[ISC] Q 2 Solution Final Accounts with adjustments TS Grewal Class 11 (2022-23)

Solution of Question number 2 solution of Final Accounts with adjustments TS Grewal class 11 Accountancy ISC Board 2022-23?

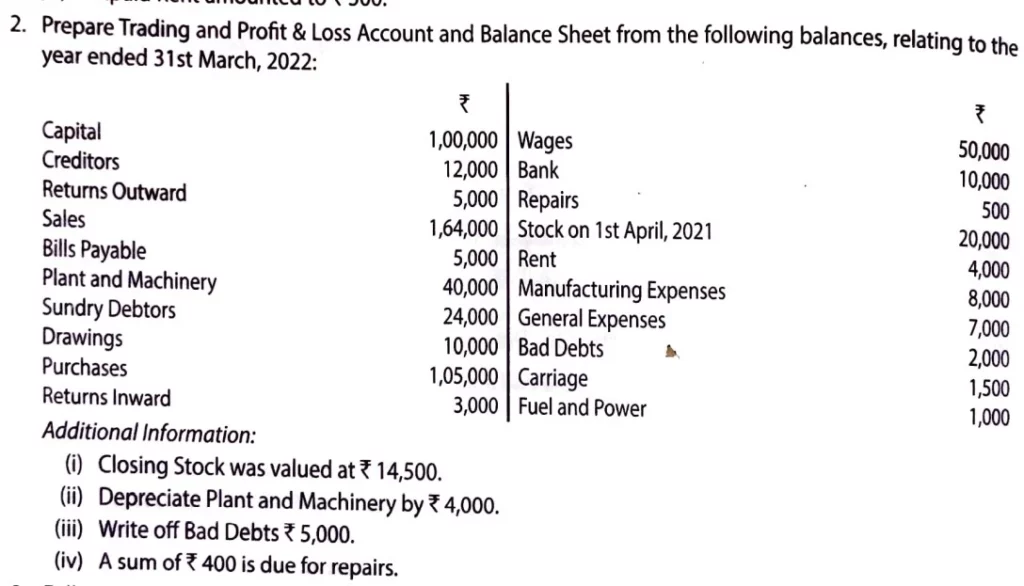

Prepare Trading and Profit & Loss Account and Balance Sheet from the following balances, relating to the year ended 31st March, 2022:

| ₹ | ₹ | ||

| Capital Creditors Returns Outward Sales Bills Payable Plant and Machinery Sundry Debtors Drawings Purchases Returns Inward | 1,00,000 12,000 5,000 1,64,000 5,000 40,000 24,000 10,000 1,05,000 3,000 | Wages Bank Repairs Stock on 1st April, 2021 Rent Manufacturing Expenses General Expenses Bad Debts Carriage Fuel and Power | 50,000 10,000 500 20,000 4,000 8,000 7,000 2,000 1,500 1,000 |

Additional Information:

(i) Closing Stock was valued at ₹ 14,500.

(ii) Depreciate Plant and Machinery by ₹ 4,000.

(iii) Write off Bad Debts ₹ 5,000.

(iv) A sum of ₹ 400 is due for repairs.

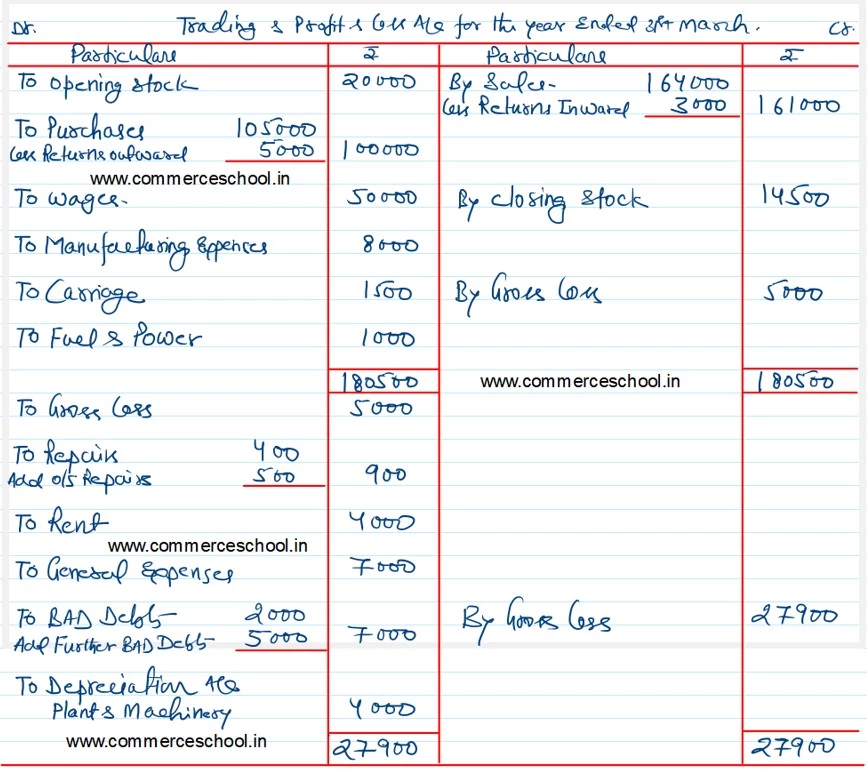

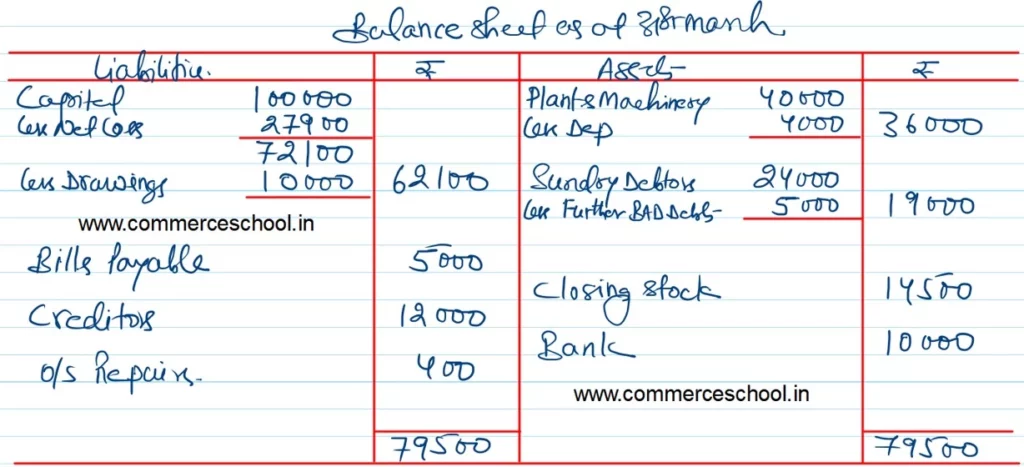

Solution:-

Here is the list of all solutions of Practical Problems below

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |