Syllabus of Money and Banking in Macroeconomics Class 12 CBSE Board

Are you looking for the syllabus of Money and Banking Unit of Macroeconomics class 12 CBSE Board for the 2021-22 session?

See there are a lot of reference books and offer a lot of study material out of syllabus to set them apart superior from other authors.

But suggest me one thing. If I have back pain, should I take medicine for fever?

Absolutely not. There is no need to waste time studying the topics out of context. I mean out of syllabus. let those topics be for higher study.

For the time being, we strictly have to stick to each topic and unit as per the syllabus of the CBSE Board.

Let’s deep dive into the syllabus of the Money and Banking unit of Macroeconomics class 12 as per the syllabus of CBSE.

Money and Banking Syllabus of Class 12 CBSE Board

| Marks | 6 Marks (1st Term) |

| Number of Chapters | 2 |

| Name of chapters | 1. Money and Money Supply 2. Banking |

There are two chapters in one unit

- Money and Money supply

- Banking

As far as Money and Money supply is concerned you have to go through with only three topics.

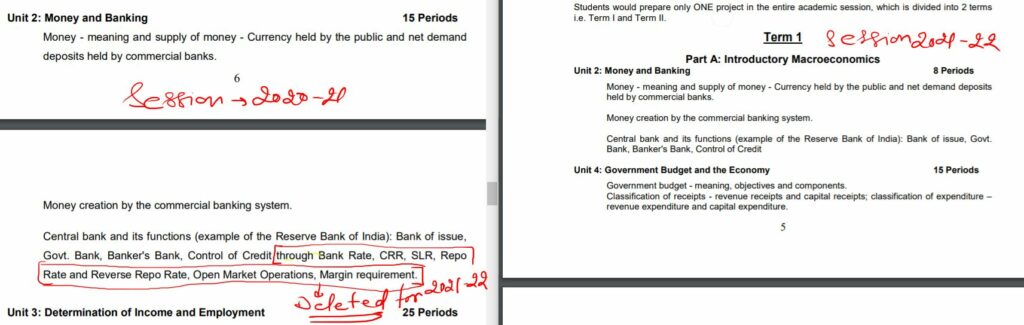

Comparison of Money and Banking syllabus with previous year syllabus

1. Money and Banking

Note:- The above-mentioned topics are note deleted. This is only the misprint. All subtopics of control of credit functions are in the syllabus for the 2021 – 22 CBSE Board.

Syllabus of Money and Money supply class 12 Economics

1. What is Money and the definition of it?

2. What is the supply of money and its definition?

3. Components of Money Supply

Let’s clear some doubts

Is Functions of Money is the part of syllabus

No, Functions of Money is not part of the syllabus of Economics class 12. However, in many reference books, it is given as an extra resource.

There is no need to go through this topic as far as you are the students of class 12 CBSE Board.

Is Barter System is the part of Economics Syllabus Class 12

No, the Barter system and its limitations are out of the syllabus. These topics are just given to make a stronghold over the need for money for the Economy.

Are M1, M2, M3, and M4 types of Money supply in the syllabus of class 12?

Only two components of the Money supply

1. Currency held by the public and

2. net demand deposits held by commercial banks have to be studied.

There is no need to mention M1 as the money supply because it includes 3 components.

M1 = currency with the public + Demand deposits + Other deposits with Reserve Bank of India

The third components ‘Other deposits with Reserve Bank of India is not in the class 12 CBSE Board syllabus.

Topics of Money chapter for 2021 – 22 session

- What is Money.

- Definition of Money.

Note:- Money only can be defined by the function it performs. Medium of exchange, a store of value, a unit of account standard of deferred payment.

- Basic and Main feature (functions of Money) that is medium of exchange.

- What is the money supply?

Meaning of supply in Money supply (supply denotes stock).

- The money supply is flow or stock variable

- Basic measures (components) of Money supply

Note:- Basic measures of money supply are those assets that can be directly used for transactions. [ i) Currency ii) Demand Deposits

- What is transactions money?

1) Currency ii) Demand Deposits/chequable deposits/deposits payable on demand

- High powered Money

- Kinds of coins/rupees in India

1 paisa to 10 rupees.

1 rupee to 10000 rupees (one-two, five-ten, twenty fifty hundred five hundred two thousand

rupee notes)

- What is paper money?

- fiat money.

- chequable deposits

Syllabus of Banking chapter for 2021-22 session CBSE

1. Money creation by the commercial banking system.

2. The central bank, its meaning, definition, and its functions.

Functions of banks include.

- Bank of Issue.

- Bank of the Government

- Banker’s Bank

- Control of Credit through Bank rate, CRR, SLR, Repo Rate and Reverse Repo Rate, Open Market Operations, Margin requirement.

Clear Your Doubts

Are functions of Commercial Bank in the syllabus in detail.

Note:- In many reference books, commercial banks functions are given in detail. you just have to study what is required to be a bank.

- Bank accepts demand deposits

- Bank is able to create money or credit

Topics of Banking Chapter of Class 12 for 2021-22

- What is Commercial Bank

- Definition of Commercial Bank and examples

- What is Financial intermediary.

- How commercial bank differs from financial institutions

1) Bank Deposits are chequable 2) Bank create money 3) transfer funds from one bank to another

Note:- scope of this topic is limited to only the money creation function of the commercial banks.

- Who creates currency

- Who creates Demand Deposits (Bank Money)

- What is Bank Money.

- Money (Credit) creation process of Commercial Bank.

- Legal Reserve Ratio and its components (SLR and CRR)

- The alternative name of legal Reserve Ratio (Required Reserve Ratio)

- What is money multiplier.

- Other names of Money multiplier.

- What is central bank and examples

- What is two tier structure of banking system

- What is the name of central bank in India.

- Central Bank vs Commercial Bank

- Functions of a Central Bank

i) Bank of Issue

II) Government’s Banker, agent, and advisor

III) Banker’s Bank and supervisor

iv) Controller of Credit

- Open Market Operations

- Cash Reserve Ratio

- Statutory Liquidity Ratio

- Repo Rate

- Reverse Repo Rate

- Bank Rate

- Margin Requirements

That’s it.

For further any doubts, ask on WhatsApp.