| 67. | Question – 67 |

| 68. | Question – 68 |

| 69. | Question – 69 |

| 70. | Question – 70 |

| S.N | Questions |

| 71. | Question – 71 |

| 72. | Question – 72 |

| 73. | Question – 73 |

| 74. | Question – 74 |

| 75. | Question – 75 |

| 76. | Question – 76 |

| 77. | Question – 77 |

| 78. | Question – 78 |

| 79. | Question – 79 |

| 80. | Question – 80 |

| S.N | Questions |

| 81. | Question – 81 |

| 82. | Question – 82 |

| 83. | Question – 83 |

| 84. | Question – 84 |

| 85. | Question – 85 |

| 86. | Question – 86 |

| 87. | Question – 87 |

| 88. | Question – 88 |