Investment Multiplier – Concept, definition, formula working (Class 12)

In this lecture, I will discuss, what is the Investment Multiplier and will Explain the working of investment multiplier with the help of examples as per the syllabus of the Class 12 Macroeconomics CBSE Board.

Investment Multiplier topic is concerned with Determination of Income and Employment Unit of Macroeconomics.

Note:- Our study of Investment Multiplier would be strictly limited to the syllabus of class 12 CBSE Board.

The Concept of Investment Multiplier

The Initial increment in the investment causes additional income (output) in the economy.

But as per the concept of Investment Multiplier, the increment in the income is many times more than the initial increase in the investment.

The factor by which the increase in output/income is greater than the increase in investment is called investment Multiplier.

The different Names of Investment Multiplier.

- Investment Multiplier

- Output Multiplier

Definition of Investment Multiplier

I am giving the exact definition given in different reference books and NCERT.

“It refers to the number of times by which the increase in output/income exceeds the increase in investment. It is measured as the ratio between the change in output/income and change in investment.”

TR. Jain

Multiplier (k) is the ratio of an increase in national income due to an increase in investment.

Sandeep Garg

It is defined as the increase in national income as a multiple of a given increase in investment.

S.K Aggarwal

The ratio of the total increment in equilibrium value of final goods output (income) to the initial increment in autonomous expenditure is called the investment multiplier.

NCERT

Formula of Investment Multiplier

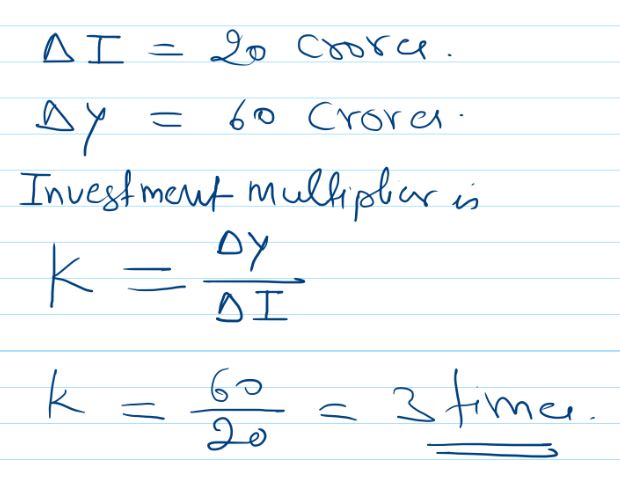

Example of Investment Multiplier

Illustration:-

If investment increases by ₹ 20 crores and as a consequence, income increases by ₹ 60 crores. What is the investment multiplier?

Solution:-

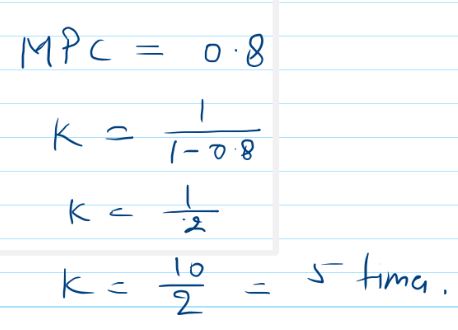

Relationship between Investment Multiplier and MPC (Marginal Propensity to consumer).

Not only an Increase in Income depends on the initial increase in investment. It only depends on the Marginal propensity to consume (MPC).

It is on the concept of expenditure of one is the income of the other.

Higher is the consumption of one, higher would be the income of the other.

Thus, the Investment multiplier has a direct relationship with MPC. Higher the value of MPC, the higher the multiplier, and vice-versa.

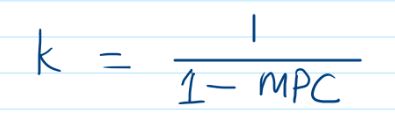

Formula of Investment multiplier with MPC

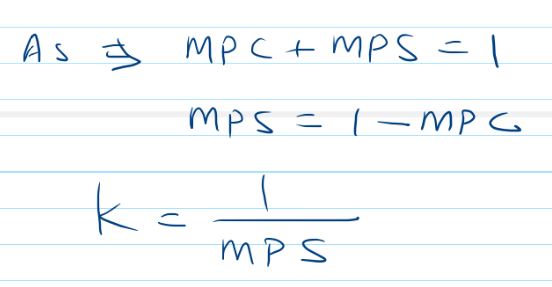

Formula of Investment Multiplier with MPS

Explain the working of Multiplier

As we already have discussed, the higher is the MPC, the higher would be the investment multiplier.

It is based on the fact that one person’s expenditure is another person’s income. Higher is the expenditure of first-person, higher would be the income of the second one.

The higher is the income of the second one more is the expenditure, the higher would be the income of the third one.

So, overall additional income generates in several rounds.

Let’s have an example to illustrate it.

How much would be the generation of additional income depends on the two factors

- Initial autonomous investment

- Value of MPC.

Let’s Suppose

1. Initial increase in autonomous Investment is = ₹ 100

2. MPC = 0.80

The total increase in income takes several rounds.

First-round increase

Investment refers to the expenditure on producer goods. So as an investment in ₹ 100 crore raises the income of suppliers of such goods by ₹ 100 crores. This is the first-round increase.

Second round increase

As MPC is 0.80, the people spend 80% of the increase in income on consumption. This raises the income of the producers of consumer goods by ₹ 80 crores.

This is the second-round increase. It equals to 80% of the first-round increase.

Now, total income generated in both two round is (100 + 80) = ₹ 180 crore

Third round increase

In the third round, people who received income in the second round, i.e, 80% of ₹ 80 crores = ₹ 64 crores on consumption.

This leads to another increase in the income of producers of consumer goods.

The income generated in this round is ₹ 64 crore.

Thus the total income generated up to third round is (100 + 80 + 64 = ₹ 244 crore)

This is the third-round increase.

All-round increase

Thus income generated goes on increasing round after round.

But in each successive rounds income generation goes on decreasing by 20% by previous rounds.

The whole process goes on until Initial investment becomes equal to the total savings of all rounds.

As in each successive round, there is an increase of saving by 20% of the previous round.

Let’s understand this whole process with the following table.

| Round | Increase in Income | Increase in consumption expenditure | Increase in savings |

| I II III IV . . . | 100 80 64 51.20 . . . | 80 64 51.20 40.96 . . . | 20 16 12.80 10.24 . . . |

| All rounds | 500 | 400 | 100 |

In the above table total increase in Income

Range of Values of Investment Multiplier

The range of Investment Multiplier is from 1 to infinity. The reason is, the value of MPC ranges from 1 to 0.

If the MPC maximum value is 1. The value of Investment Multiplier is infinity. As when all income is 100% expand. There is an unlimited rise in Income.

But, When the MPC maximum value is 0. The value of Investment Multiplier is 1. As all income is saved. The income is multiplier only one time in 1st round only.