Treatment of Interest on loan by the Firm to Partner (Partnership) Class 12

Are you looking the accounting treatment and journal entry of interest on the loan by the firm to partner in Accounting for Partnership Firm – Fundamentals chapter of Class 12 CBSE Board

A firm may give a loan to a partner. The partnership firm will charge interest on the load given to the partner by the firm at the rate agreed among the partners.

Lets understand each and every concept in detail.

Accounting Treatment of Interest on loan by the firm to Partner in Partnership chapter class 12

I will discuss the treatment of Interest on loan by the firm to partner as given in partnership chapter of class 12 CBSE Board.

Interest on loan by the firm to partner is considered as income to the firm and credited to profit and loss account. It is charged by the partners and his/her capital or current account is debited.

There are two treatment of interest on loan to partner by the firm.

Treatment of Interest on by the firm to partner if Partnership Deed Allowed it

It there is an agreement among partners to charge interest on loan to partner by the firm. It is charged at the agreed rate as mentioned in the partnership deed.

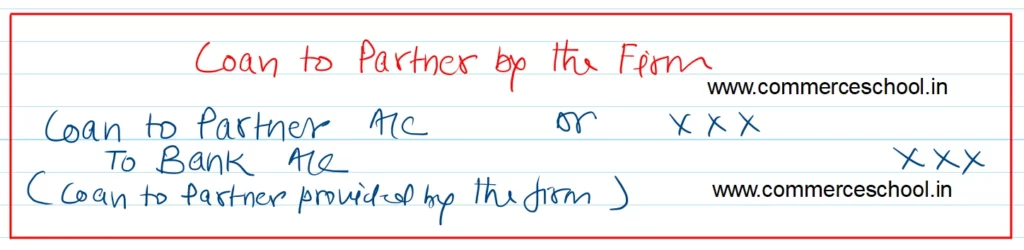

Journal Entry of Loan to Partner by the firm

Journal entry of Interest on loan by the firm to partner

Following are the journal entry

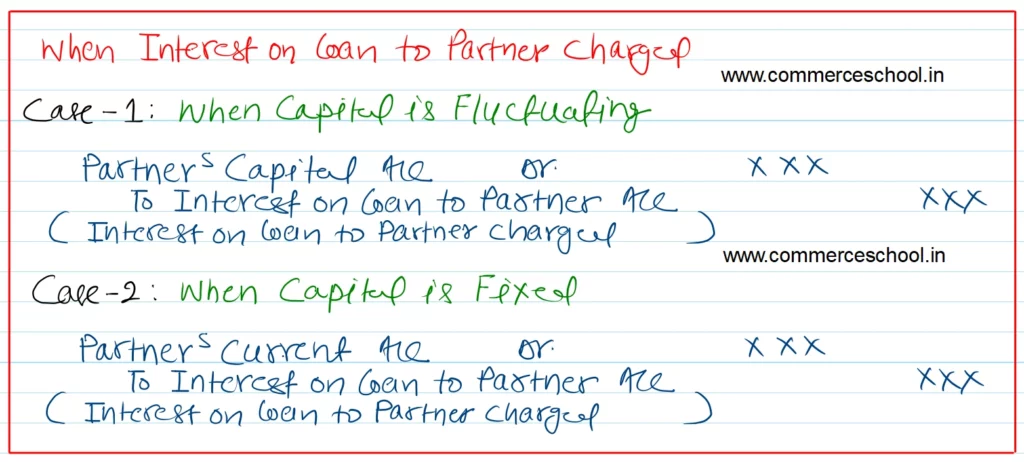

1. For charging Interest on Loan to Partner:

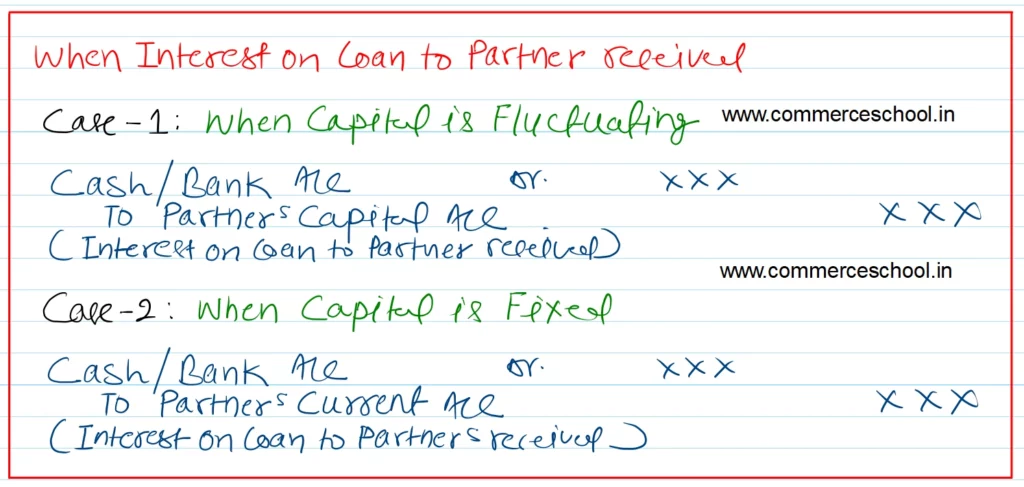

2. When Interest on Loan to Partner by the firm is received

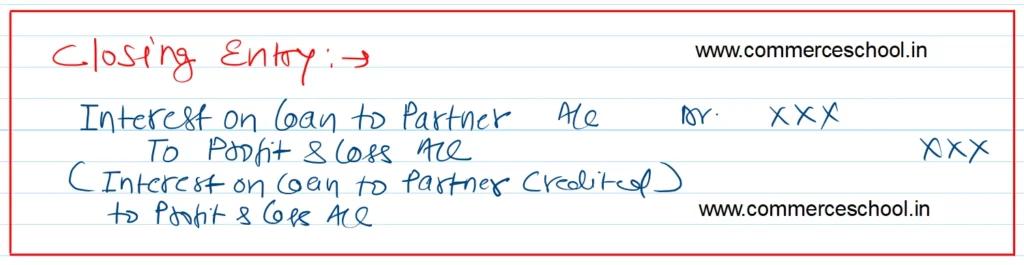

2. Closing entry for interest on loan allowed to partners

Note:-

(1) If Interest on Loan to Partner by the firm is agreed. It is Provided at the agreed rate.

(2) In the absence of the partnership deed or agreement among the partner for the rate of interest. Interest on Loan to partner by the firm is not charged.