[ISC] Q. 9 solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 (2022-23)

Are you looking for the solution to Question number 9 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2022-23 Edition for the ISC Board?

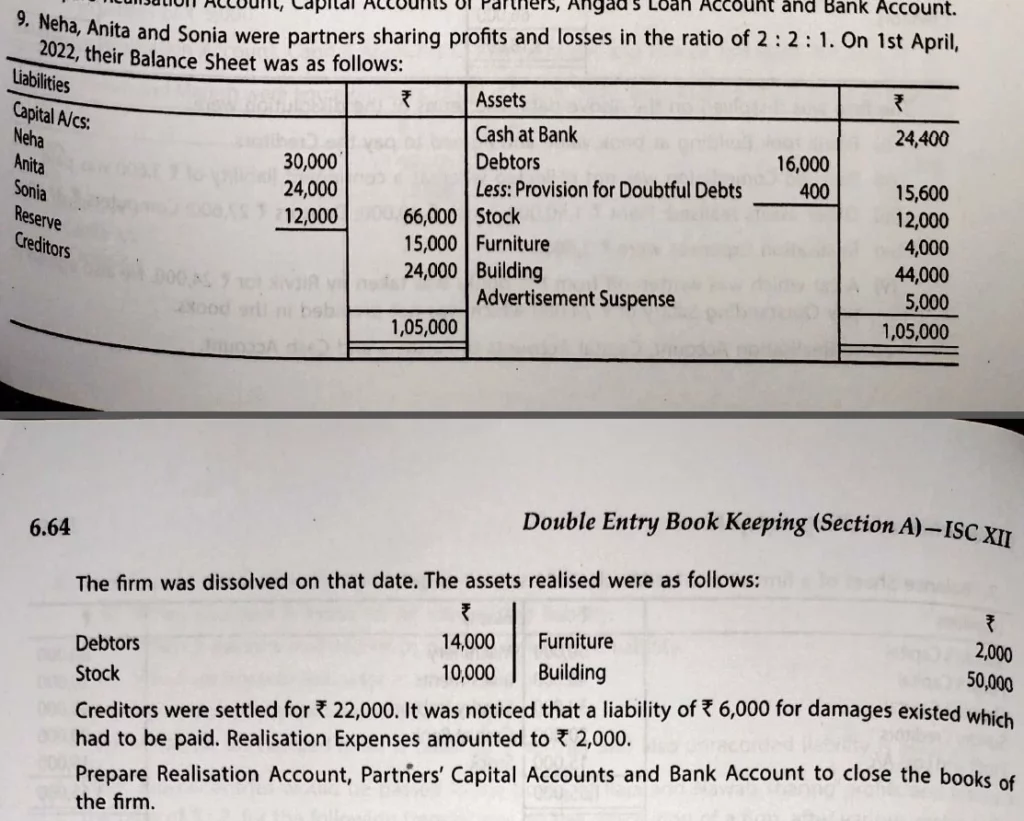

Neha, Anita and Sonia were partners sharing profits and lossses in the ratio of 2 : 2 : 1. On 1st April, 2022, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs: Neha Anita Sonia Reserve Creditors | 30,000 24,000 12,000 15,000 24,000 | Cash at Bank Debtors Less: PDD Stock Furniture Building Advertisement Suspense | 16,000 4,000 | 24,400 15,600 12,000 4,000 44,000 5,000 |

| 1,05,000 | 1,05,000 |

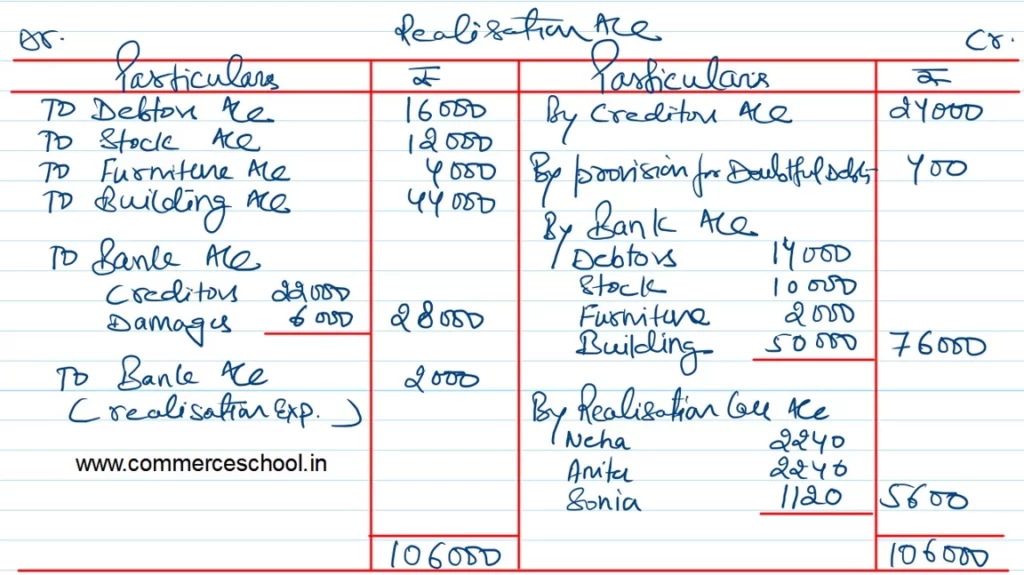

The firm was dissolved on that date. The assets realised were as follows:

| Debtors | ₹ 14,000 |

| Stock | ₹ 10,000 |

| Furniture | ₹ 2,000 |

| Building | ₹ 50,000 |

Creditors were settled for ₹ 22,000. It was noticed that a liability of ₹ 6,000 for damages existed which had to be paid. Realisation Expenses amounted to ₹ 2,000.

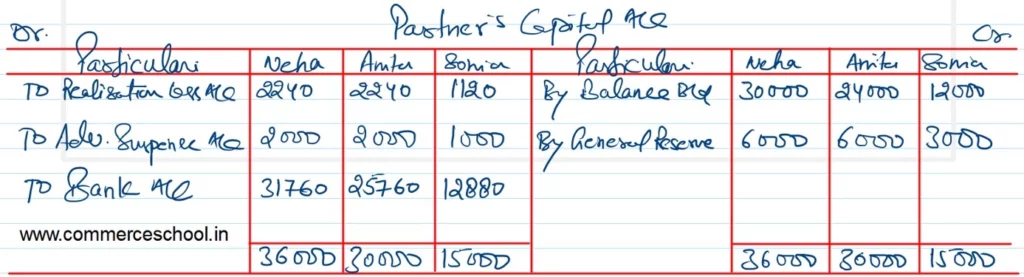

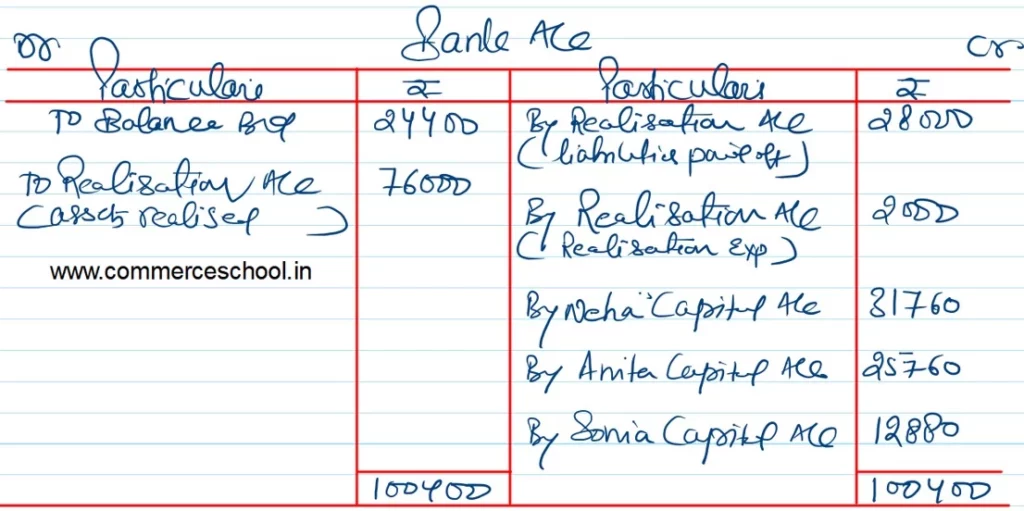

Prepare Realisation Account, Partner’s Capital Account and Bank Account to close the books of the firm.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |