[ISC] Q. 5 solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 (2022-23)

Are you looking for the solution to Question number 5 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2022-23 Edition for the ISC Board?

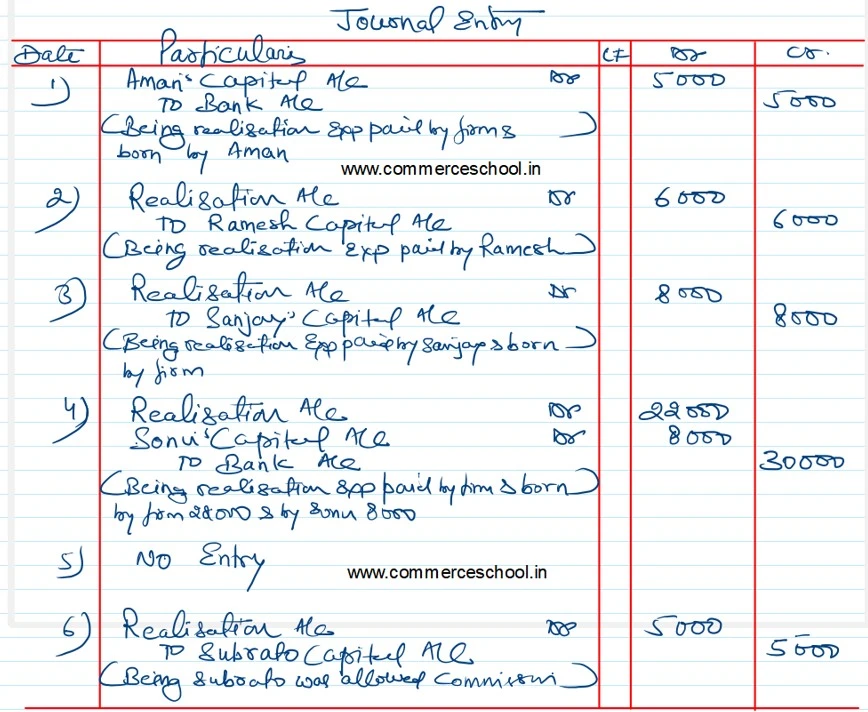

Pass the Journal entries for the following transactions at the time of dissolution:

(i) Realisation expenses of ₹ 5,000 paid by the firm which were to be borne by Aman, a partner.

(ii) Realisation expenses of ₹ 6,000 were paid by Ramesh, a partner.

(iii) Realisation expenses were ₹ 14,000; ₹ 8,000 were to be borne by the firm and the balance by Sanjay, a partner. The expenses were paid by Sanjay.

(iv) Realisation expenses paid by firm were ₹ 30,000. Out of the said expenses, ₹ 22,000 were to be borne by the firm and balance by Sonu, a partner.

(v) Realisation expenses of ₹ 6,000 paid by Rajesh, a partner, who was to bear these expenses.

(vi) Realisation expenses of ₹ 8,000 were paid by Subrato for which he was allowed ₹ 5,000.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |