Treatment of Proposed Dividend in Cash Flow Statement

Confused What is the accounting treatment of Proposed Dividend in Cash Flow statement in Class 12? Where will the proposed dividend go in the cash flow statement?

Don’t worry Let’s discuss it with real examples.

Read More:- Treatment of Provision for Taxation in cash flow statement

Read More:- Treatment of Short Term loans and advances in Cash Flow Statement

What is the Proposed Dividend (Final Dividend)?

Let’s first discuss what is the proposed dividend

Proposed Dividend is also called Final Dividend, both on Equity Shares and Preference Shares are paid after being declared and approved by the shareholders in the Annual General Meeting.

Annual General Meeting is held after the end of the financial year, i.e, that is next financial year.

Read More:- Treatment of Interim Dividend in Cash flow statement

Read More:- Treatment of Preliminary Expenses in Cash Flow Statement

What is the accounting treatment of Proposed Dividend in Cash Flow Statement?

In the current year, the Proposed Dividend of previous year will be declared (approved) by the shareholders in their Annual General Meeting because the meeting will be held after the end of the financial year.

Treatment of Proposed Dividend of Previous year in Cash Flow

Thus the proposed dividend of the previous year is shown as appropriation, i.e., as a deduction from surplus, i.e. Balance in the statement of Profit and Loss Account.

In the cash flow statement, the Proposed Dividend of the Previous year is added back to determine Net Profit Tax and Extraordinary Items.

The Same amount is deducted as an outflow in Financial Activity. If information of Unpaid Dividend (Dividend Payable) is given. The treatment would be

[Proposed Dividend of Previous year – Unpaid (unclaimed) Dividend] is deducted as an outflow in financing activity.

Read More:- Treatment of Share Issue Expenses in Cash Flow Statement

Read More:- Treatment of Discount (Loss) on Issue of Debentures in cash flow statement.

Treatment of Proposed Dividend of current year in Cash Flow

The dividend proposed by the Directors for the current year is shown in the notes to Accounts as Contingent Liability. This dividend is not considered anywhere in the Cash Flow Statement as it is just proposed and not declared and paid yet.

Accounting of Proposed Dividend

| Proposed Dividend of Previous Year | 1. It is added to determine Net Profit before tax and extraordinary items. 2. The same amount is deducted as an outflow in Financing Activity 3. If Dividend payable is also given. (Proposed Dividend – Dividend Payable) is shown as an outflow in Financing Activities. |

| Proposed Dividend of Current Year | It is not considered anywhere in the Cash flow statement. |

Note:- Unless stated otherwise, it is presumed that dividend proposed for the previous year has been declared at the AGM in the current year at the proposed amount and has also been paid during the current year.

Read More:- Treatment of Capital Reserve in Cash Flow Statement

Read More:- Treatment of Underwriting Commission in Cash Flow Statement

Examples of Treatment of Proposed Dividend in Cash Flow Statement

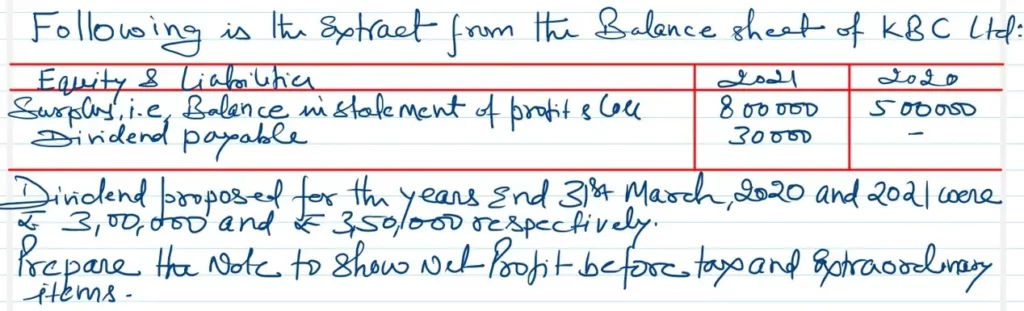

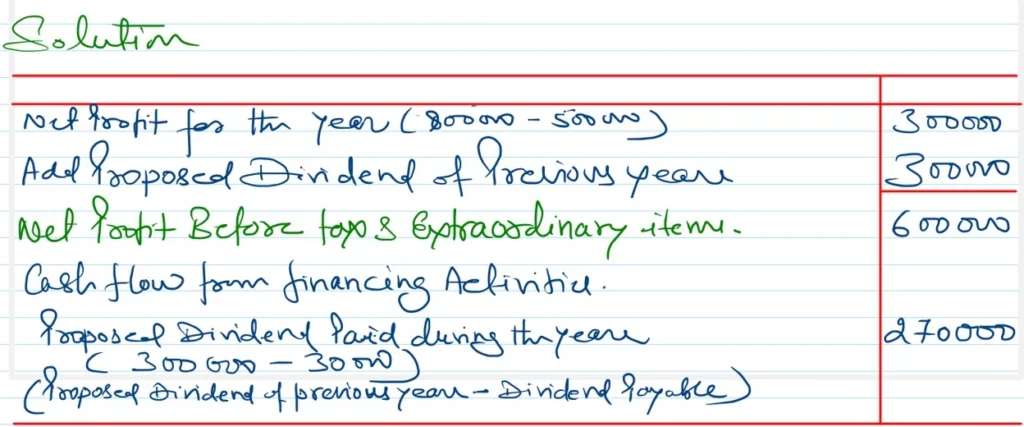

Example – 1

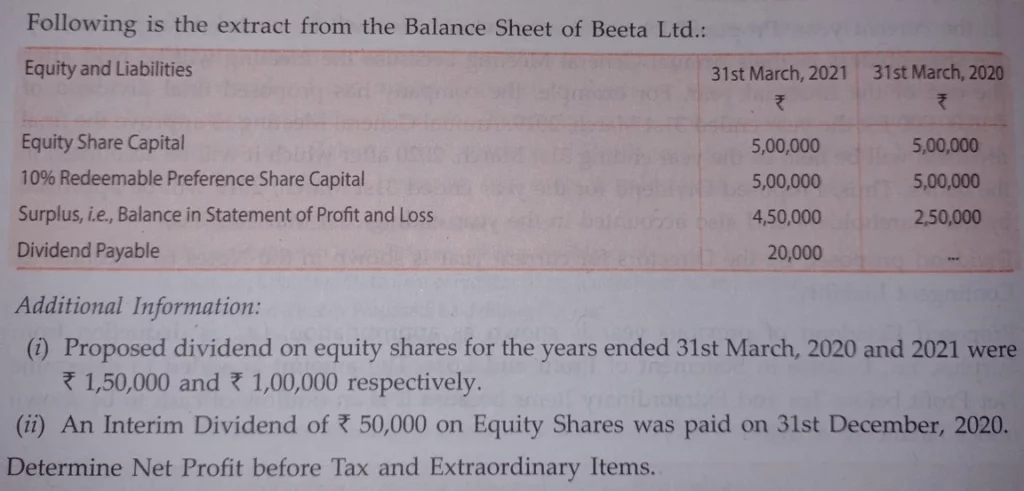

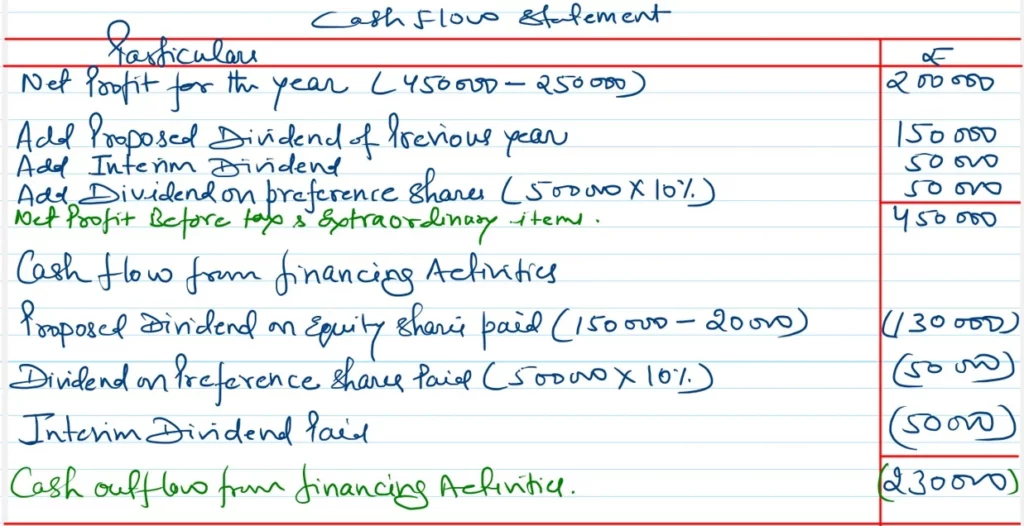

Example – 2

Solution:-

Note:- Dividend Payable would be deducted from the Proposed dividend of the previous year as an outflow of cash in financing activity.