[ISC] Q 18 Solution Rectification of Errors TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 18 of Rectification of Errors TS Grewal class 11 ISC 2022-23?

Pass rectifying entries for the following:

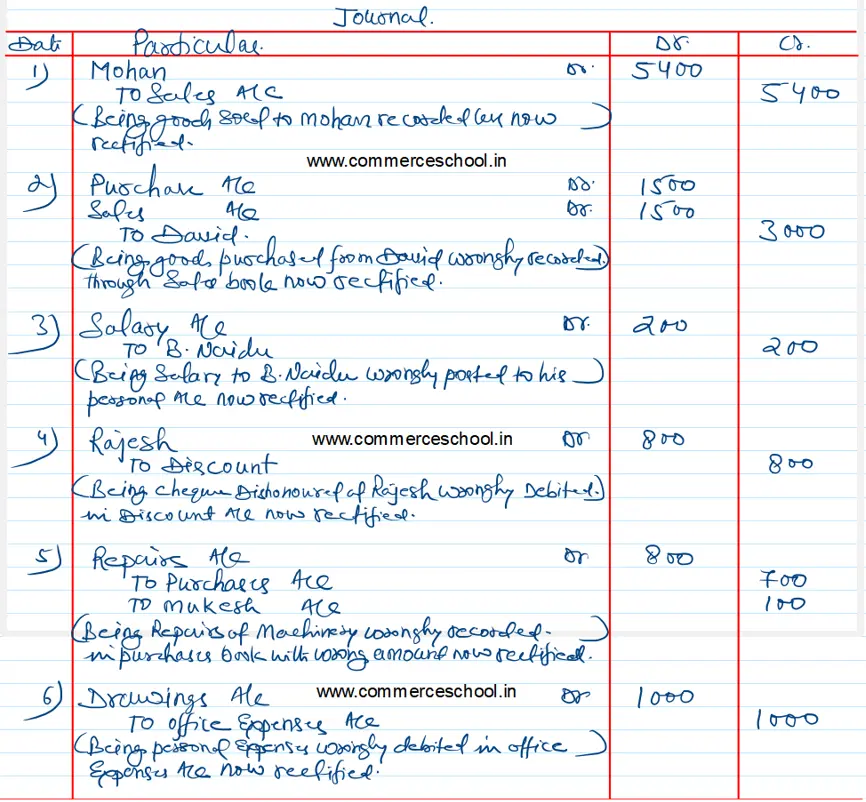

(i) Sale of goods ₹ 6,000 to Mohan was recorded as ₹ 600 in the Sales Book.

(ii) A credit purchase of goods from David amounting to ₹ 1,500 has been wrongly passed through the Sales Book.

(iii) ₹ 200 salary paid to cashier B. Naidu, stands wrongly debited to his Personal Account.

(iv) A cheque of ₹ 800 received from Rajesh was dishonoured and debited to Discount Account.

(v) Bill for ₹ 800 received from Mukesh for repairs of Machinery was entered in the Purchases Book as ₹ 700.

(vi) Personal expenses of ₹ 1,000 have been posted to Office Expenses Account.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |