Treatment of Rent Paid to a partner in Partnership class 12

Are you looking for the accounting treatment and journal entry of rent paid to a partner in Accounting for partnership firm – Fundamentals chapter of class 12 CBSE Board

I have elaborate this concept in detail.

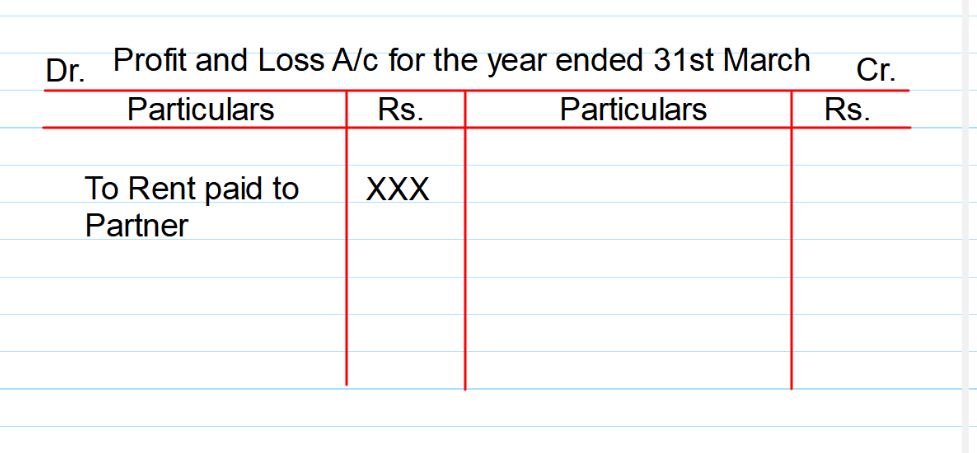

See, rent paid to partner is considered as charge against profit and recorded in profit and loss account as expense. It is not considered as appropriation thus not recorded in profit and loss appropriation account.

The rent is paid to partner against the personal property of the partner used by the firm.

Rent may be paid either in cash or by cheque during the year or it may have become due and not yet paid.

Following are Journal entries in all cases.

Journal entries of Rent to partner by the firm

following are the Journal entries in different cases:-

1. When rent is paid in cash or by Cheque:-

Rent A/c …Dr

To Cash/Bank A/c

(Rent paid in cash/cheque for… )

2. When rent is payable (Due but not paid)

Rent A/c …Dr

To Partners Capital/Current A/c

(Rent payable for… )

3. When Rent account is transferred to profit and loss account

Profit and Loss A/c …Dr

To Rent A/c

(Rent account transferred to profit and loss account)

Note:- Rent paid to partner is considered as charge against profit and has to be paid irrespective of profit or loss to the firm.

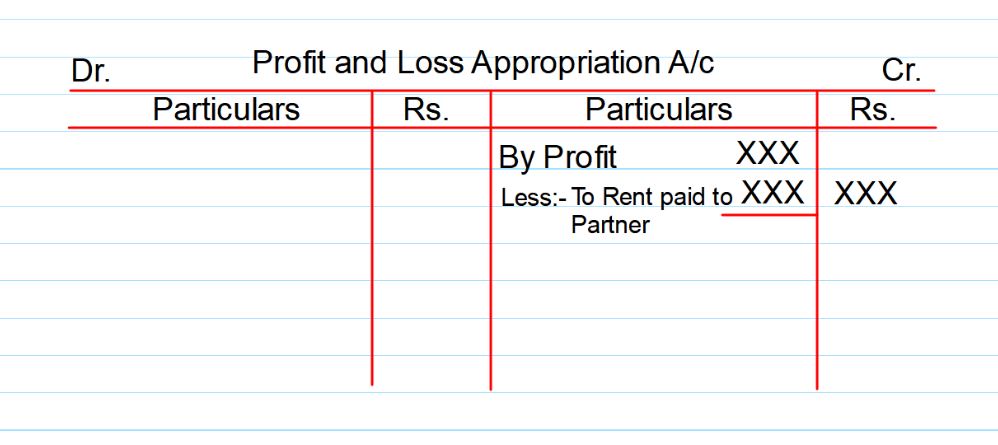

Following are specimen of its posting with two alternative in partnership Account.

Or