[ISC] Q. 11 Solution of Cash Flow Statement TS Grewal Class 12 2022-23

Solution of Question number 11 of the Cash Flow Statement of TS Grewal Book 2022-23 session ISC Board?

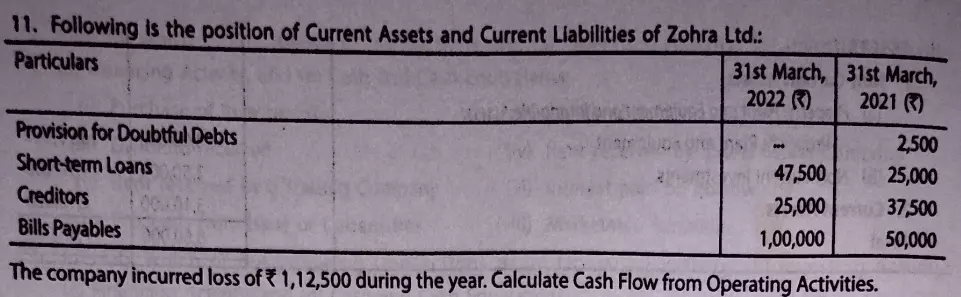

Following is the position of Current Assets and Current Liabilities of Zohra Ltd.:

| Particulars | 31st March, 2022 (₹) | 31st March, 2021 (₹) |

| Provision for Doubtful Debts Short-term Loans Creditors Bills Payables | – 47,500 25,000 1,00,000 | 2,500 25,000 37,500 50,000 |

The company incurred loss of ₹ 1,12,500 during the year. Calculate Cash Flow from Operating Activities.

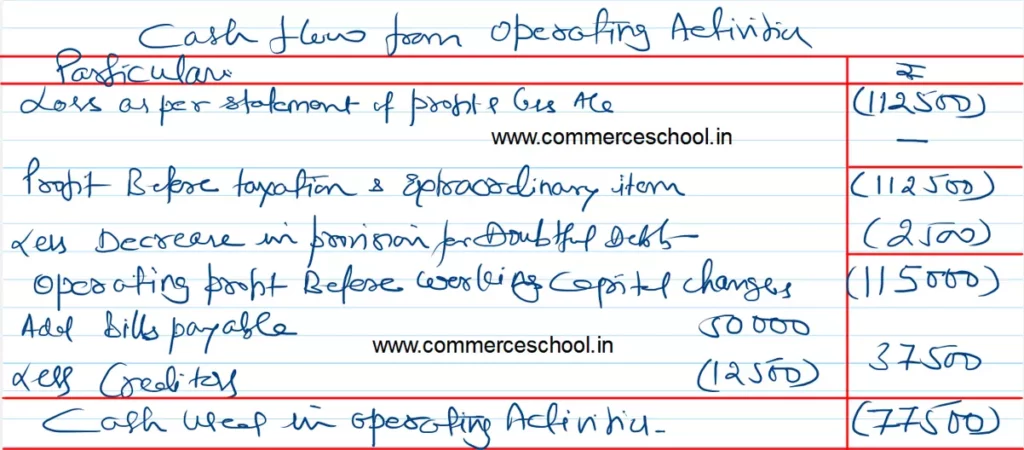

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

Read Here:- TS Grewal Solutions class 12 ISC Board (2022-23)

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |