[ISC] Q. 19 solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 (2022-23)

Are you looking for the solution to Question number 19 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2022-23 Edition for the ISC Board?

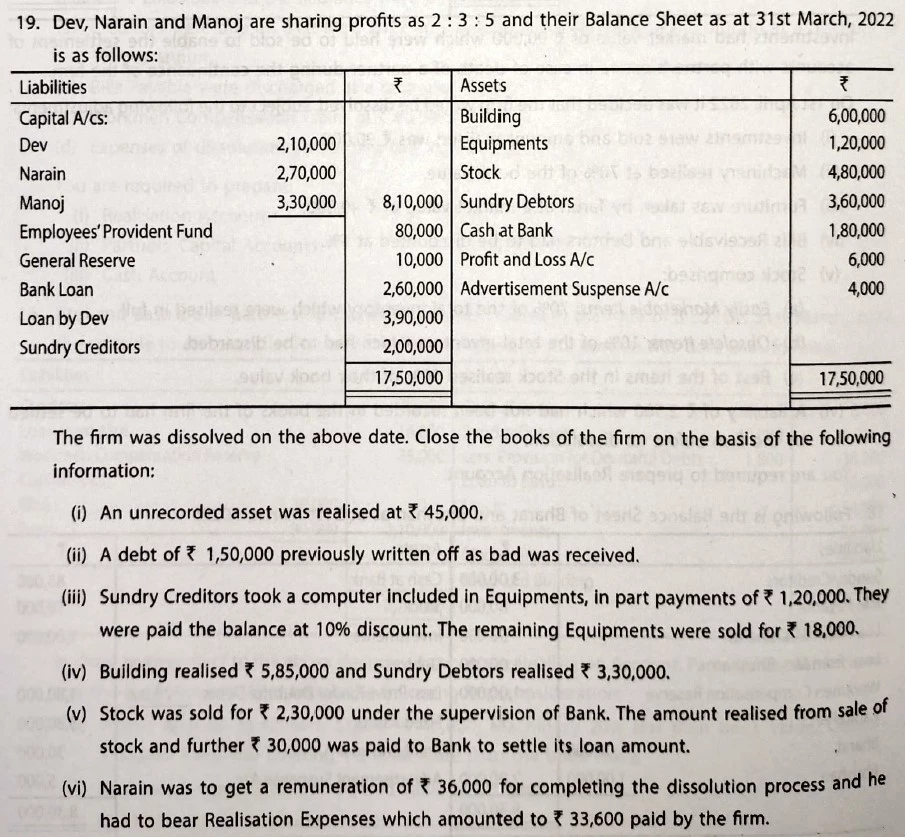

Dev, Narain and Manoj are sharing profits as 2 : 3 : 5 and their Balance Sheet as at 31st March, 2022 is as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: Dev Narain Manoj Employee’s Provident Fund General Reserve Bank Loan Loan by Dev Sundry Creditors | 2,10,000 2,70,000 3,30,000 80,000 10,000 2,60,000 3,90,000 2,00,000 | Building Equipments Stock Sundry Debtors Cash at Bank Profit and Loss A/c Advertisement Suspense A/c | 6,00,000 1,20,000 4,80,000 3,60,000 1,80,000 6,000 4,000 |

| 17,50,000 | 17,50,000 |

The firm was dissolved on the above date. Close the books of the firm on the basis of the following information:

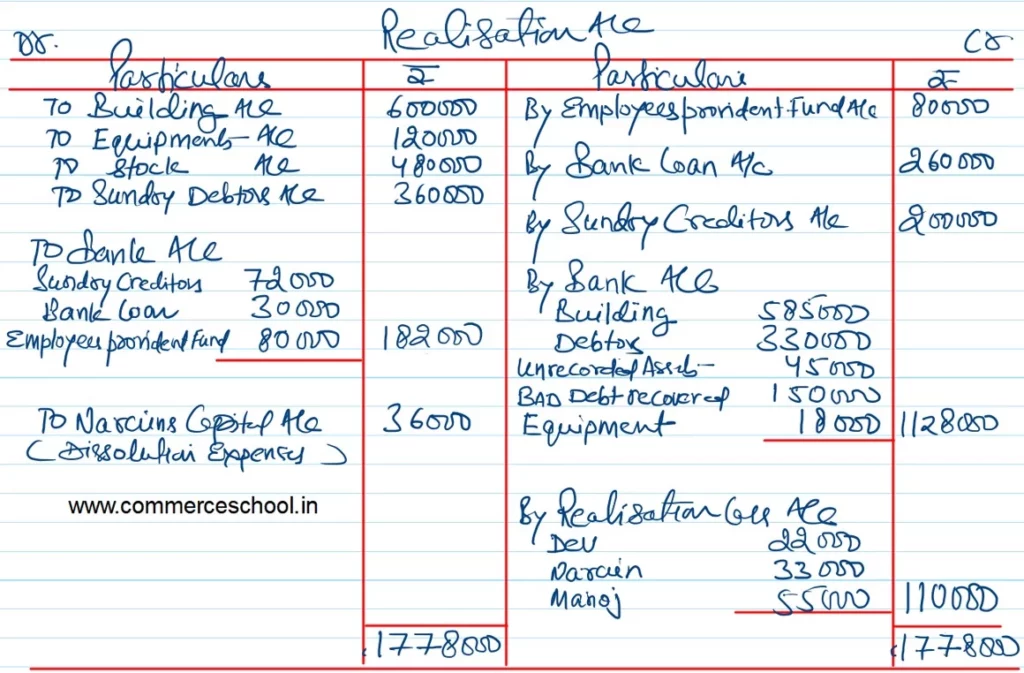

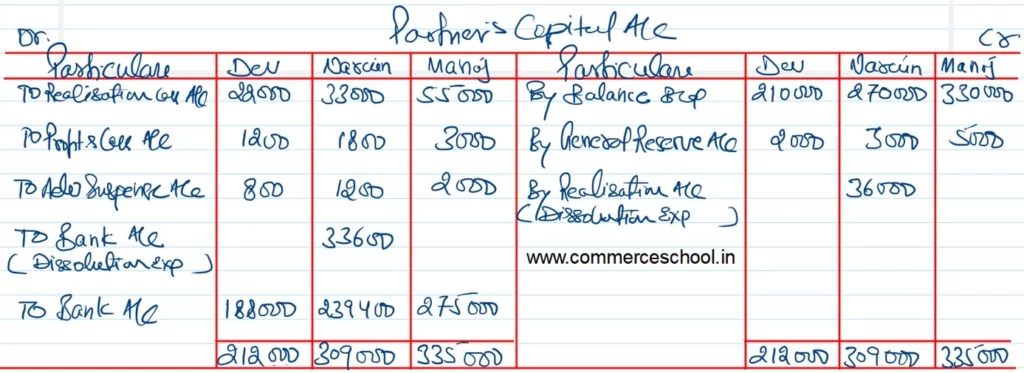

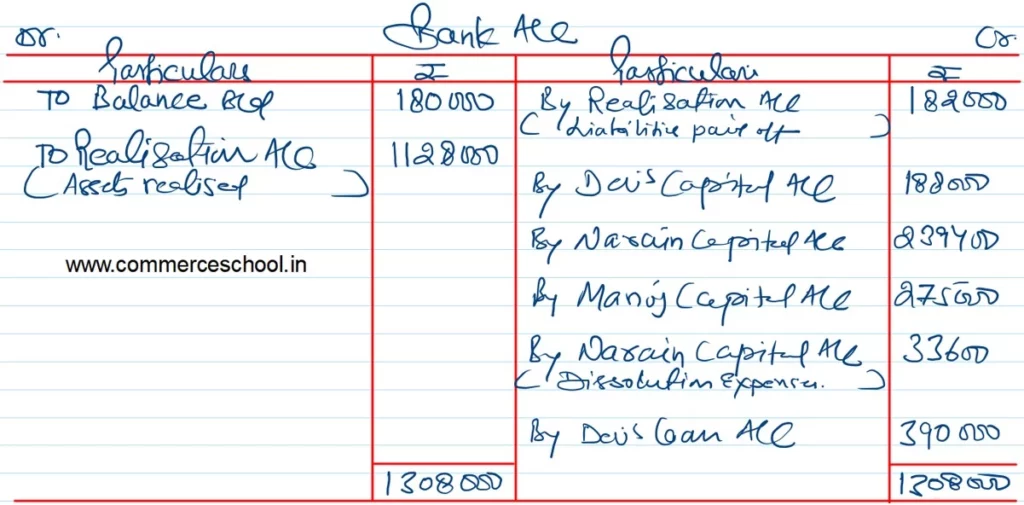

(i) An unrecorded asset was realised at ₹ 45,000.

(ii) A debt of ₹ 1,50,000 previously written off as bad was received.

(iii) Sundry Creditors took a computer included in Equipments, in part payments of ₹ 1,20,000. They were paid the balance at 10% discount. The remaining Equipments were sold for ₹ 18,000.

(iv) Building realised ₹ 5,85,000 and Sundry Debtors realised ₹ 3,30,000.

(v) Stock was sold for ₹ 2,30,000 under the supervision of Bank. The amount realised from sale of stock and further ₹ 30,000 was paid to Bank to settle its loan amount.

(vi) Narain was to get a remuneration of ₹ 36,000 for competing the dissolution process and he had to bear Reasliation Expenses which amounted to ₹ 33,600 paid by the firm.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |