Treatment of Interest on loan by Partner to the Firm (Partnership) Class 12

Are you looking for the accounting treatment or journal entry of interest on loan by the partner to the Firm. I have discussed the accounting treatment of it on the basis of partnership chapter class 12 CBSE Board.

A partner may give a loan to firm. In the case of agreement among partners for interest on loan to firm by the partner. It is allowed at agreed rate.

Otherwise in the absence of partnership deed or if there is no agreement among partners for interest on loan by partners. Interest is allowed @ 6% p.a.

Accounting Treatment of Interest on loan by the Partner to firm in Partnership chapter class 12

I will discuss the treatment of Interest on loan by the partner to firm as given in partnership chapter of class 12 CBSE Board.

Interest on loan by the partner to the firm is considered an expense to the firm and debited to profit and loss account.

It is allowed to the partners and his/her loan account account is credited.

There are two treatment of interest on loan to partner by the firm.

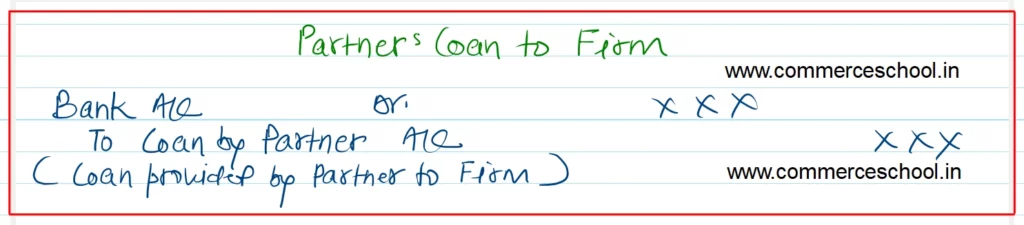

Journal Entry of Loan by Partner to the firm

Bank A/c Dr.

To Loan by Partner A/c

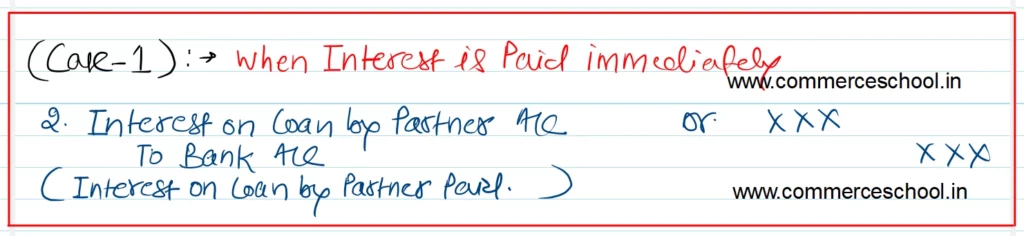

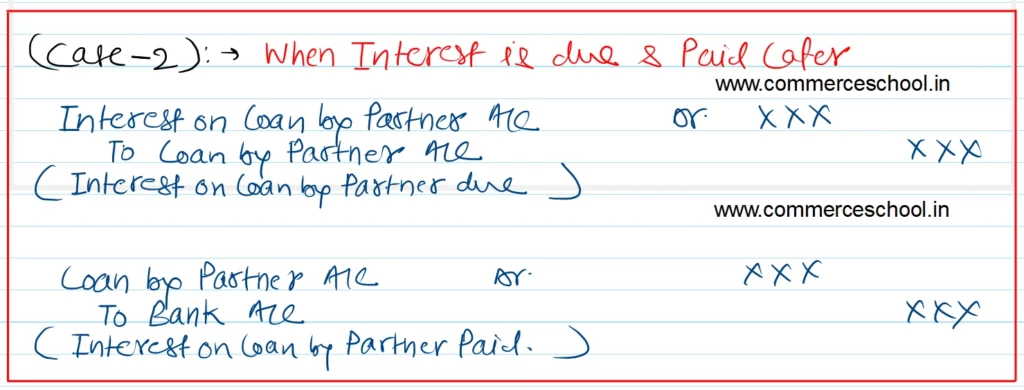

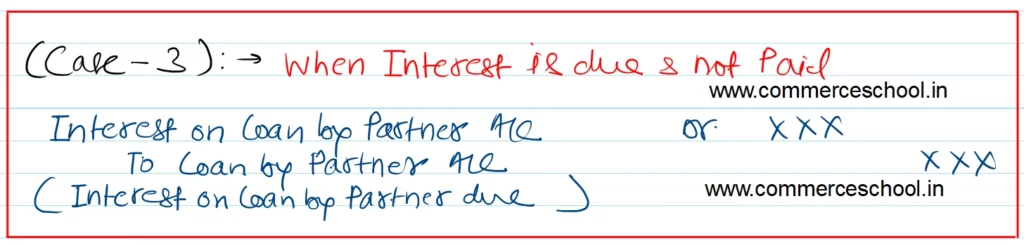

Journal Entry for the Interest on Loan by the Partner to the firm

Case – 1 (When Interest is Paid Immediately)

Case – 2 (When Interest is due and paid later within Financial year)

Case – 3: When Interest is due and paid in the next financial year

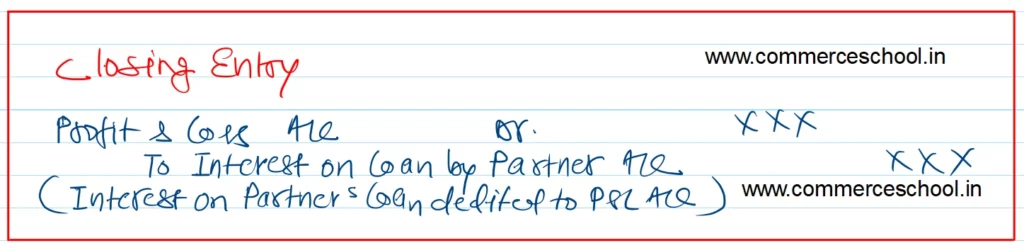

Closing Entry:- When Interest on Partner’s Loan transferred to Profit & Loss A/c

Note:-

(1) If Interest on the Partner’s Loan is agreed upon among the partners. It is provided at the rate it is agreed.

(2) If interest on the Partner’s Loan is not agreed or in the absence of the partnership deed. It is provided @ 6% p.a.

Practice MCQS

When a partner gives a loan to the firm, it is treated as:

a) Capital contribution

b) Liability of the firm

c) Asset of the firm

d) Reserve of the firm

Ans:- b)

Explanation: A partner’s loan is a liability for the firm and is shown in the liabilities section of the balance sheet.

Interest on partner’s loan is allowed at:

a) 6% p.a.

b) 8% p.a.

c) 10% p.a.

d) As per partnership deed

Ans:- d)

Explanation: If the partnership deed specifies a rate, that rate is applied; otherwise, 6% p.a. is the default.

In the absence of a partnership deed, interest on a partner’s loan is allowed at:

a) 0%

b) 6% p.a.

c) 8% p.a.

d) 10% p.a.

Ans:- b)

Explanation: As per the Indian Partnership Act, 1932, interest on partner’s loan is allowed at 6% p.a. if not specified.

Interest on partner’s loan is:

a) Debited to Profit and Loss Appropriation Account

b) Credited to Capital Account

c) Debited to Profit and Loss Account

d) Credited to Revaluation Account

Ans:- c)

Explanation: It is a charge against profit and is debited to the Profit and Loss Account.

Partner’s loan is shown in the firm’s balance sheet under:

a) Capital

b) Current liabilities

c) Long-term liabilities

d) Assets

Ans:- c)

Explanation: It is a long-term liability unless repayable within 12 months.

If the firm incurs a loss, interest on partner’s loan:

a) Is not paid

b) Is paid only if profits are available

c) Is paid regardless of profit or loss

d) Is transferred to capital account

Ans:- c)

Explanation: Interest on loan is a charge and must be paid even if the firm incurs a loss.

Which of the following is true about partner’s loan?

a) It increases the firm’s capital

b) It is not recorded in books

c) It is a liability for the firm

d) It is treated as income

Ans:- c)

Explanation: Partner’s loan is a liability and must be repaid by the firm.

Interest on partner’s loan is calculated:

a) On simple interest basis

b) On compound interest basis

c) As per market rate

d) As per RBI guidelines

Ans:- a)

Explanation: It is generally calculated on a simple interest basis unless otherwise agreed.

If a partner gives a loan and also contributes capital, interest is allowed:

a) Only on capital

b) Only on loan

c) On both, as per deed

d) On neither

Ans:- c)

Explanation:Explanation: Interest on capital and loan are treated separately as per the partnership deed.

Which account is credited when interest on a partner’s loan is provided?

a) Partner’s Capital Account

b) Partner’s Loan Account

c) Interest Account

d) Profit and Loss Account

Ans:- b)

Explanation: Interest is credited to the Partner’s Loan Account as it increases the amount payable.

Higher Order Thinking MCQS

A partner gave a ₹1,00,000 loan to the firm on 1st July. The firm closes its books on 31st March. The partnership deed is silent on interest. What amount of interest will be paid?

a) ₹6,000

b) ₹4,500

c) ₹9,000

d) ₹3,000

Ans:- b)

Explanation: Interest @6% p.a. for 9 months = ₹1,00,000 × 6% × 9/12 = ₹4,500

A firm has incurred a net loss of ₹20,000. It has to pay ₹6,000 as interest on a partner’s loan. What will be the net loss transferred to partners’ capital accounts?

a) ₹14,000

b) ₹26,000

c) ₹20,000

d) ₹6,000

Ans:- b)

Explanation: Interest on loan is a charge. Net loss = ₹20,000 + ₹6,000 = ₹26,000.

Which of the following best explains why interest on partner’s loan is treated as a charge and not an appropriation?

a) It is paid only when profits are available

b) It is paid before calculating net profit

c) It is a contractual obligation, not dependent on profits

d) It is paid from capital

Ans:- c)

Explanation: Interest on loan is a liability and must be paid irrespective of profits.

A partner gave a loan of ₹50,000 to the firm and also contributed ₹1,00,000 as capital. The deed allows 10% interest on loan and 12% on capital. The firm earned ₹5,000 profit. How much interest will be paid?

a) ₹15,000

b) ₹12,000

c) ₹5,000

d) ₹10,000

Ans:- c)

Explanation: Interest on loan (charge) = ₹5,000. Interest on capital (appropriation) not paid due to insufficient profit.

Which journal entry is correct when interest on partner’s loan is due?

a) Partner’s Capital A/c Dr. To Interest on Loan A/c

b) Interest on Loan A/c Dr. To Partner’s Loan A/c

c) Profit and Loss A/c Dr. To Partner’s Loan A/c

d) Interest on Capital A/c Dr. To Partner’s Loan A/c

Ans:- b)

Explanation: Interest is an expense, so it is debited and credited to the partner’s loan account.

Assertion (A): Interest on partner’s loan is paid even if the firm incurs a loss.

Reason (R): It is an appropriation of profit.

a) Both A and R are true, and R is the correct explanation of A

b) Both A and R are true, but R is not the correct explanation of A

c) A is true, but R is false

d) A is false, but R is true

Ans:- c)

Explanation: Interest on loan is a charge, not an appropriation.

Assertion (A): Partner’s loan is shown under liabilities in the firm’s balance sheet.

Reason (R): The firm is obligated to repay the loan to the partner.

a) Both A and R are true, and R is the correct explanation of A

b) Both A and R are true, but R is not the correct explanation of A

c) A is true, but R is false

d) A is false, but R is true

Ans:- a)

Assertion (A): Interest on partner’s loan is credited to the partner’s capital account.

Reason (R): It increases the partner’s capital in the firm.

a) Both A and R are true, and R is the correct explanation of A

b) Both A and R are true, but R is not the correct explanation of A

c) A is true, but R is false

d) Both A and R are false

Ans:- d)

Explanation: Interest is credited to the loan account, not capital account.

Assertion (A): A partner’s loan is repaid before capital at the time of dissolution.

Reason (R): Loan is an external liability for the firm.

a) Both A and R are true, and R is the correct explanation of A

b) Both A and R are true, but R is not the correct explanation of A

c) A is true, but R is false

d) A is false, but R is true

Ans:- a)

Explanation: Interest is credited to the loan account, not capital account.

Assertion (A): Interest on the partner’s loan is calculated using compound interest.

Reason (R): Compound interest ensures higher returns for the partner.

a) Both A and R are true, and R is the correct explanation of A

b) Both A and R are true, but R is not the correct explanation of A

c) A is true, but R is false

d) Both A and R are false

Ans:- d)

Explanation: Interest is calculated on simple interest basis unless otherwise agreed.