[CBSE] Q 6 Accounting for Goods and Services Tax (GST) TS Grewal class 11 (2022-23)

Are you looking for solutions of Question number 6 of Accounting for Goods and Services Tax (GST) of TS Grewal class 11 CBSE Board 2022-23

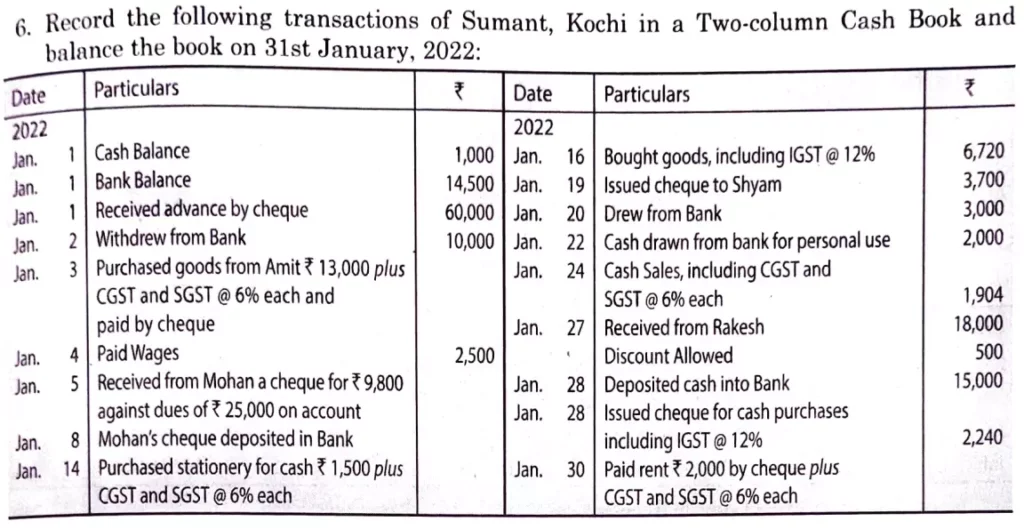

| Date | Particulars | ₹ | Date | ₹ | |

| 2022 Jan. 1 Jan. 1 Jan. 1 Jan. 2 Jan. 3 Jan. 4 Jan. 5 Jan. 8 Jan. 14 | Cash Balance Bank Balance Received advance by cheque withdrew from Bank Purchased goods from Amit ₹ 13,000 plus CGST and SGST @ 6% each and paid by cheque Paid wages Received from Mohan a cheque for ₹ 9,800 against dues of ₹ 25,000 on account Mohan’s cheque deposited in Bank Purchased stationery for cash ₹ 1,500 plus CGST and SGST @ 6% each | 1,000 14,500 60,000 10,000 2,500 | 2022 Jan. 16 Jan. 19 Jan. 20 Jan. 22 Jan. 24 Jan. 27 Jan. 28 Jan. 28 Jan. 30 | Bought goods, including IGST @ 12% Issued cheque to Shyam Drew from Bank Cash drawn from bank for personal use Cash sales, including CGST and SGST @ 6% each Received from Rakesh Discount Allowed Deposited cash into Bank Issued cheque for cash purchases including IGST @ 12% Paid rent ₹ 2,000 by cheque plus CGST and SGST @ 6% each | 6,720 3,700 3,000 2,000 1,904 18,000 500 15,000 2,240 |

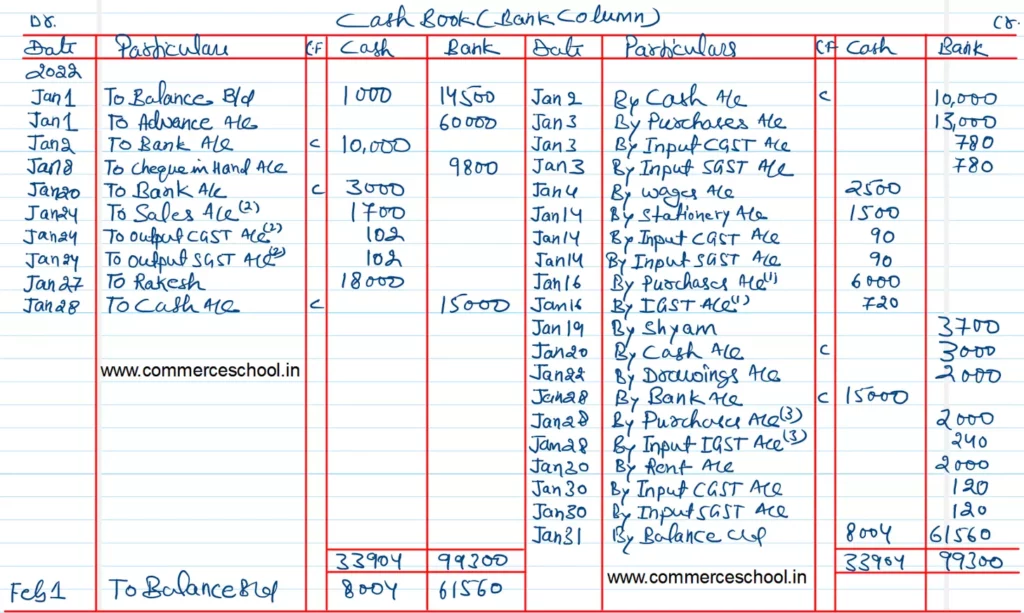

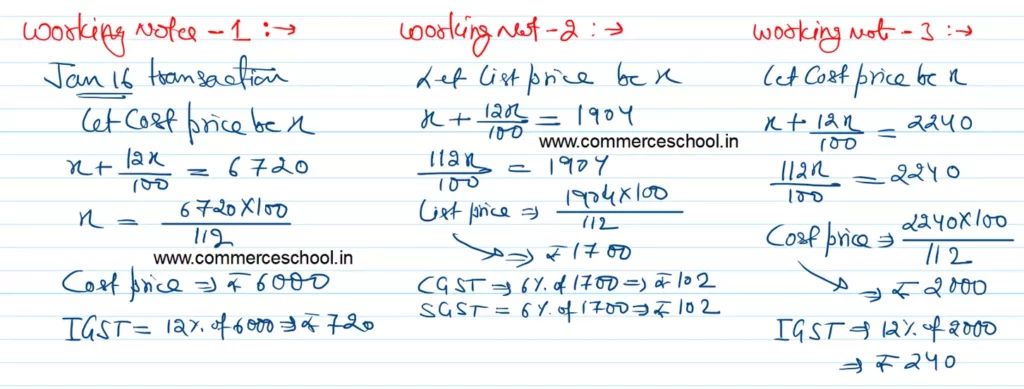

Solution:-

Below is the list of all solutions of chapter 12 Goods and Services Tax (GST) TS Grewal class 11 CBSE 2022-23