[CBSE] Q 2 Accounting for Goods and Services Tax (GST) TS Grewal class 11 (2022-23)

Are you looking for solutions of Question number 2 of Accounting for Goods and Services Tax (GST) of TS Grewal class 11 CBSE Board 2022-23

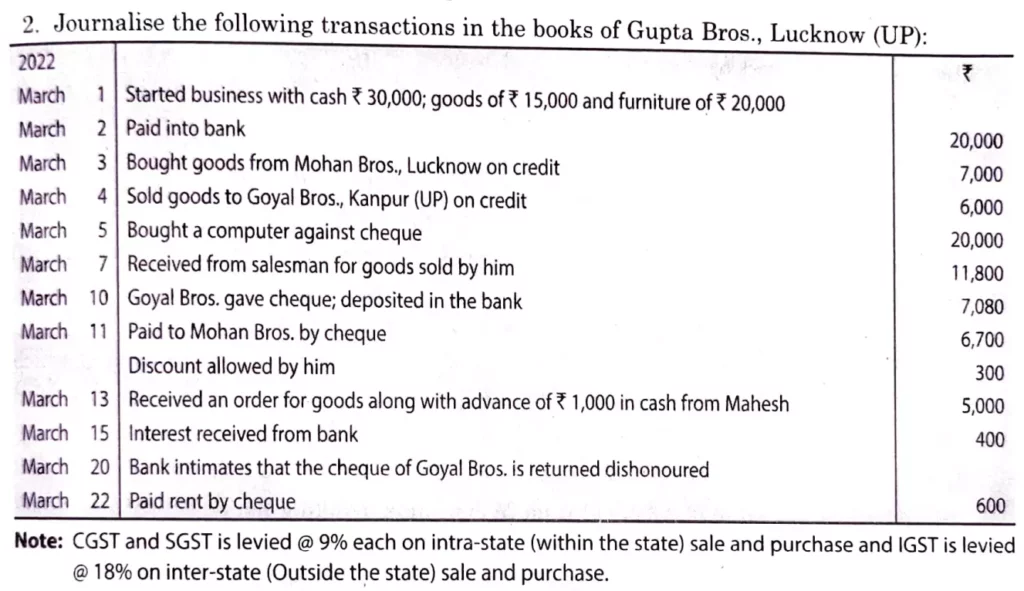

Journalise the following transactions in the books of Gupta Bros., Lucknow (UP):

| 2022 March 1 | Started business with cash ₹ 30,000; goods of ₹ 15,000 and furniture of ₹ 20,000 | |

| March 2 | Paid into Bank | 20,000 |

| March 3 | Bought goods from Mohan Bros., Lucknow, on credit | 7,000 |

| March 4 | Sold goods to Goyal Bros., Kanpur (UP) on credit | 6,000 |

| March 5 | Bought a computer against cheque | 20,000 |

| March 7 | Received from salesman for goods sold by him | 11,800 |

| March 10 | Goyal Bros. gave cheque; deposited in the bank | 7,080 |

| March 11 | Paid to Mohan Bros. by cheque Discount allowed by him | 6,700 300 |

| March 13 | Received an order for goods along with advance of ₹ 1,000 in cash from Mahesh | 5,000 |

| March 15 | Interest received from bank | 400 |

| March 20 | Bank intimates that the cheque of Goyal Bros. is returned dishonoured | |

| March 22 | Paid rent by cheque | 600 |

Note: CGST and SGST is levied @ 9% each on intra-state (within the state) sale and purchase and IGST is levied @ 18% on inter-state (Outside the state) sale and purchase.

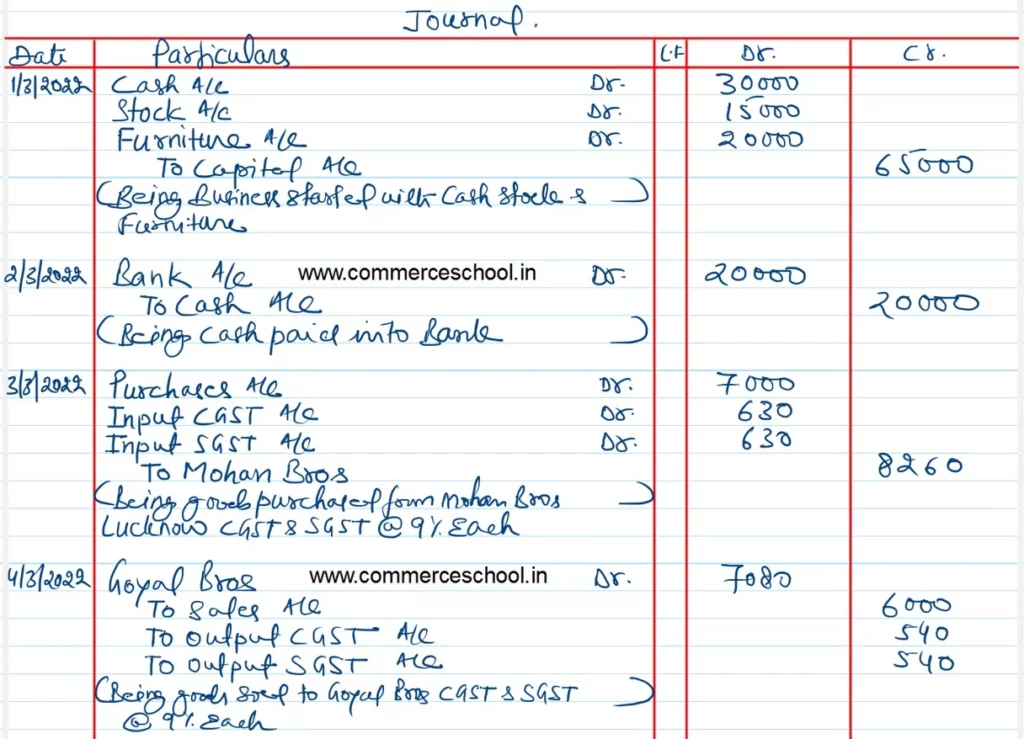

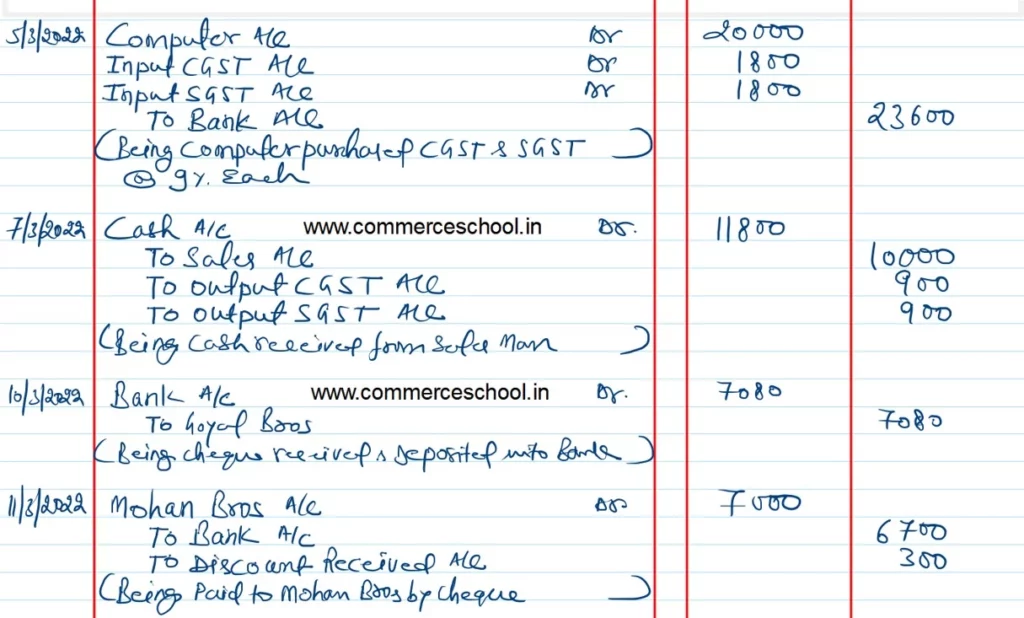

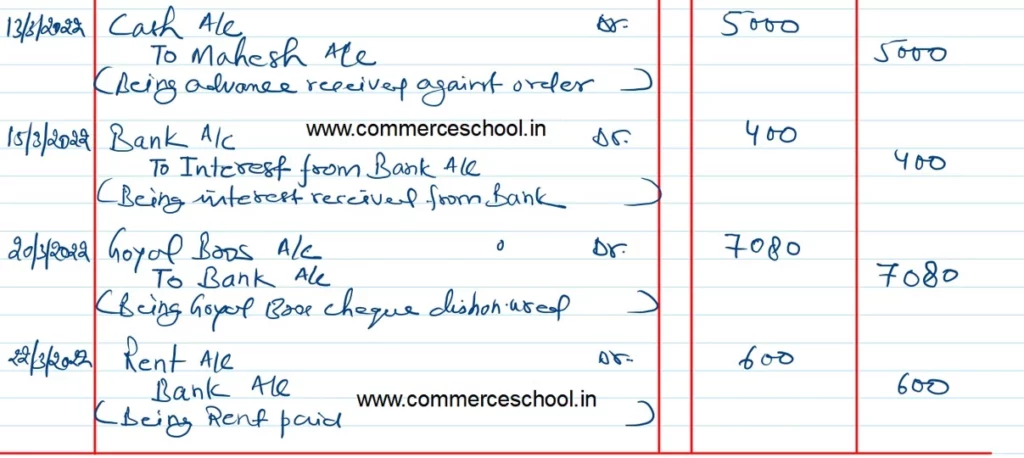

Solution:-

Note:-

- The question allowed GST on Sales and purchases. That’s why Rent GST is not considered. Interest received is exempted from GST.

- Interest received is exempted from GST.

Below is the list of all solutions of chapter 12 Goods and Services Tax (GST) TS Grewal class 11 CBSE 2022-23