What are the methods of maintaining Partners Capital Account Class 12

Are you looking for the format and method of maintaining partners capital account in partnership firm in class 12 CBSE Board.

I have explained all methods and format of the same.

As Partnership Firm has more than one owner. So in order to maintain systematic records of accounts in firm, a separate account is maintained for each partner to show the distribution of the net profit. Such individual account dedicated to each partner is called partner capital account.

For example, if there are partners says, A, B, C, D in a firm. 4 accounts named A’s capital A/c, B’s capital A/c, C’s capital A/c and D’s capital A/c are maintained.

Note:- Partner’s capital account is just meant to show the distribution of the net profit in different heads among the partners. In this way, we can maintain the transaction records of the firm in a systematic manner.

So, that we can derive any desired information as fast as possible.

What are the Methods of Maintaining Partners Capital Account?

There are two ways to maintain partners capital account in a partnership firm as per the syllabus of CBSE class 12 Accountancy.

- Fixed Capital Accounts Method;

- Fluctuating Capital Accounts Method

Lets first understand the fixed capital method account

Fixed Capital Accounts Method:-

In this Method, two accounts a capital account and current account is maintained for each partner.

Capital Account:-

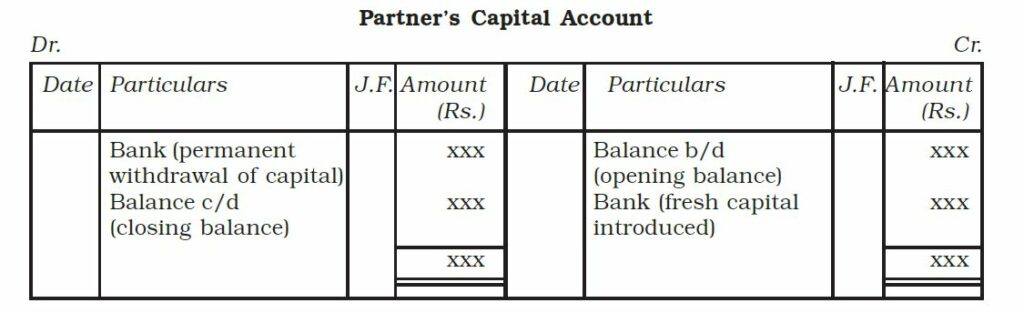

Capital account is credited with opening capital of partners. This account shows same balance year after year of partners capital until there is additional capital introduced or withdrawal out of capital during the year.

In other words, capital of the partners remain fixed year after year if there is no additional capital or withdrawal out of capital during the year.

That’s why it is called Fixed capital Method to a certain extent. However capitals do not remain fixed if partners introduced further capital or withdrew out of capital.

Fixed Capital Account of the Partners are credited with:-

- The credit balance of partners capital

- Additional capital of the partners

Fixed Capital Account of the Partners are debited with:-

- Drawing out of Capital

Note:- Under Fixed Capital Method, Capital accounts of the partners never show debit balances as all factors that may cause debit balance of partners capital account are recorded in current account of partners such as loss.

Current Account:-

This account can also be said as regular account or recurring account. Under this account, transactions concerned with net profit distribution among partners under different recurring nature heads are shown.

Such as:

- Interest allowed on capital

- Interest charged on drawings out of profit

- Partners salary

- Partners commission

- Distribution of divisible profit

Apart from it the transaction of creating reserves out of profit are also shown here. However this transaction is not concerned with partners.

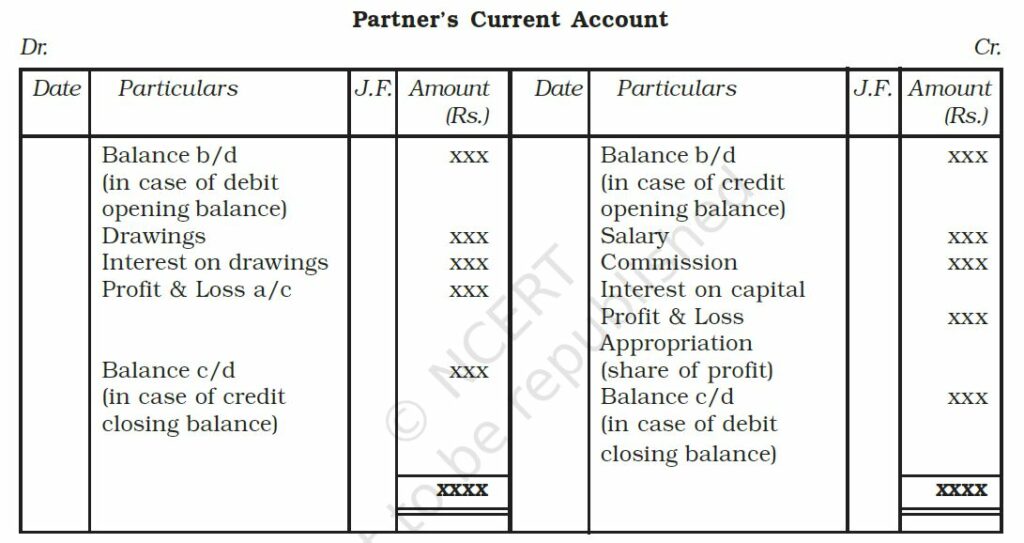

Current account of partners are credited with:-

- Credit balances of the current account.

- Interest on capital of partners

- Salary to partners

- Commission to partners

- Share of distributable profits of partners

- Transfer of amount from Capital Account

Current account of partners are debited with:-

- Interest on drawings of partners

- Drawings of partners out of profit

- Transfer of amount to capital amount

Note:- It should be noted that partners current account can show Debit or Credit balance.

Where balances of capital account and current account are shown in Balance Sheet in Fixed Capital Method.

Balances of Partner’s Capital Account are shown at the liabilities side of Balance Sheet. Whereas the credit balances of partner’s current account are shown at the liabilities side and Debit balances are shown at assets side.

Format of Partners Capital Account under Fixed Capital Method.

Format of Partners Current Account under Fixed Capital Method.

Fluctuating Capital Accounts Method

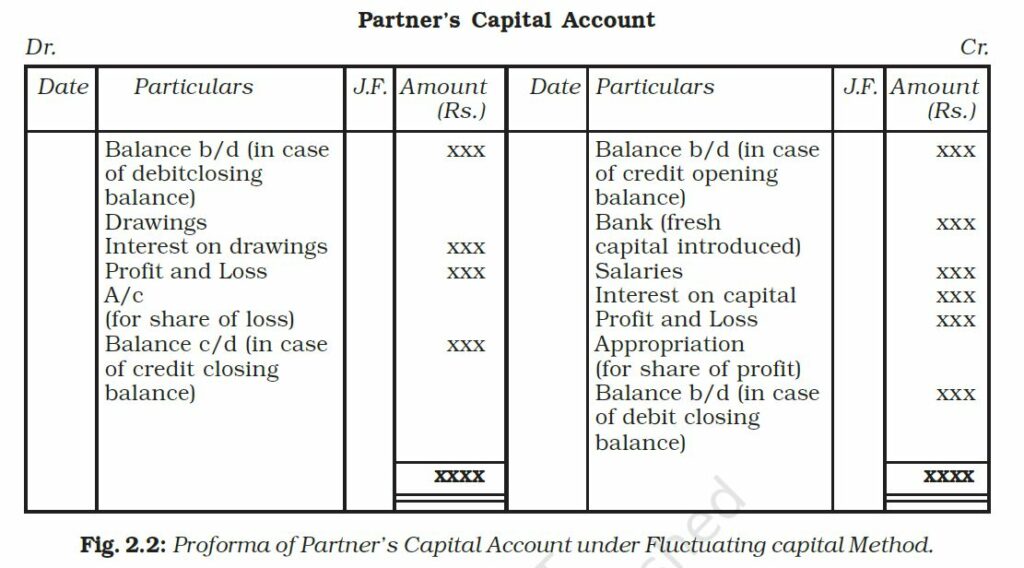

Under Fluctuating Capital Account Method, only partners capital account is maintained and all transactions relating to distribution of net profit under different heads are shown in it.

Capital accounts of partners in fluctuating capital method are credit with.

- opening credit balances of partners capital

- Interest on Capital

- Salary of partners

- Commission of partners

- distributable profits

Capital Accounts of partners under fluctuating Capital Method are debited with:-

- Interest of Drawings

- Drawings of the partners out of capital

- Drawings of the partners out of profits

- distribution of loss

Note:- In this method, capital accounts of the partners may have debit or credit balances.

Credit balances of partners capital account are shown at the liabilities side of Balance sheet. Debit balances are shown at the assets side of balance Sheet.

Format of Partner’s Capital Account under Fluctuating Method

Note:- It is not mandatory to write by and to at credit and debit side as the accounting rule