[ISC] Q. 16 solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 (2022-23)

Are you looking for the solution to Question number 16 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2022-23 Edition for the ISC Board?

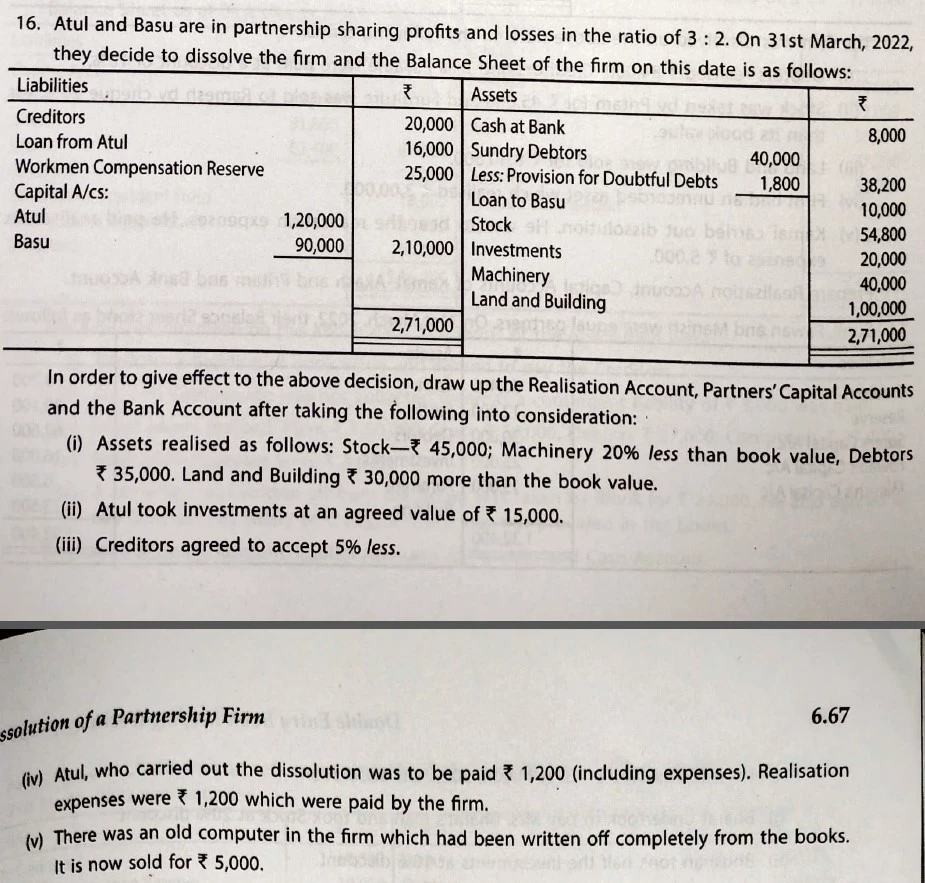

Atul and Basu are in partnership sharing profits and losses in the ratio of 3 : 2. On 31st March, 2022, they decided to dissolve the firm and the Balance Sheet of the firm on this date is as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors Loan from Atul Workmen Compensation Reserve Capital A/cs: Atul Basu | 20,000 16,000 25,000 1,20,000 90,000 | Cash at Bank Sundry Debtors Less: PDD Loan to Basu Stock Investments Machinery Land and Building | 40,000 1,800 | 8,000 38,200 10,000 54,800 20,000 40,000 1,00,000 |

| 2,71,000 | 2,71,000 |

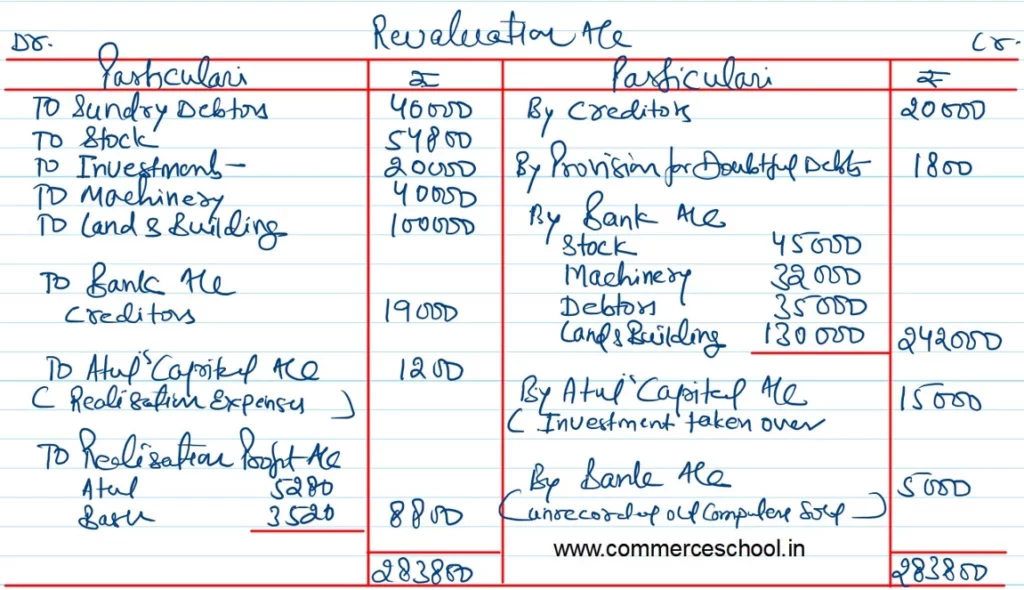

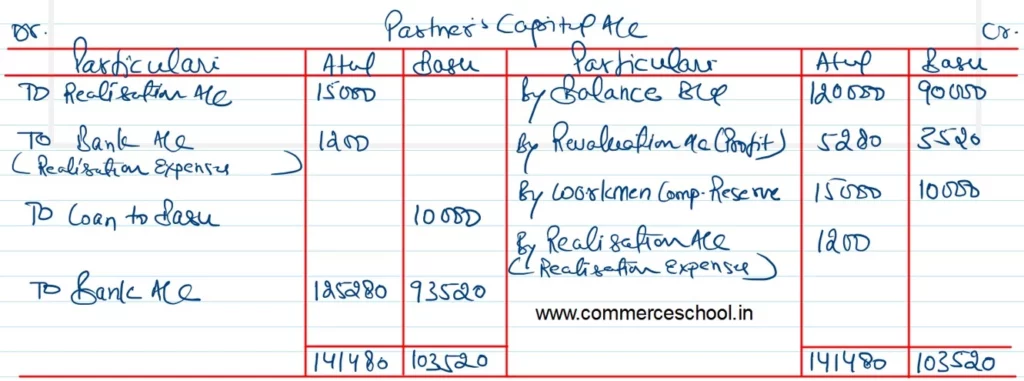

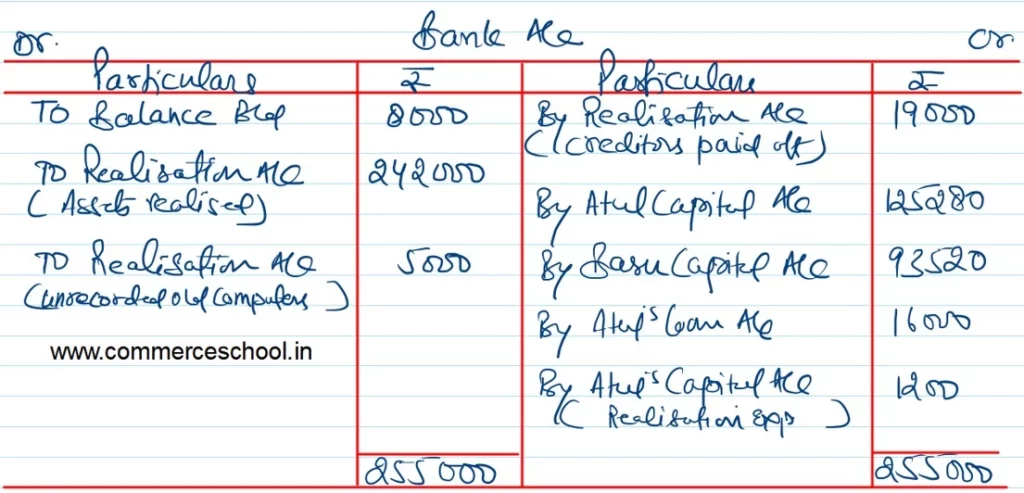

In order to give effect to the above decision, draw up the Realisation Account, Partner’s Capital Accounts and the Bank Account after taking the following into consideration:

(i) Assets realised as follows: Stock – ₹ 45,000; Machinery 20% less than book value, Debtors ₹ 35,000. Land and Building ₹ 30,000 more than the book value.

(ii) Atul took investments at an agreed value of ₹ 15,000.

(iii) Creditors agreed to accept 5% less.

(iv) Atul, who carried out the dissolution was to be paid ₹ 1,200 (including expeses). Realisation expenses were ₹ 1,200 which were paid by the firm.

(v) There was an old computer in the firm which had been written off completely from the books. It is now sold for ₹ 5,000.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |