[DK goyal] Q 5 Accounting Ratios Solution CBSE (2022-23)

Are you looking for the solution of question number 5 of accounting ratios chapter DK Goyal class 12 CBSE 2022-23 Session?

I have solved this question in detail

Question number 5 is an unsolved practical one of the accounting ratios chapter DK goyal CBSE for 2022-23.

Question number 5 solution of Accounting Ratios of DK Goyal class 12 CBSE 2022-23

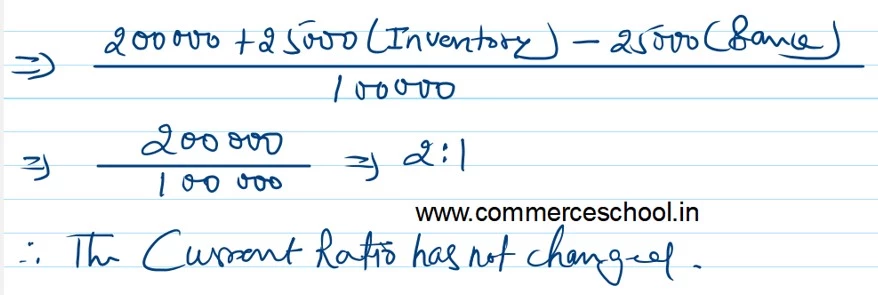

Question – 5

Solution:- 5 (A)

current Ratio as given in the question is 2:1. In order to understand the question in a simple manner, it may be assumed that current assets are ₹ 2,00,000 and current liabilities are ₹ 1,00,000.

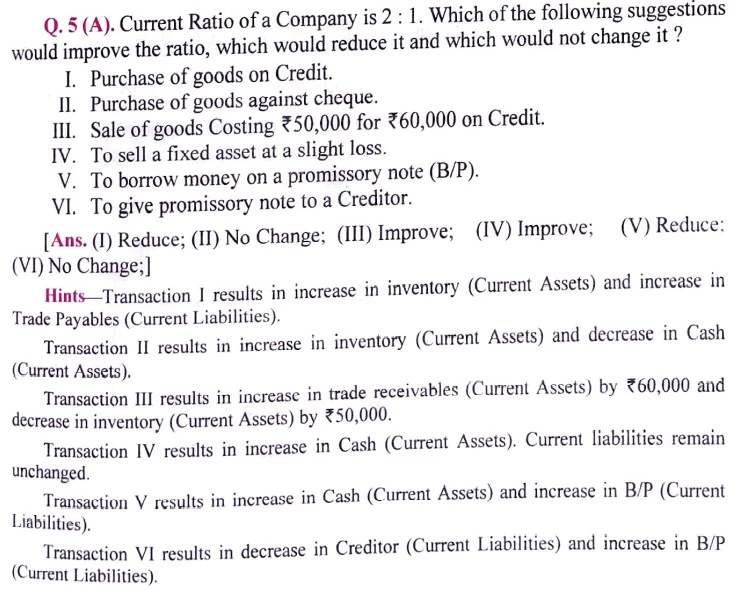

1) Purchase of Goods on Credit:-

Suppose, goods for ₹ 25,000 is purchased on credit, the revised current ratio would be:

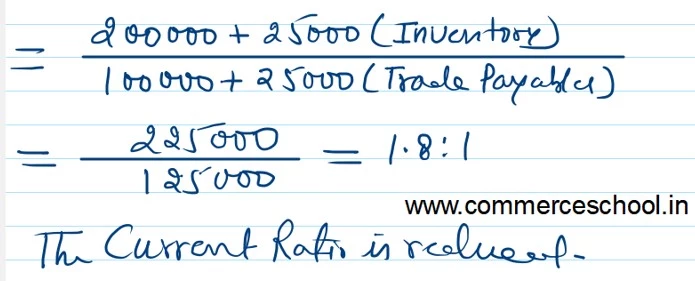

2) Purchase of goods against Cheque: Suppose, goods from ₹ 25,000 is purchased for cash, the revised current ratio would be:

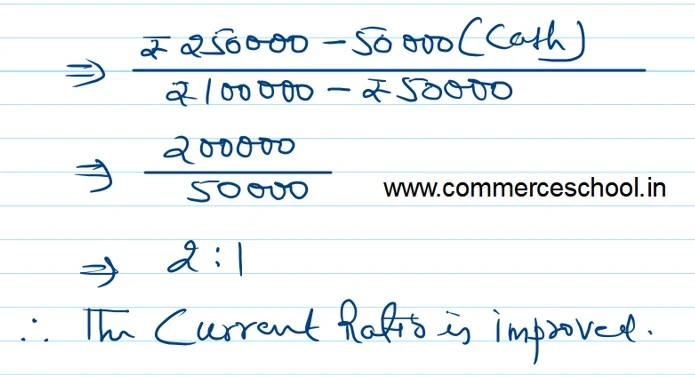

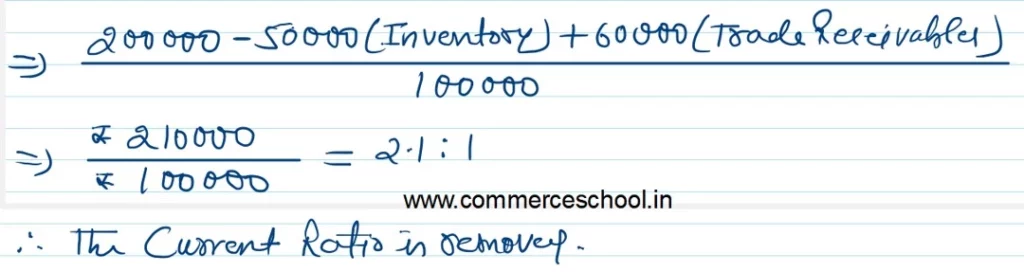

3) Sale of Goods Costing ₹ 50,000 for ₹ 60,000 on Credit:

The Effect of the above will be a decrease in Inventory by ₹ 50,000 and an increase in Trade Receivables by ₹ 60,000. Thus the revised current ratio would be:

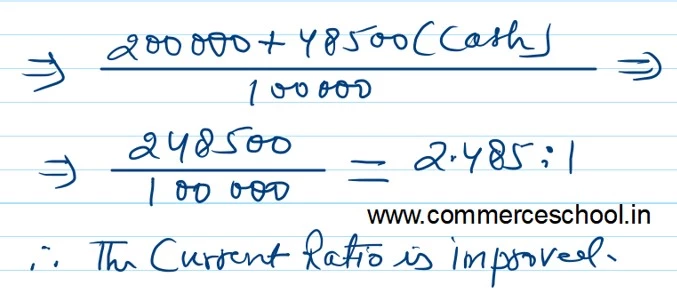

4) To sell a non-current asset at a slight loss:-

The sale of a non-current asset results in an increase in Cash balance even though the asset is sold at a slight loss. Suppose the non-current asset worth ₹ 50,000 is sold at a loss of ₹ 1,500 i.e., at ₹ 48,500, the revised current ratio would be:

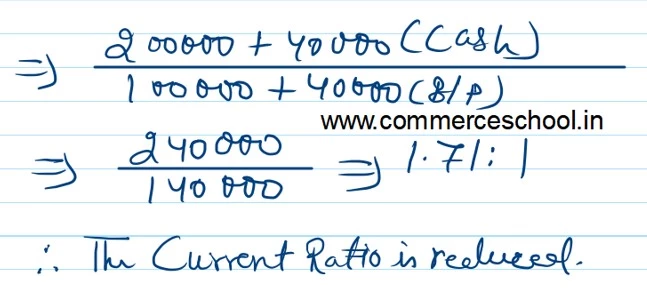

5) To borrow money on a promissory note (B/P):-

Borrowing money on the basis of a promissory note increases cash on one hand and increases B/P on the other hand. Thus, if ₹ 40,000 are borrowed on the basis of a promissory, then the revised current ratio would be:

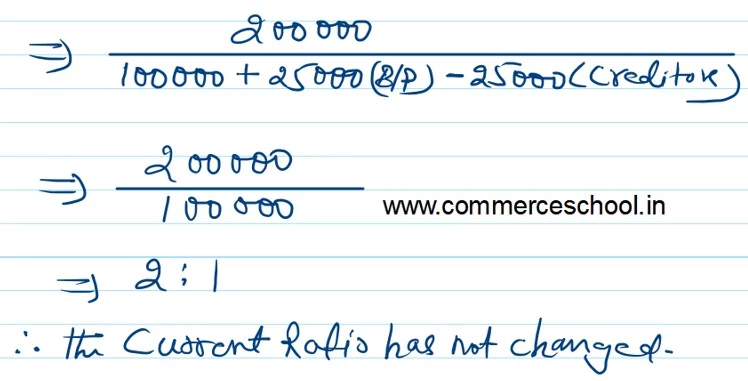

6) To give a promissory note to a creditor:-

Suppose a promissory note for ₹ 25,000 is given to a creditor. Its effect would be an increase in B/P by ₹ 25,000 and a decrease in the trade payables by ₹ 25,000. Thus the revised ratio would be:

Question – 5 (B)

Solution 5(B):-

The current Ratio as given in the question is 2.5:1. Hence, it may be assumed that current Assets are ₹ 2,50,000 and Current Liabilities are ₹ 1,00,000.

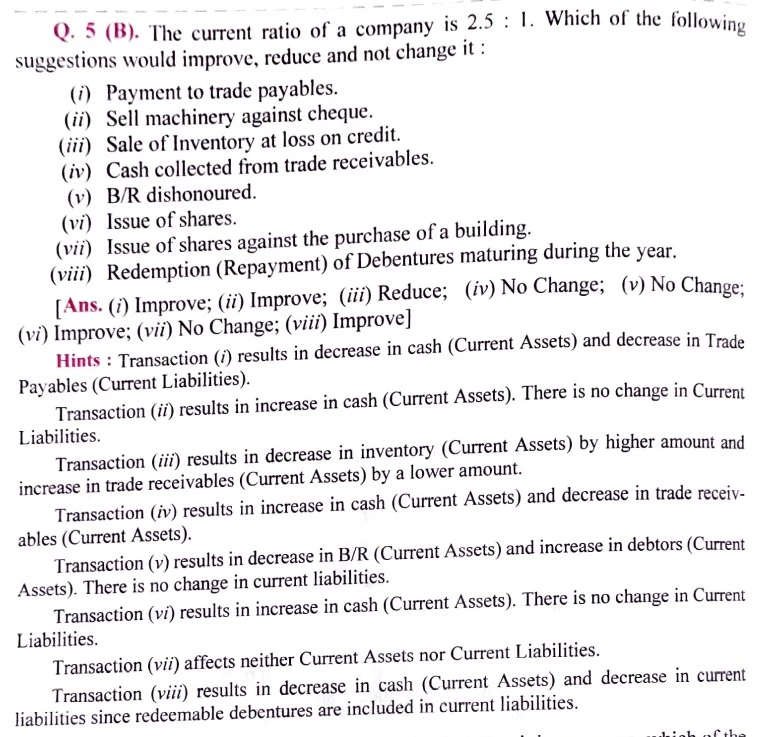

1) Payment to Trade Payables:-

Suppose, trade payables amounting to ₹ 25,000 are repaid, the revised current ratio would be:

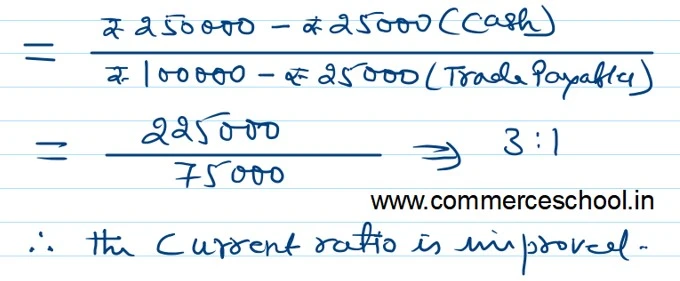

2) Sell Machinery against Cheque:-

Suppose, machinery is sold for ₹ 50,000, the revised current ratio would be:

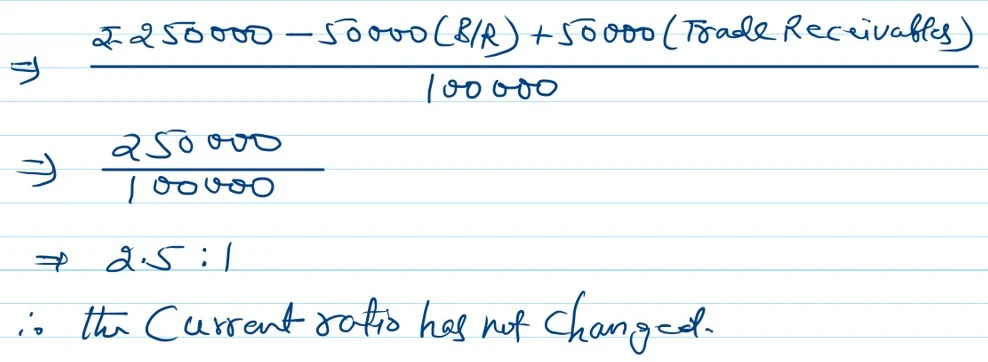

3) Sale of Inventory at a loss on credit:

Suppose, inventory costing ₹ 50,000 is sold for ₹ 40,000 on credit, the revised current ratio would be:

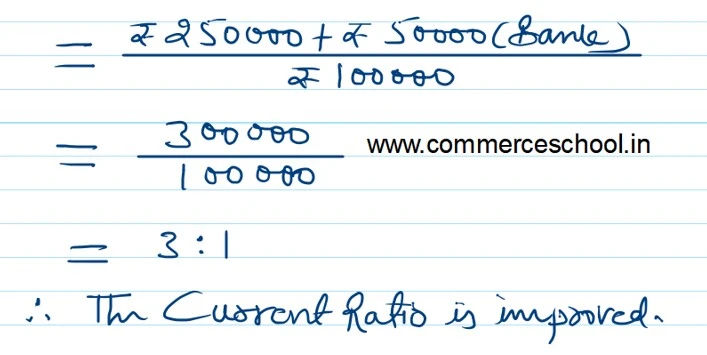

4) Cash collected from trade receivables:-

Suppose, cash amounting to ₹ 50,000 is collected from trade receivables, the revised current ratio would be:

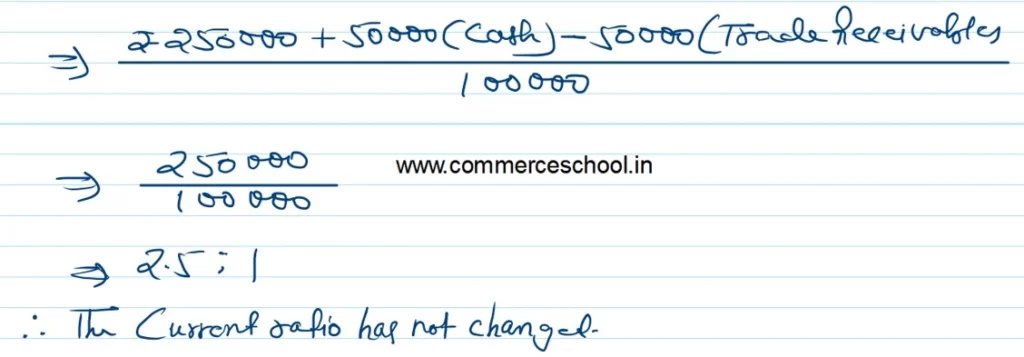

5) B/R dishonoured:-

Suppose, a B/R for ₹ 50,000 is dishonored, it will result in a decrease in B/R and an increase in trade receivables. Hence, the revised current ratio would be:

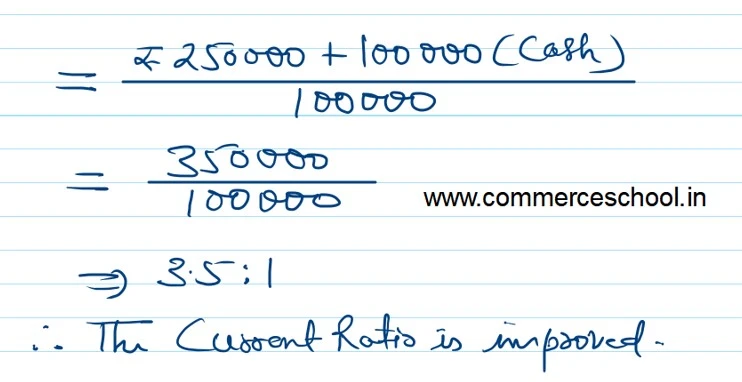

6) Issue of Shares:-

Suppose, shares for ₹ 1,00,000 are issued for cash:

7) Issue of Shares against the purchase of a building:-

Suppose, shares for ₹ 1,00,000 are issued against the purchase of the building, it will result in an increase in Share Capital on the one hand and an increase in building on the other hand.

Since there is no effect either on current assets or on current liabilities, the current ratio would not change.

8) Redemption (Repayment) of Debentures:-

Debentures, which are to be redeemed, are included in current liabilities. Hence, current assets as well as current liabilities will be reduced. Suppose, debentures for ₹ 50,000 are redeemed.