Treatment of Manager’s Commission in partnership class 12

Are you looking for the accounting treatment and journal entry of Manager’s commission in accounting for partnership – fundamentals chapter of class 12 CBSE Board.

I have elaborate this topic in detail.

See, manager’s commission is treated as charge against profit and debited to profit and loss account. This amount may be paid in cash or due but not paid.

in both cases it is transferred to profit and loss account.

now lets discuss its Journal Entry.

Journal entry of Manager’s commission

Following are the journal entries in all cases.

1. When Manager’s commission is paid in cash or by Cheque:-

Manager’s commission A/c …Dr

To Cash/Bank A/c

(Manager’s Commission paid in cash/cheque for… )

2. When Manager’s commission is payable

Manager’s Commission A/c …Dr

To Manager’s Commission Payable A/c

(Manager’s Commission payable for… )

3. When Manager’s commission account is transferred to profit and loss account

Profit and Loss A/c …Dr

To Manager’s Commission A/c

(Manager’s Commission account transferred to profit and loss account)

How to treat Manager’s commission while preparing profit and loss appropriation Account

See, in many practical questions of chapter 1 of partnership that is fundamentals of partnership firm. The manager’s commission accounting treatment is still pending while preparing profit and loss appropriation account.

In this case, It is a common practice to reduce the amount of profit by manager’s commission. In order to represent its accounting treatment student has two option.

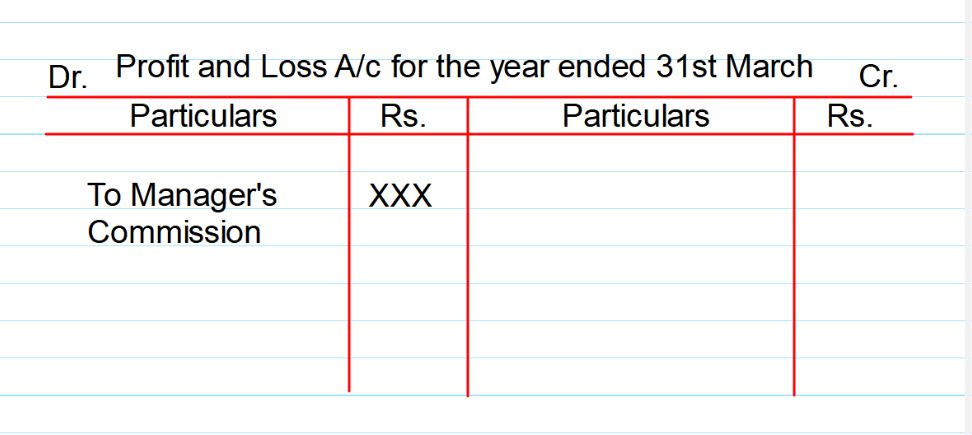

1. Prepare Profit and loss account and debit managers commission account as charge against profit as shown below.

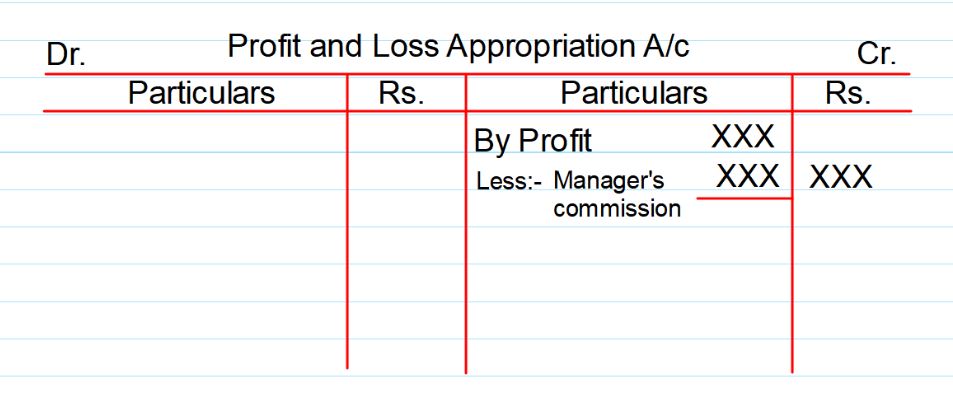

2. A student also can reduce profit with the amount of managers commission in profit and loss appropriation account and as shown below.